Our present government is taking a lot of initiatives to make the life of an average person stressfree. For this, they had issued many schemes like Make in India or Digital India or Housing for all.

As per the Central government’s 5-year plan, till 2024, every person shall have its own house and the government is making all the efforts to make this possible.

The first step taken by the government is boosting the real estate market in India by making it compulsory for the builder to make the flats for EWS category up to a particular portion and also recently government has revised the rates of GST for real estate entities by reducing them to 1% or 5% as the case may be. In this article, you will get a full understanding of the applicability of GST in affordable housing.

Meaning of the term ‘Affordable Housing’

Before understanding the applicability of GST, it is necessary to understand the meaning of the term ‘Affordable Housing. Let’s understand the term of Affordable Housing by the below table:

| Particulars | Conditions |

| Affordable Housing for Metro cities | 1. A residential house/flat having carpet area up to 60 sqm. |

| 2. The gross amount charged cannot be more than INR 45 Lakhs. | |

| Affordable Housing for non-metro cities | 1. A residential house/flat having carpet area up to 90 sqm. |

| 2. The gross amount charged cannot be more than INR 45 Lakhs. |

Here the metro cities mean Chennai, Bengaluru, Delhi NCR (restricted to Noida, Delhi, Greater Noida, Gurgaon, Ghaziabad, Faridabad), Kolkata, Hyderabad, and Mumbai.

From 1st April 2019, GST Rates for Affordable Housing has been changing and new rates have been applicable:

With effect from 1st April 2019, the new effective GST rate shall be 1% (without input tax credit) on the construction of affordable housing. The GST rate of 1% is applicable to all the projects commencing on or after 1st April 2019.

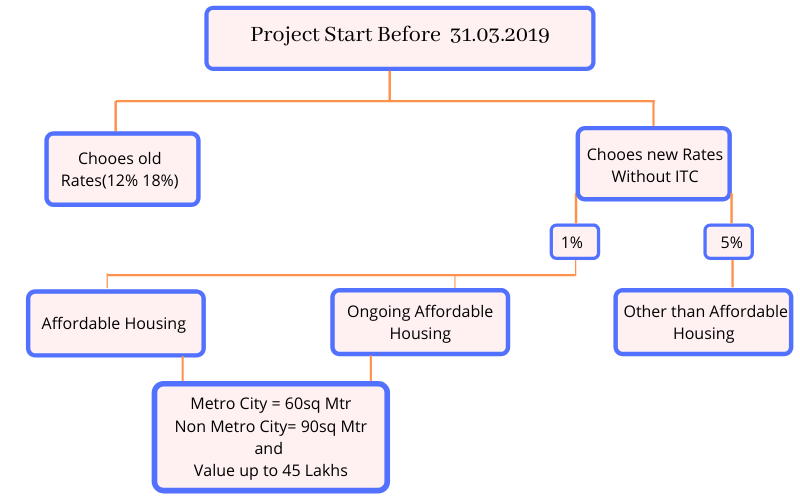

Option available for the ongoing projects i.e. which are not completed till 31.03.2019

Those projects which have been started before 1st April 2019 and not been completed by 31st March 2019 for the construction then the Real estate entity shall be given an option to either continue with the old GST rate of 8% or convert into 1%.

Such Real Estate entities can choose any one option and whatever the option would be chosen by such entity, it would be applicable to them permanently on all projects.

Note: It is to be noted here that ‘ongoing projects’ means those projects which have been started by receiving the commencement certificate; however, a certificate for completion of such project has not received till 31.03.2019.

Note: The option for continuing with the old rates is only applicable for ongoing projects. Projects for construction started at any time after 31.03.2019, the new rates shall be applicable to such real estate entities.

Let’s understand this with a diagram:

What are the conditions to be satisfied by the entity for the new GST rate of 1%

The promoters/builder shall be required to fulfill all of the following conditions to avail the benefit of GST lower rate of 1%:

Such Entities engaged in the real estate, opting for the new rates, will not be eligible for availing the input tax credit (ITC).

It would become compulsory for the entity to purchase 80% of the value of the inputs and input services from the registered persons.

Also, in such 80% value following shall not be included:

- Capital Goods;

- Service By Way Of Grant Of Development Rights;

- Long Term Lease Of Land;

- Fsi; High-Speed Diesel;

- Natural Gas;

- Electricity;

- Motor Spirit.

In simple words, If there is a shortfall in the value of 80%, then such entity being the promoter/builder would be required to pay tax @ 18% on reverse charge basis (RCM).

The promoters/builders are required to purchase cement only from the registered person. In case the cement is purchased from the unregistered person, the promoters/builder is required to pay tax @ 28% on a reverse charge basis (RCM).

As we already discussed above that if the entity opting the new rates then it would be compulsory for them to purchase capital goods only from the registered person. In case, they have purchased the capital goods from the unregistered person, then such entity being promoters/builder would be required to pay tax which shall be applicable on the capital goods on reverse charge basis (RCM).

The GST tax shall be paid only by debiting the ‘electronic cash ledger’.

Where a developer has transferred the right to the builder for making the residential apartment through long term lease or transferrable development rights (TDR) or FSI, such a developer shall become the supplier and the builder becomes the recipient and such supply shall be taxable under GST. Although, it would be fall under RCM and the builder shall be liable for the payment of GST. Also, this shall be applicable only when the developer has sold the property to the buyer after receiving the completion certificate. If the developer has sold the under constructed property then the supply between developer and builder shall be exempted.