DTAA between India and Singapore

Introduction

The Double Taxation Avoidance Agreement (DTAA) is a bilateral agreement between two countries that aims to eliminate the burden of double taxation on taxpayers who have income in both nations. The DTAA between India and Singapore plays a crucial role in facilitating cross-border trade, investment, and economic cooperation. In this article, we will explore the various aspects of the India-Singapore Tax treaty, its historical context, key provisions, impact on investment, challenges, and controversies, and its role in strengthening bilateral relations.

Background of India and Singapore

India and Singapore are two vibrant economies with a history of strong trade relations. Both countries have experienced significant economic growth and share a common goal of fostering mutually beneficial ties. Singapore serves as a major gateway for Indian companies expanding into Southeast Asia, while India offers immense opportunities for Singaporean investors. The close economic and cultural connections between the two nations make the DTAA crucial for promoting bilateral trade and investment.

Overview of DTAA

A DTAA is a legal agreement signed between two countries to allocate taxing rights and provide relief from double taxation. The primary objective of the India-Singapore DTAA is to promote cross-border investment and trade by ensuring that taxpayers are not subjected to double taxation on the same income. This agreement enhances tax certainty, encourages economic cooperation, and facilitates the exchange of goods, services, and capital between India and Singapore.

Historical Context of India-Singapore DTAA

The India-Singapore DTAA has evolved over time to address the changing needs of both countries. The agreement was first signed in 1994 and has since undergone revisions to align with international tax standards and address emerging challenges. These revisions have strengthened the provisions related to tax residency, permanent establishment, and exchange of information, providing a solid foundation for bilateral economic relations.

Consult CA Arun Tiwari for more info at 📞 8080088288 or cs@aktassociates.com

Key Provisions of the India-Singapore DTAA

The India-Singapore DTAA encompasses several critical provisions that govern the taxation of income earned by residents of both countries. These provisions include tax residency rules, permanent establishment criteria, tax rates for various types of income, and mechanisms to avoid double taxation. The agreement also includes provisions for the exchange of information and mutual assistance in tax matters, facilitating effective tax administration and enforcement.

Impact on Cross-Border Investment

The India-Singapore DTAA has played a pivotal role in promoting cross-border investment and fostering economic cooperation. By providing tax certainty and favorable tax rates, the agreement has encouraged Indian companies to invest in Singapore and Singaporean companies to invest in India. This has led to increased capital flows, job creation, and technology transfer, benefiting both countries economies.

Case Studies of Successful Investments

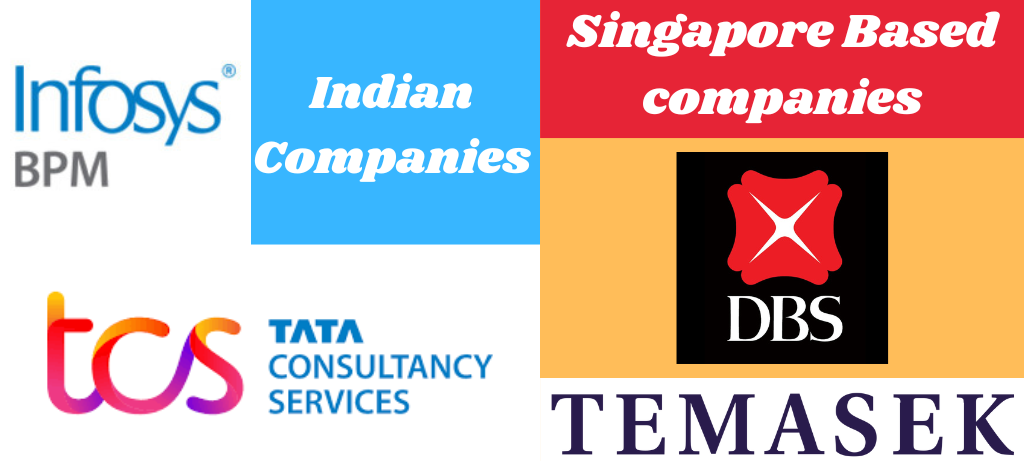

Numerous examples illustrate the positive impact of the India-Singapore DTAA on investment flows. Indian companies, such as Tata Consultancy Services (TCS) and Infosys, have established a significant presence in Singapore, leveraging the country’s strategic location, business-friendly environment, and access to regional markets. Conversely, Singaporean companies, including DBS Bank and Temasek Holdings, have made substantial investments in sectors such as banking, finance, and infrastructure in India, contributing to the country’s development.

Challenges and Controversies

While the India-Singapore DTAA has been instrumental in facilitating investment and trade, it has also faced challenges and controversies. One of the concerns raised is the potential for misuse and tax evasion, as some entities may attempt to take advantage of the agreement’s provisions for improper purposes. Additionally, there have been debates regarding the use of tax havens and round-tripping of funds, highlighting the need for robust monitoring and enforcement mechanisms.

Role of DTAA in Strengthening Bilateral Relations

Beyond its economic impact, the India-Singapore DTAA has played a crucial role in strengthening bilateral relations between the two countries. The agreement has deepened economic ties, fostered cultural exchanges, and facilitated people-to-people interactions. The close cooperation in tax matters has laid the foundation for broader collaboration in various sectors, including technology, innovation, and education.

Recent Developments and Amendments

The India-Singapore DTAA has undergone recent developments and amendments to address emerging challenges and align with international best practices. These changes include revisions to the agreement’s provisions on tax residency, permanent establishment, and capital gains taxation. These amendments have provided greater clarity and certainty to taxpayers and have had a significant impact on businesses and individuals operating between India and Singapore.

Comparison with Other DTAA Agreements

Comparing the India-Singapore DTAA with similar agreements signed by India and other countries offers valuable insights. While each DTAA is unique, analyzing the provisions and experiences of different agreements can provide lessons for other nations seeking to enhance their bilateral economic relationships. The India-Singapore DTAA stands out for its comprehensive framework and successful implementation, making it a model for others to learn from.

Future Prospects and Potential Enhancements

Looking ahead, the India-Singapore DTAA holds promising prospects for further collaboration. Areas such as digital economy taxation, transfer pricing, and dispute resolution mechanisms offer opportunities for enhancement and refinement. Strengthening cooperation in these areas can further boost bilateral trade and investment and ensure a fair and transparent tax environment for businesses and individuals.

Conclusion

The DTAA between India and Singapore is a cornerstone of their bilateral economic relationship. It provides a robust framework for taxation, avoids double taxation, and promotes cross-border investment and trade. The agreement has played a pivotal role in fostering economic growth, job creation, and technology transfer between the two nations. As India and Singapore continue to strengthen their ties, the tax treaty between both countries will remain a vital instrument for deepening economic cooperation and facilitating mutually beneficial outcomes.