In this article, we will discuss about...

Introduction

GST is a win-win situation for the entire country. It brings benefit to all the stakeholders of the industry, Government and the end consumer. One of the major benefits to the taxpayer is the “Elimination of Multiple taxes and double taxation”. In the earlier tax regime, when goods were manufactured and sold, then both Excise duty (Central) and State Level VAT levied. Also, the credit of one could not be set off against the other because CENTVAT is central level tax and VAT is a state-level tax. This caused double taxation on the same goods. After application of GST, the majority of the State level taxes have been subsumed into GST. The GST regime promises seamless flow of tax credit on goods and services across the entire supply chain with some exceptions like supply under composition Scheme.

In this article, we will understand the following:

- Meaning of ITC

- Conditions to be satisfied to avail the ITC

- Specific supplies in which ITC is not available

- Manner of the utilization of ITC

- Electronic Ledgers

- Concept of apportionment of ITC

Meaning of Input Tax Credit (ITC):

Input Tax: Input Tax in relation to registered person is the Central tax (CGST), State tax(SGST), Integrated tax (IGST) or Union Territory tax(UTGST), but does not include composition levy tax charged on the supply of any goods or services made to him.

Output Tax: Output Tax is the tax payable by a Registered person on the supply of goods or services made by him or his agent but shall not include tax paid by him under reverse charge.

Input Tax Credit: Input Tax credit is the tax credit of the above input taxes paid by a registered person on the supply of any goods or services made to him. Such credit shall be available to him at the time of making payment of the output tax on the outward supply.

Below is the example of explaining the above concepts.

For Example, Mr. X is supplying the goods of Rs.1,18,000 (Inclusive of GST of Rs.18,000) to Mr. Y. and Mr. Y further sold the goods to Mr. Z for Rs.1,77,000 (Inclusive of GST of Rs.27,000). In such a case, the net output liability of Mr. Y shall be:

| Input Tax Paid by Mr.Y (ITC) | Output Tax Payable by Mr.Y (Output Tax Liability) | Net Tax Output Tax Payable after adjusting ITC |

| ₹18000 | ₹27000 | ₹9000 (₹27000-₹18000) |

In the given case, an input tax credit of ₹18000 is utilized for the payment of Output Tax Liability of ₹27000.

Eligibility and Conditions for availing Input Tax Credit (Section 16):

Obtain Invoice Copy: (Section 16(2)(a)):

- The recipient should receive an invoice issued by the supplier.

- If the supply is received from an unregistered dealer then the registered person will himself raise an invoice and pay tax under RCM

- Debit Note issued by the supplier

- Bill of entry as per Customer Act.

- Revised Invoice, if any.

- Input Service Distributor invoice.

1. Receipt of Goods or service: (Section 16(2)(b)):

- The goods or services should be received by the recipient himself or

- The goods or services should be received by a third party on the directions of the recipient.

For Example, Mr.A is a trader who places an order on Mr.B for the consignment of shoes. Mr.A receives buying orders from Mr.C for the same quantity of shoes. Mr.A instructs Mr.B to deliver the goods to Mr.C, and in turn, Mr.A raises the invoice on Mr.C. Though goods are not physically delivered to Mr.A, he shall be eligible to claim the credit. This Model is called “Bill to Ship to” Model.

[Note: An explanation regarding “Bill to ship to” Model, in case of services, has been added in the CGST Amendment Act, 2018 which states that w.e.f. 01.02.2019. As per the explanation the services shall be deemed to be received by the registered person if the third person receives such services on the directions of the registered person.]

- If goods are received in installments, then the recipient can claim the ITC only upon the receipt of the last lot.

For Example, Mr.A entered into an agreement with Mr.B for the supply of 1000 pens over a period of 6 Months and charged Rs.11,800 (Inclusive of GST @ 18%) on July 19. Mr.B raised the invoice on July 19 but the supply of pens continued to be delivered till Dec 19. In this case, although Mr.A has made the full payment the amount including GST on July 19, he will be eligible to take the credit upon the receipt of the last lot i.e. Dec 19.

2.Payment of Tax to the government: (Section 16(2)(C)):

For claiming of the ITC by the recipient, it is necessary that the supplier has paid the tax collected on such supply through Cash or utilization of ITC.

3. Filing of valid return: (Section 16(2)(d)):

To avail the ITC, the recipient is required to file a valid return in form GSTR-3 under section 39 of CGST Act, 2017.

