Introduction

Hey there, fellow Non-Resident Indians (NRIs)! If you’ve been navigating the intricacies of managing finances while living abroad, you’ve probably come across the terms NRO and NRE accounts. These are two crucial banking tools that NRIs can use to handle their money in India efficiently. Today, we’ll dive deep into the world of NRO and NRE accounts, discussing how they can be effectively used for family expenses and investments.

Understanding NRO Accounts

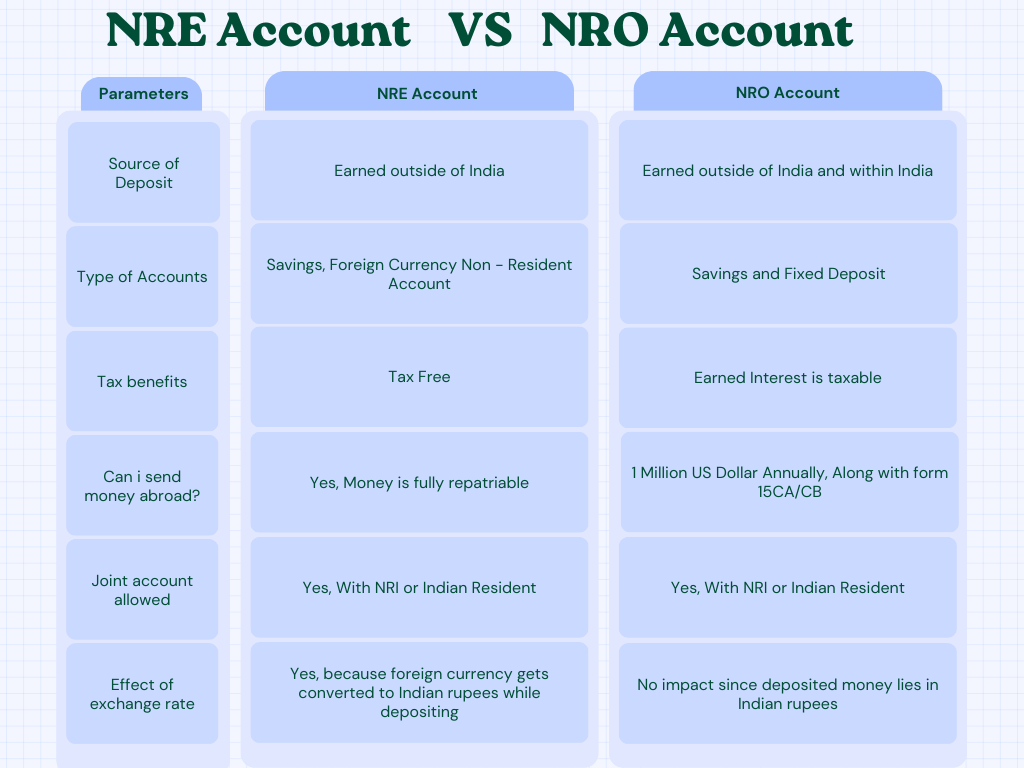

Let’s start with the NRO account, which stands for Non-Residential Ordinary account. This account is designed to manage your income earned in India, such as rental income, dividends, and pension, among others. As an NRI, you are required to open an NRO account to handle these earnings and ensure a smooth financial flow.

Consult CA Arun Tiwari for more information at 📞 8080088288 or cs@aktassociates.com

First and foremost, an NRO account allows you to manage your family’s daily expenses back home. You can deposit your Indian earnings into this account and easily make payments for bills, school fees, medical expenses, and more. This way, you can ensure that you take care of your loved ones’ needs even when you are miles away.

First and foremost, an NRO account allows you to manage your family’s daily expenses back home. You can deposit your Indian earnings into this account and easily make payments for bills, school fees, medical expenses, and more. This way, you can ensure that you take care of your loved ones’ needs even when you are miles away.

Moreover, an NRO account offers certain tax benefits and allows you to repatriate a limited amount of funds each year. This makes it an ideal choice for NRIs who want to invest in the Indian market or buy property in the country. Additionally, you can hold joint accounts with resident Indians, which can be a great way to facilitate seamless money transfers within the family.

Understanding NRE Accounts

Now, let’s move on to the NRE account, which stands for Non-Residential External account. Unlike the NRO account, you maintain the NRE account in foreign currency, and it is fully repatriable. This means you can freely transfer both the principal amount and interest earned back to your foreign country.

On the other hand, an NRE account is primarily used for investments and long-term financial planning. Since the account is denominated in foreign currency, it shields you from fluctuations in the Indian rupee’s value. This makes it an attractive option for NRIs looking to grow their wealth through investments without currency risks.

Additionally, an NRE account provides high liquidity, making it easy to access your funds whenever you need them. This is particularly beneficial for NRIs who may have sudden financial requirements in their home country or abroad.

Differentiating Family Expenses and Investments

Now that we understand the basic purposes of both NRO and NRE accounts, let’s explore the key differences in using these accounts for family expenses and investments.

For family expenses, an NRO account is the preferred choice. As mentioned earlier, this account allows you to manage your Indian income and make payments for various expenses. You can easily transfer money to your family members and dependents residing in India, ensuring they have the financial support they need.

On the other hand, for investments, the NRE account takes the lead. When you want to put your hard-earned money into Indian financial instruments like fixed deposits, mutual funds, stocks, or real estate, the NRE account becomes invaluable. Not only does it protect your investments from currency risks, but it also offers tax-free interest income, providing higher returns compared to the NRO account.

Best Practices for Using NRO and NRE Accounts

Now that we’ve grasped the distinction between family expenses and investments, let’s dive into some best practices to make the most of your NRO and NRE accounts.

Firstly, maintain clear segregation of funds. Designate your NRO account for all your Indian income and expenses. This will help you keep track of your domestic financial obligations and ensure compliance with Indian regulations.

Secondly, utilize the repatriation facility wisely. An NRO account allows you to repatriate up to USD 1 million per financial year. Be strategic about transferring funds to your foreign accounts and ensure that you comply with any applicable tax regulations in your home country.

Additionally, diversify your investments through your NRE account. India offers a wide array of investment opportunities, and the NRE account can be an excellent tool to explore them. However, always conduct thorough research and seek professional advice before making any investment decisions.

Moreover, leverages technology for easy monitoring and transactions. Most banks now offer online banking services, making it convenient for NRIs to access and manage their NRO and NRE accounts remotely. Keep a close eye on your accounts, track transactions, and set up alerts to stay on top of your financial game.

Conclusion

In conclusion, NRO and NRE accounts are essential tools that NRIs can use to manage their family expenses and investments effectively. The NRO account allows you to handle your Indian income and support your family back home, while the NRE account provides an avenue for currency-protected investments with higher returns.

By understanding the distinct purposes of these accounts and following best practices, NRIs can make the most of their finances and ensure a secure future for their loved ones and themselves.

So, dear NRIs, go ahead and make the most of your NRO and NRE accounts! Embrace the financial freedom they offer and confidently navigate the world of family expenses and investments with ease.

Happy banking, and may your financial journey be rewarding and fruitful!