Introduction

Tax compliance is an essential aspect of maintaining a healthy financial profile. By meeting your tax obligations, you contribute to the smooth functioning of the economy while avoiding potential penalties and legal troubles. One significant component of tax compliance is the submission of the Income Tax Return Verification (ITR-V) form. This article aims to shed light on the importance of ITR-V and guide you through its ins and outs.

Understanding ITR-V

ITR-V, or Income Tax Return Verification, serves as proof of the authenticity of your tax return filing. Once you have completed your tax return, the next step is to submit it to the income tax department for verification. This is where ITR-V comes into play. By signing and submitting the ITR-V form, you affirm the accuracy of your tax information and comply with the legal requirements.

The Process of Filing ITR-V

To initiate the ITR-V process, you must first complete your tax return, ensuring that all relevant sections and schedules are accurately filled. Once done, you will generate an XML file, which contains the digital version of your tax return. This XML file will be submitted online through the income tax department’s e-filing portal. After successfully submitting your tax return, you will receive an acknowledgment, which includes a link to download your ITR-V.

Consult CA Arun Tiwari for more info at 📞 8080088288 or cs@aktassociates.com

Downloading and Sending ITR-V

To obtain the ITR-V, you need to access the link provided in the acknowledgment received after e-filing your tax return. It is crucial to download the ITR-V within the specified time frame mentioned in the acknowledgment, typically 120 days. The downloaded ITR-V will be a PDF document that you need to print.

The next step involves signing the printed ITR-V form using a blue or black ink pen. Make sure the signature matches the one provided in your tax return. Once signed, You must send the ITR-V to the Centralized Processing Center (CPC) in Bengaluru. Remember to send only the first two pages of the ITR-V and avoid any folds or damages to the document.

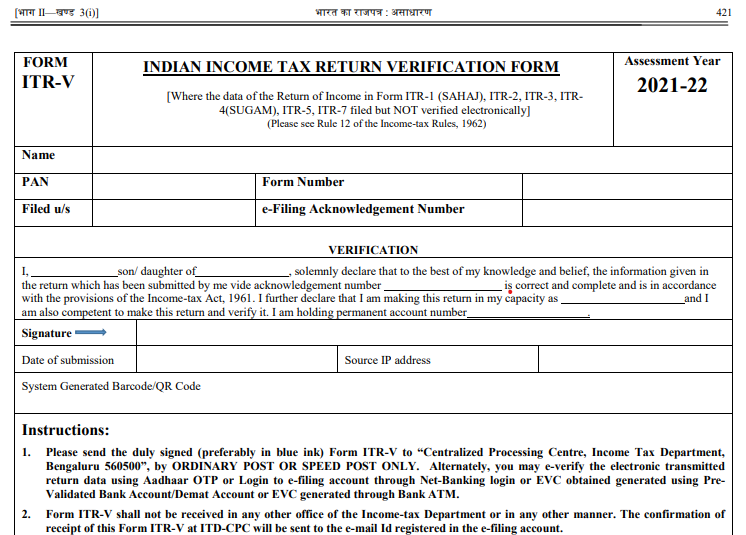

Sample of ITR-V form

Importance of Submitting ITR-V

Submitting the ITR-V holds immense importance in ensuring tax compliance. It is not just a procedural requirement; it serves as a verification mechanism for the income tax department. Without the submission of the ITR-V, your tax return will not be considered valid. Failure to comply with this requirement can result in penalties and legal consequences.

By submitting the ITR-V, you provide proof of your commitment to accurate and complete tax filing. It demonstrates your willingness to cooperate with the income tax department and facilitates faster processing of your tax return. Moreover, it ensures that the tax authorities can carry out proper scrutiny and verification, enhancing overall transparency and fairness in the tax system.

Tips for Handling ITR-V

To ensure a smooth ITR-V submission process, follow these essential tips:

- Properly signing and sending the ITR-V: Take care to sign the ITR-V form correctly and ensure that it matches the signature provided in your tax return. When sending the document to the CPC, use a reliable courier or speed post service to ensure safe and timely delivery.

- Choosing the right mode of submission: Depending on your preference and convenience, you can choose to submit the ITR-V through regular post or opt for the electronic mode by using e-verification methods such as Aadhaar OTP, net banking, or bank account-based validation.

- Tracking the status of your ITR-V: It is advisable to keep track of the status of your ITR-V submission. The income tax department provides online tracking services, which allow you to monitor the progress of your ITR-V and ensure that it reaches the CPC successfully.

- Precautions to avoid rejection or delays: Ensure that the ITR-V form is printed clearly and legibly without any smudges or distortions. Avoid any folds or damages to the document during packaging and dispatch. Additionally, double-check the address of the CPC to ensure accurate delivery.

Conclusion

ITR-V plays a pivotal role in your tax compliance journey. By submitting this verification form, you not only fulfill the legal requirements but also contribute to a transparent and efficient tax system. Take the necessary steps to complete and submit your ITR-V accurately and within the specified time frame. Remember, it is your golden ticket to tax compliance, providing peace of mind and paving the way for a financially secure future.