In this article, we will discuss about...

Introduction

The Form 33 clearance certificate holds great significance for Non-Residential Indians (NRIs) who engage in financial transactions or property dealings in India. Understanding the intricacies of this legal requirement is essential to ensure smooth and transparent transactions for NRIs. In this article, we will explore the concept of the Form 33 clearance certificate, its eligibility criteria, the documentation process, and its benefits in property transactions.

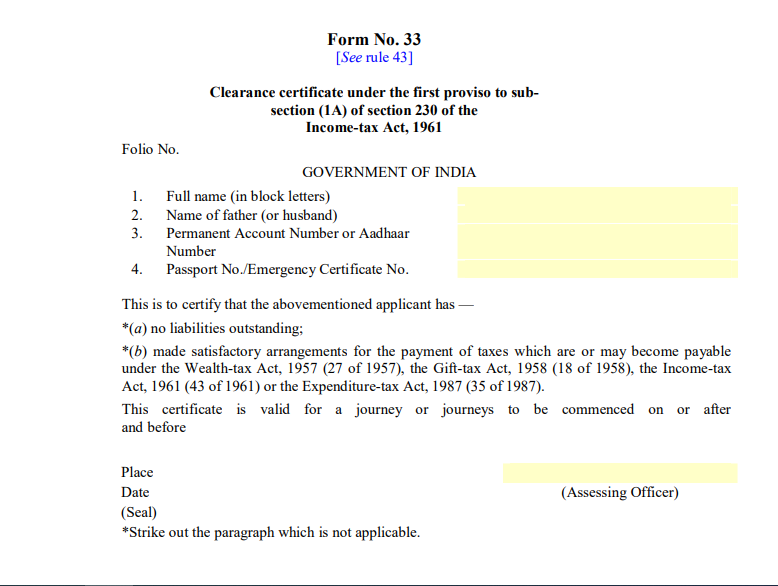

Understanding Form 33 Clearance Certificate

Form 33 clearance certificate, commonly known as the NRI clearance certificate, is a legal document that verifies the NRI status of an individual. It serves as proof that an NRI has fulfilled all the necessary tax obligations and financial responsibilities as per Indian laws. This certificate is mandatory for NRIs who wish to engage in various financial and property transactions in India.

Eligibility Criteria for NRIs

To be eligible for a Form 33 clearance certificate, an individual must qualify as a Non-Residential Indian. The number of days an individual has spent outside India in a financial year determines the NRI status. Generally, an individual who has spent 182 days or more outside India qualifies as an NRI. However, the eligibility criteria may vary based on specific circumstances and tax laws.

Consult CA Arun Tiwari for more information at 📞 8080088288 or cs@aktassociates.com

Documents Required for Form 33 Clearance Certificate

Obtaining a Form 33 clearance certificate requires the submission of various essential documents. These include proof of NRI status, identification documents, supporting documents for financial transactions, and any other relevant documents as specified by the concerned authorities. Valid passports, visa copies, bank statements, and income tax returns are some examples of commonly required documents.

Process of Obtaining Form 33 Clearance Certificate

The process of obtaining a Form 33 clearance certificate involves several steps. NRIs must carefully follow these steps to ensure a successful application:

- Application form submission: NRIs need to obtain the prescribed application form for the Form 33 clearance certificate from the designated authority. This form must be completed accurately with all the required details.

- Verification process: Once the application form is submitted, the authorities conduct a verification process to ensure the accuracy of the provided information. This may involve scrutinizing the supporting documents and contacting the NRI for further clarification if required.

- Documentation and fee payment: After the verification process, the NRI must submit all the necessary documents as specified by the authorities. Additionally, any applicable fees or charges must be paid during this stage.

- Issuance of Form 33 clearance certificate: Upon successful completion of the above steps, the Form 33 clearance certificate will be issued to the NRI. This certificate serves as a legal document for the NRI to engage in financial and property transactions in India.

Benefits of Form 33 Clearance Certificate

Obtaining a Form 33 clearance certificate offers several benefits for NRIs:

Legal compliance and transparency: By obtaining this certificate, NRIs ensure compliance with Indian tax laws and financial regulations. It provides transparency and credibility in their financial dealings within the country.

Ease of conducting financial transactions in India: The Form 33 clearance certificate simplifies the process of opening bank accounts, investing in financial instruments, or carrying out other monetary transactions in India. It serves as proof of the NRI’s legitimacy and enables hassle-free transactions.

Avoidance of unnecessary tax implications: Without the Form 33 clearance certificate, NRIs may face unnecessary tax implications or complications in their financial affairs. This certificate helps them avoid such issues and ensures a smooth financial journey.

Importance of Form 33 in Property Transactions

In property transactions, the Form 33 clearance certificate holds immense importance for NRIs. It serves as a validation of their legal right to sell or transfer property in India. The certificate acts as a safeguard against fraudulent activities and provides assurance to potential buyers regarding the authenticity of the property and the NRI’s ownership rights. It plays a vital role in ensuring smooth property transactions and title transfer processes.

Conclusion

The Form 33 clearance certificate is an essential document for NRIs engaging in financial and property transactions in India. It provides legal compliance, transparency, and ease of conducting financial affairs. Moreover, in property transactions, it plays a crucial role in validating ownership rights and preventing fraudulent activities. The authorities strongly encourage NRIs to obtain the Form 33 clearance certificate to facilitate hassle-free and secure transactions in India.