Receiving an income tax notice under Section 143(2) can be daunting, but with the right approach, it’s manageable. This guide breaks down the process of responding to a scrutiny assessment notice in a clear, straightforward manner.

What Does a Notice Under Section 143(2) Mean?

A notice under Section 143(2) is issued when the income tax department detects inconsistencies in your tax returns. These discrepancies could be due to under-reporting income, over-reporting losses, or other errors. The purpose of this notice is to ensure that the correct amount of tax has been paid.

Key Points About the Notice

1. Method of Notification:

- Sent via email as a PDF to your registered email address.

- Also dispatched to your postal address.

2. Preliminary Notice:

- If you haven’t filed returns for the financial year, a notice under Section 142(1) is issued first, requesting you to file returns.

3. Required Documents:

- Proof of deductions, exemptions, allowances, reliefs, and other claims made in your tax returns.

- Proof of all income sources.

4. Detailed Inquiry:

- The assessing officer will conduct a detailed inquiry into your Income tax returns.

Consult CA Arun Tiwari for more information at 📞 8080088288 or cs@aktassociates.com

The Process Unfolds as Follows

1. Filing of Income Tax Return:

- Your tax return is initially filed.

2. Issuance of Notice:

- The assessing officer issues a notice under Section 143(2).

3. Submission of Documents:

- Present your case and submit required documents and declarations to the assessing officer.

4. Final Order:

- After reviewing all submissions, a final order is issued regarding tax payable or refund receivable under Section 143(3).

Types of Notices Under Section 143(2)

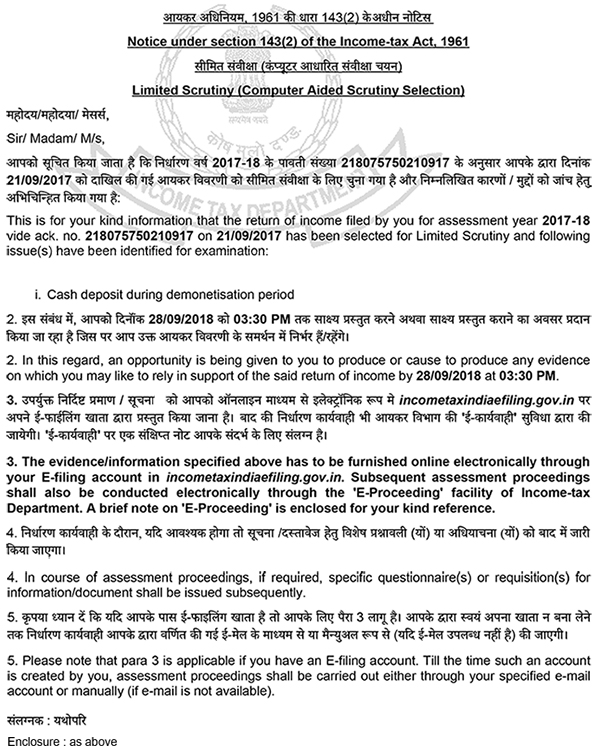

1. Limited Scrutiny:

- Selected through Computer-Assisted Scrutiny Selection (CASS).

- Focuses on specific discrepancies like mismatched information or particular claims.

2. Complete Scrutiny:

- Thorough examination of the return and all supporting documents.

- The scope of scrutiny pertains only to the particular assessment year.

3. Manual Scrutiny:

- Selected based on criteria defined by the Central Board of Direct Taxes.

- Undergoes comprehensive scrutiny.

Sample scrutiny notice

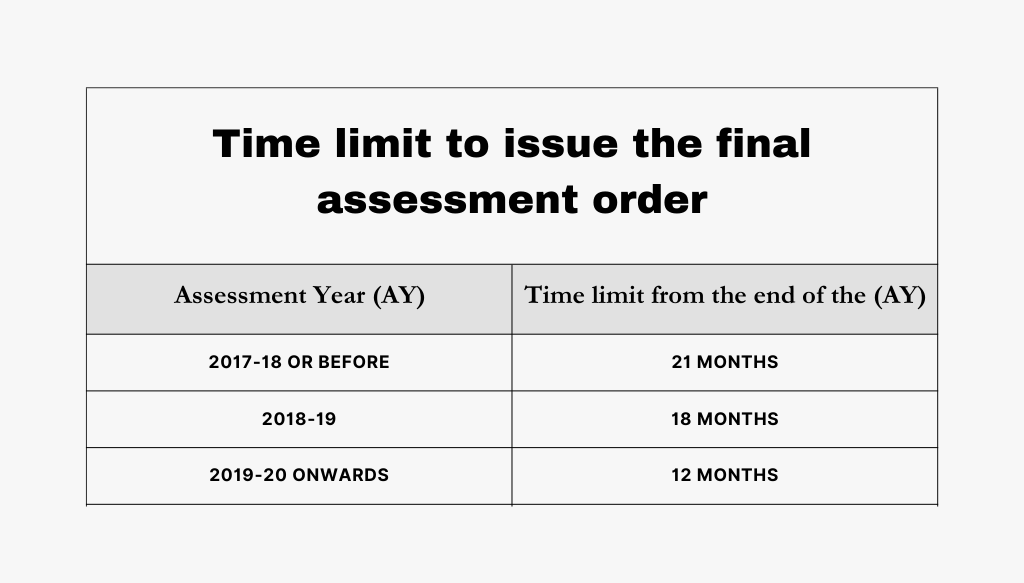

Time Limit for Issuing the Notice

- A notice under Section 143(2) can be issued within three months from the end of the financial year in which the return was filed.

- Example: If Mr. Ram filed his returns on July 31, 2023, for the financial year 2022-23, the assessing officer must issue the notice by June 30, 2024.

Consequences of Ignoring the Notice

Ignoring the notice is not advisable. Failure to respond within the stipulated timeframe can result in several consequences:

1. Penalty:

- A penalty of Rs. 10,000 under Section 272A for each failure to respond.

2. Best Judgment Assessment:

- The assessment officer may finalize the assessment with the information available, applying best judgment under Section 144, potentially leading to higher taxable income and consequently higher tax and penalties.

3. Appeals:

- To appeal to higher authorities when disputing a higher tax demand, you must pay a minimum of 20% of the tax due.

4. Legal Prosecution:

- There may be legal prosecution, potentially resulting in imprisonment if found guilty.

Conclusion

In conclusion, understanding and promptly addressing a notice from the income tax department under Section 143(2) is crucial. This notice indicates discrepancies in your tax returns that need to be clarified to avoid penalties and legal issues. By knowing the types of notices and how to respond, you can navigate the process effectively and ensure compliance with tax regulations.

the above format is also applicable to notice issued u/s 143(2) by NFAC during A.Y. 2022-23 and 2023-24? and if yes then is it necessary that t