Have you ever received a notice from the Income Tax Department and felt your heart skip a beat? If you’re nodding along, you’re not alone. One such notice that can cause a stir is the Notice under Section 148 of the Income Tax Act. In this post, we’ll break down everything you need to know about this notice in a friendly, conversational manner. So, grab a cup of coffee, and let’s dive in.

What is a Notice under Section 148?

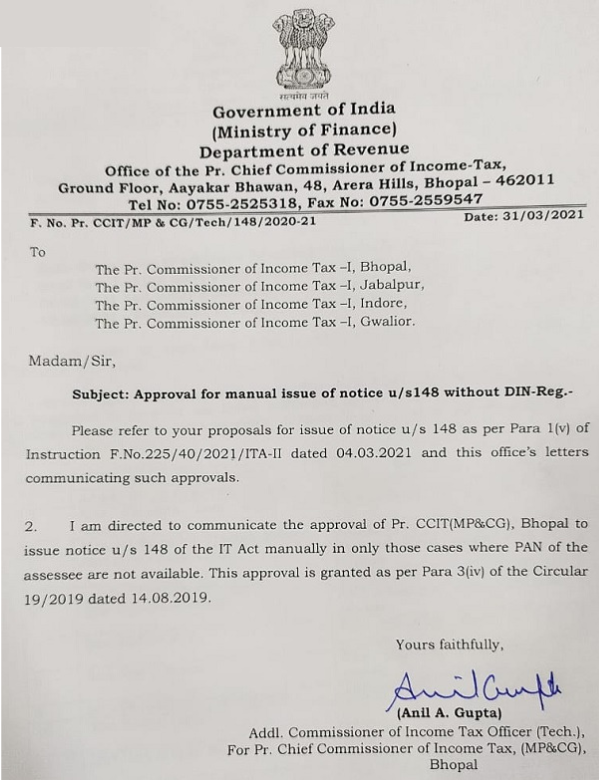

First things first, what exactly is a Notice under Section 148? Simply put, it’s a notice issued by the Income Tax Department when they believe you have not disclosed your income correctly, or there’s some income that has escaped assessment. This notice essentially means that the tax authorities want to reassess your income for a particular financial year.

Get the same knowledge without reading. Watch now!

Why Did You Receive This Notice?

Receiving this notice doesn’t necessarily mean you’ve done something wrong. There are several reasons why you might get a Notice under Section 148:

- Unreported Income: Maybe you forgot to report some income.

- Incorrect Deductions: Perhaps there were mistakes in your deductions.

- Information from Third Parties: The department could have received information about your income from third parties.

The Purpose Behind the Notice

The main aim of issuing a Notice under Section 148 is to ensure that all income is correctly assessed and taxed. The tax authorities use this tool to bring to light any discrepancies or omissions in your tax return. It’s a way to maintain the integrity of the tax system and ensure everyone pays their fair share.

Consult CA Arun Tiwari for more information at 📞 8080088288 or cs@aktassociates.com

What Should You Do When You Receive a Notice?

Alright, you’ve got the notice. Now what? The first step is not to panic. Here’s a step-by-step guide on how to handle it:

1. Read the Notice Carefully

Understand what the notice is about and which financial year it pertains to. Every notice has specific details that need your attention.

2. Check the Validity

A Notice under Section 148 should be issued within the prescribed time limits.

- Up to 4 years: For cases where the amount of income that has escaped assessment is less than ₹1 lakh.

- Up to 6 years: If the income that has escaped assessment is ₹1 lakh or more.

- Up to 16 years: If the escaped income is related to any foreign asset.

3. Gather Your Documents

Collect all relevant documents related to the financial year in question. This includes bank statements, income proofs, investment documents, and any other financial records.

4. Consult a Tax Professional

It’s wise to seek the help of a tax consultant or a professional. They can guide you on how to reply to Notice u/s 148 and help you prepare a robust response.

5. Draft Your Response

Your response should address each point mentioned in the notice. Provide necessary explanations and supporting documents. Be clear and concise.

Crafting a Reply to Notice u/s 148

When drafting a reply to Notice u/s 148, ensure that you cover the following:

Acknowledge the Notice

Start by acknowledging the receipt of the notice. Mention the date you received it and the assessment year in question.

Provide Explanations

Give a detailed explanation for each point raised in the notice. If there was an error in your original return, admit it and provide the correct information.

Attach Supporting Documents

Attach all necessary documents that support your explanations. This could include bank statements, proofs of income, investment details, etc.

Express Your Willingness to Cooperate

Convey your willingness to cooperate with the authorities. This helps in creating a positive impression and shows that you are serious about resolving the issue.

Potential Outcomes

Once you’ve submitted your reply, the tax authorities will review it. Here are a few potential outcomes:

1. Acceptance of Your Explanation

If the authorities are satisfied with your explanation and the supporting documents, they may accept your response, and no further action will be taken.

2. Revised Assessment

In some cases, the tax authorities might reassess your income and issue a revised assessment order. This could result in additional tax liability, interest, or penalties.

3. Further Inquiry

Sometimes, the authorities might ask for additional information or clarification. In such cases, you’ll need to provide the requested information promptly.

Important Points to Remember

Handling a Notice under Section 148 can be daunting, but keeping a few key points in mind can make the process smoother:

1. Timely Response

Always respond to the notice within the stipulated time. Delayed responses can lead to penalties and further complications.

2. Accuracy is Key

Ensure that all the information you provide is accurate and truthful. Misleading information can lead to severe consequences.

3. Keep Records

Maintain thorough records of all correspondence with the tax authorities. This includes copies of the notice, your replies, and any documents submitted.

4. Seek Professional Help

Don’t hesitate to seek professional help. Tax laws can be complex, and a professional can provide valuable guidance.

Conclusion

Receiving a Notice under Section 148 of the Income Tax Act might seem intimidating, but it’s manageable with the right approach. By understanding the notice, gathering your documents, seeking professional advice, and crafting a detailed response, you can navigate this process with confidence. Remember, the key is to stay calm, be proactive, and ensure that your reply to the notice u/s 148 is clear and comprehensive.