In this article, we will discuss about...

Introduction

Goods and Service Tax or GST as it is called follows a Mutual trust taxation system, Where Taxpayer files and pays GST on a self-assessment basis. However along with trusting the taxpayer to pay GST properly and disclose information faithfully it is also important to put checks & balances to keep a watch on revenue leakage and also defaulting taxpayers. Hence under the GST Act, 2017 Various kind of Audit and its procedure has been prescribed. Let’s have a look at various types of Audits Under the GST Act 2017.

As per section 2(13) of CGST Act, 2017, Audit Means:

- Examination of Records, returns and other documents maintained or furnished by the registered person under this Act or any other law,

- Verify the correctness of turnover declared,

- Taxes Paid,

- Refund claimed and input tax credit availed and,

- To assess compliance with the provisions of the act and rules made thereunder.

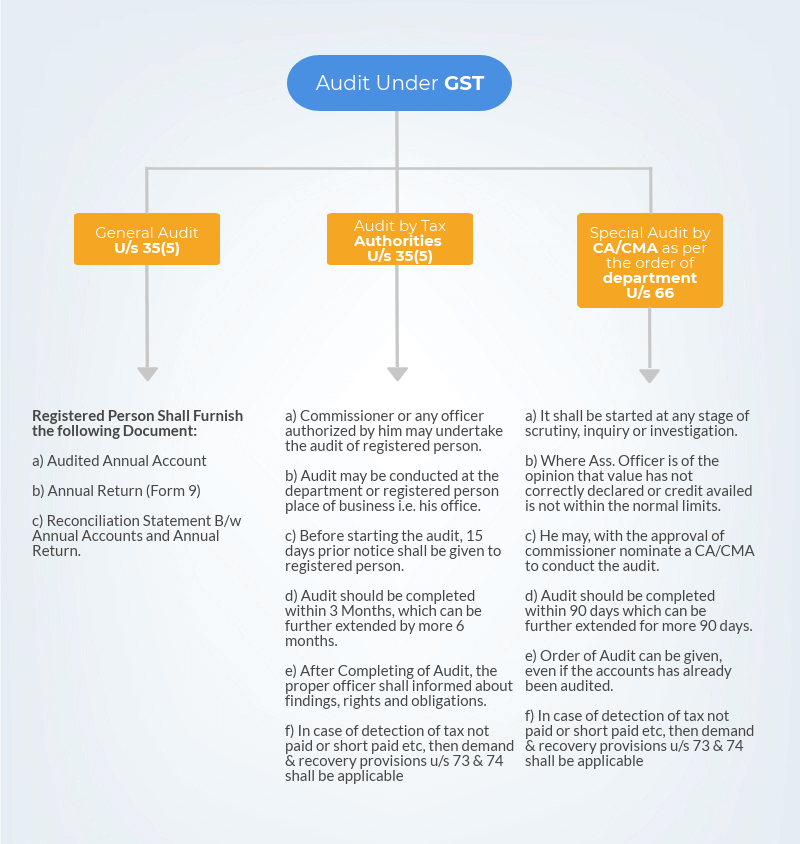

Under GST, there are 3 types of audit which are:

- Audit by a Chartered Accountant or Cost Accountant (Section 35(5) read with 44(2) and Rule 80 of CGST Act, 2017)

- Audit by the Tax Authorities (Section 65 of CGST Act, 2017)

- Special Audit (Section 66 of CGST Act, 2017)

We will understand the concept of each audit under GST herewith.

-

Audit by a Chartered Accountant or Cost Accountant

Every registered person whose turnover exceeds Rs. 2 crore during a financial year, Falls under GST Audit Limit & must get his accounts audited by a Chartered Accountant or Cost Accountant. This Audit Under GST is also known as Reconciliation Audit as in this audit, Figure shown in financial statements has to be reconciled through Figures appearing in GST Annual Return i.e. Form GSTR 9. Hence It needs to be clarified that the GST Audit limit is Rs 2 cr and not 1 cr as for Income Tax.

He shall also be required to furnish the following documents electronically at GST Portal:

- Copy of Annual Return (Form GSTR-9 under Normal Scheme and GSTR-9A for Composite dealer) by 31st December of Next Year.

- Copy of Audited Annual Accounts

- A Reconciliation Statement, reconciling the value of supplies declared in the annual return with the audited annual financial statement duly certified (GST Audit Report in Form GSTR-9C)

- Other Particulars, as specified.

It seems that a lot of people get confused between Turnover amount limit of Audit under GST and income tax Act, 1961. If we speak in simple words:

| Audit Required | When Turnover exceeds |

| The limit for GST Audit | 2 Crore |

| 44AB of IT Act | 1 Crore |

| 44AD of IT Act | 2Crore |

Note: The definition of Turnover is different in both Act.

Under GST, It is very important to calculate aggregate turnover accurately because your aggregate turnover will decide whether you required to get your accounts audited or not.

As per section 2(6) of CGST Act, Aggregate Turnover Means:

Value of all Outward Supplies, which include

- Taxable Supply

- Exempted Supply

- Exports

- Branch Transfer( I.e. Interstate supply to its branch having common PAN Number)

Note: Outward supply taxable under RCM would continue to be part of such a supplier.