4. Payment to be made within 180 days: The registered person must make the payment of the value(including GST), of goods or service or both within 180 days from the date of issue of the invoice. In case, the recipient fails to make the payment within 180 days then the credit availed by the recipient on such goods shall be added to his output liability of the month immediately following the period of 180 days. Interest shall be calculated from the date of claiming the ITC till the date on which credit is added to output tax liability. However, once the payment is made by the reception he will again become eligible for the ITC without any time limit. If proportionate payment is made then proportionate ITC will be available.

Below are the exceptions where the condition of 180 days is not applicable:

- Supply made under Reverse charge Mechanism

- Deemed supply made without consideration. As per Section 7(1)(c) read with the schedule I of CGST Act, 2017, there are certain transactions that have been specified in schedule shall be deemed to be a supply of goods or services or both even though there is no consideration involved. For Example: If there is a supply of goods or services or both between “Related Persons” or between “Distinct Persons”, such supply shall qualify as supply even though it is made without consideration, provided it is made in the course of or furtherance of business.

5. Use for Business: Inward supply must be used or intended to be used for business or furtherance of business.

6. No ITC if depreciation claimed (Section 16(3)): If the registered person is taking the credit of ITC on capital goods then he shall not be eligible to claim depreciation on the same assets and vice versa. That means dual benefit cannot be available in the Income Tax Act and GST Act simultaneously. In other words, one can either claim depreciation on the tax component or ITC on such tax paid under GST laws.

7. The time limit for availing the ITC: The due date for availing the ITC is earlier of the following(Section 16(4)).

The due date for filing of September Month return in the next financial year

OR

Date of filing of Annual Return

8. Outward supply should be Non-Exempted: ITC can be claimed only in respect of an outward supply made by the recipient which is not exempted. i.e. it should be taxable or zero-rated supply.

Till now we have discussed the conditions to be followed for availing the ITC. Now we shall understand the supplies on which the ITC is blocked.

SECTION: 17(5) & (6): Blocked Credit i.e., No ITC shall be allowed to Recipient in respect of the following supplies:

As per section 17(5) Credit of following inward supplies shall not be available to the recipient subject to some exceptions:

1. Motor Vehicle: Generally input tax credit of passenger motor vehicle shall not be allowed to the recipient. however, for certain class of persons input tax credit of passenger motor vehicle will be available who provides:

- For further supply of such motor vehicle:

For Example, ITC on cars purchased by a car dealer for sale to customers is allowed because in this case, they have purchased for further supply of such motor vehicle.

- For passenger transportation or goods transportation service:

For Example, ITC on cars purchased by a company engaged in renting out cars for transportation of passengers is allowed.

ITC on trucks purchased by a company for transportation of its finished goods is allowed.

- For imparting training on motor driving or flying service:

For Example, ITC on cars purchased by a car driving school is allowed.

2. Personalized Services: No ITC would be available on the following supplies:

- Food & Beverages

- Outdoor catering

- Beauty treatment service

- Health service

- Cosmetic & plastic surgery

- Life insurance

- Health insurance service

- Rent a Cab

In all the above services, the ITC is not available to the supplier however there are some exceptions that means if any of the following conditions are satisfied then the ITC of above services shall be available.

- If the service is being provided to a similar line of business:

Example1: Although ITC on Life insurance policy is not available if the LIC has taken reinsurance from HDFC insurance then the LIC shall be eligible to take the credit of GST charged by the HDFC on his invoice.

Example 2: AB & Co. a caterer from Amritsar has been awarded a contract for catering in a marriage to be held at Ludhiana. AB & Co. has given the contract for the supply of snacks, to be served in the marriage, to CD & Sons, a local caterer of Ludhiana. ITC on such outdoor catering services availed by AB & Co. will be allowed.

- A mandatory requirement by the Govt:

If the government has made it mandatory for the supplier to make such supply. For Example, The Government has made it mandatory for all the employers to provide cab services for ladies working in the Nightshift. Hence although the ITC on renting a cab is not available in the above case, employers shall be eligible to take the ITC on the GST charged by the cab service provider.

3.Membership of club, Health or Fitness center, Travel Benefit to an employee for their personal trip: No ITC is available in these services

4.Works Contract Services for the construction of immovable property: Works contract means a contract for building, construction, repairs or maintenance of an immovable property wherein there is a transfer of property in goods(whether as goods or in some other form) is involved in the execution of such a contract.

As works contract involves both goods and services, it is considered as a supply of services as per Schedule II.

