Have you recently received an intimation under Section 143(1) of the Income Tax Act? If so, you’re not alone. Many taxpayers find these notices in their emails and wonder what they mean. Don’t worry! We’re here to break it down for you in simple terms. This blog post will help you understand what this notice is, why you might receive one, and what you should do next. Let’s dive in!

What is a Notice u/s 143(1)?

First things first, let’s clarify what a Notice u/s 143(1) is. Essentially, it’s an intimation from the Income Tax Department. When you file your income tax return, the department processes it and compares the details you provided with their records. The notice u/s 143(1) is the result of this initial check.

Get the same knowledge without reading, Watch now!

Types of Notices

The intimation can be of three types:

1. No Discrepancy: Your return matches the department’s calculations. No further action is required.

2. Refund: The department owes you money, usually because you paid more tax than necessary.

3. Demand: There’s a discrepancy, and you owe additional tax.

Understanding which type of notice you have received is crucial. So, carefully read the intimation and identify what category it falls under.

Why Did You Receive This Notice?

Receiving an Income Tax Intimation can be stressful, but it’s often just a routine check. Here are some common reasons why you might get one:

Mismatch in Tax Calculation

One of the most common reasons is a mismatch between the tax you calculated and the department’s calculations. This can happen due to errors in reporting income, deductions, or exemptions.

Incorrect Personal Details

Sometimes, it’s as simple as a typo in your personal details like your PAN number, address, or bank account information. These errors can trigger a notice.

TDS Discrepancies

If there’s a discrepancy in the Tax Deducted at Source (TDS) figures reported by your employer or other deductors and what you’ve reported, you might receive an intimation.

Consult CA Arun Tiwari for more information at 📞 8080088288 or cs@aktassociates.com

What Should You Do Next?

Now that you understand what a Notice u/s 143(1) is and why you might receive one, let’s talk about what to do next. Here’s a step-by-step guide to handling this notice effectively.

1. Read the Notice Carefully

This might seem obvious, but the first step is to thoroughly read the notice. It will contain details about your filed return, the department’s calculations, and any discrepancies identified.

2. Verify the Details

Check the details mentioned in the notice against your records. Look for any errors in your return, such as incorrect income figures, missed deductions, or TDS mismatches.

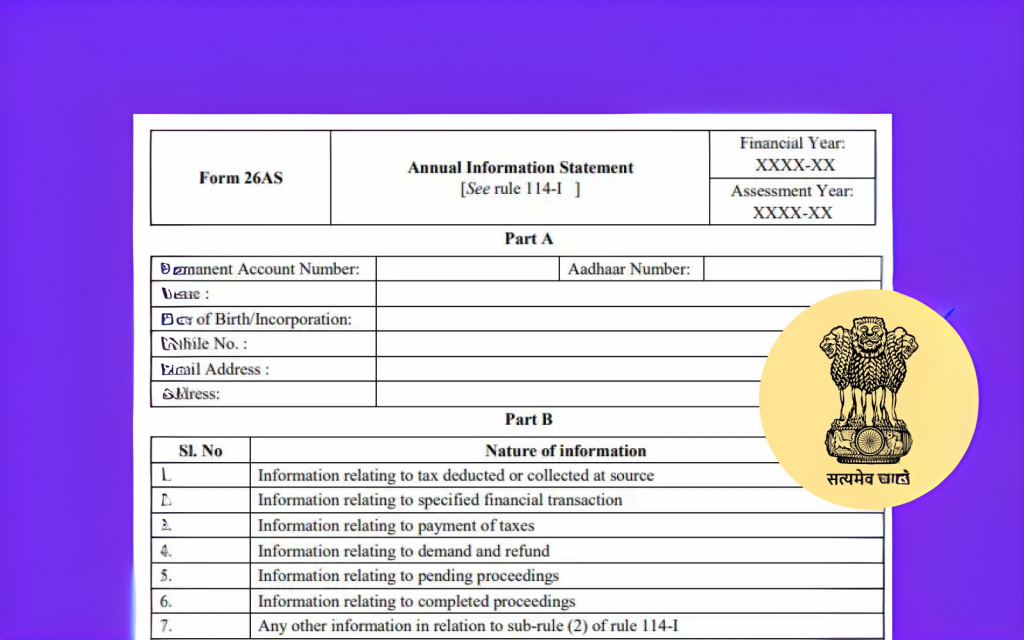

3. Compare with Form 26AS

Form 26AS is a consolidated tax statement that includes details of TDS, TCS, and other tax information. Compare the figures in your return with those in Form 26AS to spot any discrepancies.

4. Calculate the Difference

If there’s a tax demand, calculate the difference to understand why it arose. Sometimes, small errors in calculation or reporting can lead to significant differences.

5. File a Revised Return if Necessary

If you find errors in your original return, you might need to file a revised return. This should be done as soon as possible to avoid penalties.

6. Respond to the Notice

Depending on the type of intimation, you may need to respond. Here’s how:

- No Discrepancy: If the notice indicates no discrepancy, no further action is needed.

- Refund: If you’re due a refund, it will be processed automatically.

- Demand: If there’s a demand, you can either accept it and pay the additional tax or disagree and file a rectification request.

7. Pay the Due Amount

If the notice indicates a tax demand, ensure you pay the due amount within the specified period to avoid interest and penalties.

How to Reply to the Notice

Replying to a Notice u/s 143(1) is straightforward, but it requires attention to detail. Here’s a simple guide:

Online Portal

Most of the time, you’ll handle this via the Income Tax Department’s e-filing portal. Here’s what to do:

- Login: Visit the e-filing portal and log in using your credentials.

- View Notice: Go to the ‘My Account’ section and click on ‘View e-Filed Returns/Forms’ to see the notice.

- Submit Response: Click on ‘Submit’ under the response section. You’ll need to provide details and documents supporting your case.

Documentation

Ensure you have all the necessary documents handy. This includes:

- Form 16/16A (TDS certificates)

- Form 26AS

- Original tax return

- Bank statements

- Any other relevant documents

Seek Professional Help

If you’re unsure about how to proceed, it might be wise to consult a tax professional. They can help you understand the notice and respond appropriately.

Conclusion

Receiving an Income Tax Intimation under Section 143(1) can be daunting, but it’s usually just a routine check. Understanding why you received the notice and knowing how to respond is key to resolving any issues quickly and efficiently. Always read the notice carefully, verify the details, and take the necessary steps to respond appropriately.

If you have any experiences or tips about dealing with these notices, we’d love to hear from you. Leave a comment below and share your insights.