Let’s understand this with a simple example:

M/s ABC is a Lawyer firm providing Legal services in Delhi. It also has a business of trading of taxable goods in Mumbai. They have the following receipts during the year:

| S.No. | Receipts | Amount in Lakhs |

| 1 | Sale of Taxable goods | 100.00 |

| 2 | Legal services to Non Business Entity | 20.00 |

| 3 | Sale of Goods outside India | 20.00 |

| 4 | Transfer of goods from Delhi to Mumbai | 50.00 |

| 5 | Legal services to Business Entity having a turnover of Rs.50 Lacs | 20.00 |

| Total | 210.00 |

Now let us understand each point:

- Sale of Taxable Goods (100 Lakhs): It is a taxable supply under GST, hence it will be included while calculating Aggregate Turnover.

- Legal services to Non-Business Entity (20 Lakhs): As per Serial Number 45 of Notification Number 12/2017, If any Legal services have been provided to any Non-Business Entity or business entity having a turnover in the last financial year is up to 20 lakhs, such service is exempted supply. But still, the receipts from such services shall be included while calculating the turnover for Audit Under GST.

- Sale of Goods outside India (20 Lakhs): When goods have been exported outside India, GST shall not be charged. Although such receipts shall be included while calculating the aggregate turnover.

- Transfer of goods from Delhi to Mumbai (50 Lakhs): Although it was transferred to its own branch in other states, hence the amount shall be included in turnover.

Note: Even if the firm has transferred goods without consideration then still it will be counted as supply as per Para 2 of Schedule I read with section 7 of the CGST Act, 2017.

- Legal services to Business Entity having turnover of Rs.50 Lacs (20 Lakhs): As per Notification Number 13/2017 read with section 9(3) of CGST Act, 2017, if any legal services provided by advocate to any business entity, then such service shall be covered under RCM and such business entity shall be liable to pay GST.

Although, in this case, the liability to pay GST under RCM is on business entity still the turnover amount shall be included in Supplier Firm.

Note: In this case, it is given that the business entity’s last year turnover is Rs. 50 lakhs, if it was less than 20 lakh then it would be exempted supply as explained in point number 2. As the firm exceeds the GST Audit Limit. It required to be Audited Under GST.

- Audit by the Tax Authorities (Section 65 of CGST Act, 2017)

- The Commissioner or

- Any officer authorized by him by general or any specific order

Can undertake the audit of any registered person

At the registered person’s place of business or the department office for the financial year or multiple.

The department shall issue a notice to the registered person within 15 working days before the conduct of the audit in form GST ADT-1.

The Audit shall be completed within 3 months from the date of commencement of audit i.e. audit shall be completed within 90 days.

This period can be further extended by 6 Months if the commissioner is of the opinion that Audit can’t be completed within 3 months.

Where the commence of audit means

- The date on which records are called by the department or

- Actual institution of Audit at the place of business of the registered person.

For Example, Records has been called by the commissioner for the audit under section 65 of the CGST Act as on 17th July 2019.

Since notice period includes only working days, It means, the commissioner has to send the notice as on 01st July 2019 (It is assumed that there are 2 Sundays from 01st July to 17th July 2019)

The last date to complete the audit is 15th Oct 2019 (i.e. 3 Months from 15th July 2019).

However, the commissioner may allow extending the period of the audit by a further 6 months.

The officer along with his team has to verify

- Documents on the basis of which the books of account are maintained and the returns and statements furnished under the provisions of the Act and the Rules made thereunder.

- The correctness of the turnover

- Exemptions and deductions claimed

- Rate of tax applied in respect of the supply of goods or services or both

- Input tax credit availed and utilized

- Refund claimed

- Other relevant issues

Once the audit has been completed, the proper officer from the department shall, within 30 days, inform the registered person about his findings from the audit, the reason for findings and rights and obligations of a registered person in form GST ADT-2.

Where the Audit results in

- Detection of tax not paid or Short Paid or

- ITC wrongly availed or utilized or

- Erroneously refunded

The department shall initiate the action of demand & recovery as defined U/s 73 or 74.

- Special Audit (Section 66 of CGST Act, 2017)

If at any stage of scrutiny, inquiry, investigation or any other proceedings before him, any officer not below the rank of Assistant Commissioner, having regard to the nature and complexity of the case and the interest of revenue, is of the opinion that

The value has not been correctly declared or

The ITC availed is not within the normal limits,

He may, with the prior approval of the Commissioner,

Direct such registered person, by a communication in writing, to get his records including books of account examined and audited by a chartered accountant or a cost accountant as may be nominated by the Commissioner.

The officer has to issue direction in FORM GST ADT-03 to the registered person in this regard.

The Proper officer may order the registered person for the special audit even if his records have already been audited under any other provisions of the GST Act or any other law.

The chartered accountant or cost accountant so nominated shall, within the period of 90 days, submit a GST Audit report of such audit duly signed and certified by him to the said Assistant Commissioner.

Provided that the Assistant Commissioner may, on an application made to him in this behalf by the registered person or the chartered accountant or cost accountant or for any material and sufficient reason, extend the said period by a further period of 90 days.

A special audit can be conducted even if the accounts of the registered person have been audited under any other provisions of this Act or any other law for the time being in force.

The registered person shall be given an opportunity of being heard before taking any actions against him under this Act or the rules made thereunder.

The expenses of the examination and audit of records, including the remuneration of such chartered accountant or cost accountant, shall be determined and paid by the Commissioner and such determination shall be final.

On the conclusion of the special audit, the registered person shall be informed of the findings of the special audit in FORM GST ADT-04.

Where the Audit results in

- Detection of tax not paid or Short Paid or

- ITC wrongly availed or utilized or

- Erroneously refunded

The department shall initiate the action of demand & recovery as defined U/s 73 or 74.

This provision is the same as section 65 of the CGST Act, 2017.

I have read your article and it is very useful for all GST user.

https://www.filingsguru.com

Thank you. Do read our other blogs aswell.