ITC in respect Works Contract shall not be available except when:

- When the service is in utilized for plant and machinery

- When it is used as an input service for providing a further supply of similar service i.e. works contract service. For example, DLF providing a service to Amarpali as subcontractor then Amarpali shall be eligible to take the credit of the GST charged by DLF

5. Other Supplies on which ITC shall not be available:

- Inward supplies on which tax has been paid under Composition Scheme

- Inward supplies of Non-Resident Taxable Person except goods imported by him

- Goods or services used for personal consumption

- Goods which has been lost, destroyed, theft or disposed of by way of gift or a free sample.

Let us discuss the Manner of the utilization of ITC:

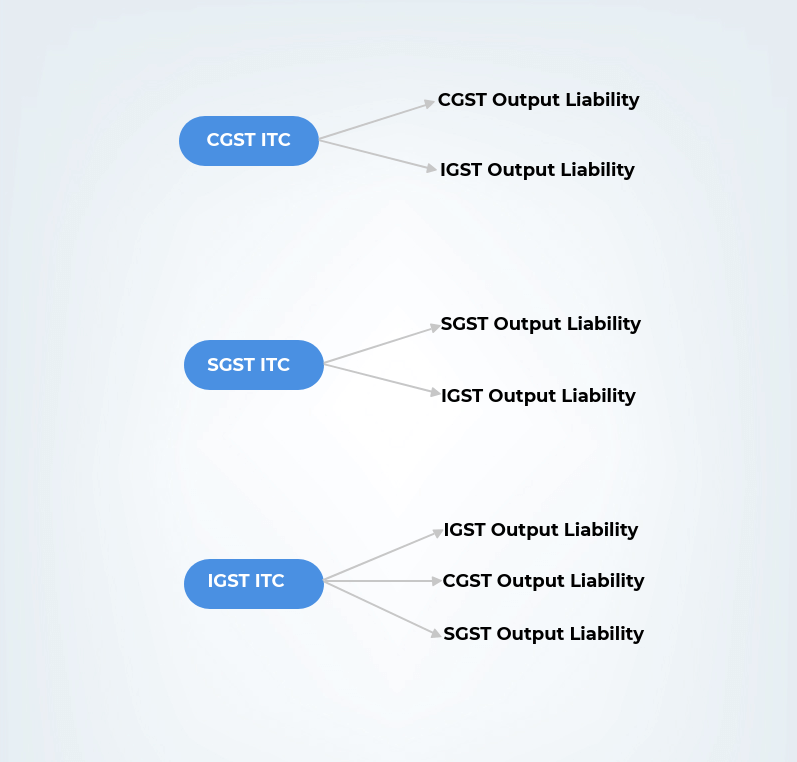

The tax paid on the inward supplies by a registered person shall be credited to the electronic credit ledger of the registered person. This credit shall be utilized for meeting the output tax liability of the registered person in the following manner and order:

Note:

- The input tax credit would be shown in the electronic credit ledger on the GST Portal.

- The ITC can be utilized exclusively for the setting off the output tax liability. It shall not be utilized for payment of interest or penalties. Interest and penalties have to be paid through electronic cash ledger.

Once registered on the GST portal, a person shall hold 3 ledgers which are

Electronic credit ledger, Electronic cash ledger, and Electronic liability Register.

- Electronic credit ledger will provide all the input tax credit information.

- Electronic Cash Ledger will provide all the deposits made in cash, TDS/TCS made on account of the taxpayer and summary of payments on account of tax, interest, penalties, and fees.

- Electronic liability register will provide it shows the net amount payable by the taxpayer for a particular month.

[Note: For payment of output tax liability, the input tax credit available in the Electronic Credit Ledger shall be utilized first. If there is any shortfall, the same can be met by depositing cash in electronic cash ledger. The balance available in the electronic cash ledger can be utilized for the payment of output tax remaining after utilization of input tax credit, but the balance in Electronic Credit ledger reflecting ITC cannot be utilized for the payment of penalties, interest, and fees.]

Apportionment of ITC between taxable and exempted supplies:

If any taxable person is making supplies of both taxable and Exempted goods or he is using the goods or services or both for business purposes or any other purpose, then the ITC shall also be apportioned between the taxable and exempted supplies.

For example, A registered person is engaged in the supply of taxable and exempted goods.ITC on inward supplies used for making exempted supplies shall not be allowed. This ITC attributable to the exempted supplies shall be calculated on the basis of the proportion of the exempted supplies to the total supplies.

14 thoughts on “Input Tax Credit – ITC”