Introduction

Income Tax Form 26AS is a vital document in the realm of income tax filing. Designed to consolidate various tax-related information, Form 26AS plays a significant role in providing taxpayers with a comprehensive overview of their tax transactions. In this article, we will delve into the nuances of Form 26AS, its purpose, and why it holds immense importance for taxpayers.

Understanding the Components of Form 26AS

Tax Deducted at Source (TDS)

TDS stands as a pivotal element in the income tax ecosystem. It refers to the practice of deducting a certain amount of tax from the income of individuals or entities at the time of payment. Form 26AS serves as a repository for all the TDS details associated with an individual’s income. This includes information about TDS deducted by employers, banks, or any other source of income. By encompassing these details, Form 26AS offers taxpayers a consolidated view of the tax already deducted on their behalf, facilitating the calculation of their net taxable income.

Tax Collected at Source (TCS)

Similar to TDS, Tax Collected at Source (TCS) entails the collection of tax at the source of specific transactions. TCS is primarily applicable to businesses engaged in activities such as the sale of goods, the provision of services, or the execution of contracts. Form 26AS reflects the TCS details pertaining to these transactions, thereby enabling taxpayers to ascertain the tax already collected and remitted on their behalf.

Consult CA Arun Tiwari for more info at 📞 8080088288 or cs@aktassociates.com

Advance Tax and Self-Assessment Tax

Advance tax refers to the payment of taxes in installments, as per the prescribed schedule, based on an individual’s estimated income for the financial year. Self-assessment tax, on the other hand, is the tax paid by an individual after the financial year ends, to cover any additional tax liability. Form 26AS encapsulates the details of both advance tax and self-assessment tax, providing taxpayers with a comprehensive record of their tax payments.

Details of High-Value Transactions

Details of High-Value Transactions

In recent times, the income tax department has intensified its focus on high-value transactions to curb tax evasion. Form 26AS now includes information about such transactions, including the sale or purchase of immovable property, large bank deposits, credit card payments, and mutual fund investments. By incorporating these details, Form 26AS aids taxpayers in ensuring accurate reporting of their income and assets.

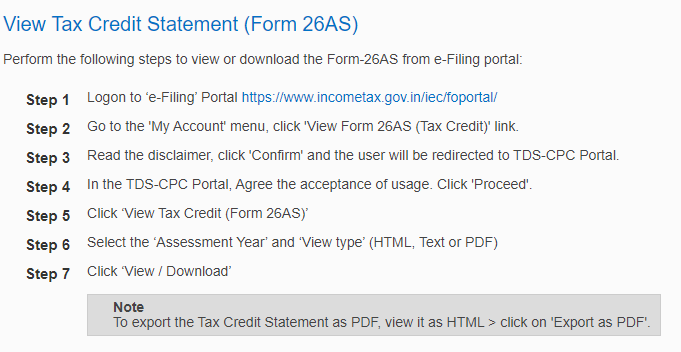

Accessing and Downloading Form 26AS

To access Form 26AS, taxpayers can leverage online methods offered by the income tax department. The income tax department’s website provides an option to view Form 26AS by logging in using one’s PAN (Permanent Account Number). Additionally, taxpayers can access Form 26AS through their net banking portals by selecting the relevant option for viewing tax credit statements.

Downloading Form 26AS is a straightforward process. Through the income tax department’s website, users can follow the step-by-step procedure outlined on the portal. Similarly, net banking portals offer the option to download Form 26AS by navigating to the designated section.

Step-by-step procedure for downloading Form 26AS

Verifying and Correcting Form 26AS

Verifying Form 26AS is crucial to ensure its accuracy and avoid any discrepancies. Taxpayers should carefully review the details mentioned in Form 26AS and cross-verify them with their own records. If any discrepancies or errors are identified, the income tax department provides a mechanism for rectification. Taxpayers can file a request for rectification online, providing the necessary documentation and supporting evidence to address the issue.

Utilizing Form 26AS for Income Tax Filing

Form 26AS plays a pivotal role in the income tax filing process. By providing a consolidated view of tax-related information, it assists taxpayers in accurately reporting their income, deductions, and tax payments. During the income tax filing process, individuals can refer to Form 26AS to ensure that they capture all relevant details and avoid any oversight or errors.

Conclusion

Income Tax Form 26AS serves as an indispensable resource for taxpayers, offering a comprehensive summary of their tax transactions. By including details of TDS, TCS, advance tax, self-assessment tax, and high-value transactions, Form 26AS provides individuals with a consolidated view of their tax-related information. Accessible through online methods and downloadable in a few simple steps, Form 26AS empowers taxpayers to verify its accuracy and utilize it effectively during the income tax filing process. In this age of digitization, embracing Form 26AS can greatly contribute to accurate income tax reporting and a hassle-free tax compliance experience.