This article discusses in detail the use of Form DRC 03 and its procedure to file on the GST Portal.

In this article, we will discuss about...

Form GST DRC-03

Form GST DRC-03 is a form facilitated to the taxpayers for making payment for any causes like audit, investigation, annual return, reconciliation statement or on a voluntary basis or in response to the show-cause notice issued by the department. Format of Form DRC 03 is annexed below

When to make payment in Form DRC 03

When to make payment in Form DRC 03

Form DRC 03 is filed for making the payment on a voluntary basis for settling the tax due under section 73 and 74 of the GST act. A Taxpayer can file Form DRC 03 either by self-ascertaining the tax liability before the issue of show cause notice or within 30 days from the issue of show cause notice by the tax authorities.

Section 73- deals with the cases of non-payment or short payment of tax without any intention of fraud or any willful misstatement or suppression of facts.

Section 74- deals with the cases of non-payment or short payment of tax with the intention of committing fraud or any willful misstatement or suppression of facts.

Note: The Taxpayer can utilize the Input Tax Credit (ITC) available in the electronic credit ledger or the cash balance available in the electronic cash ledger for the payment of taxes. But, in case of Interest and penalties due, such liabilities should be discharged only through making payment in cash.

Pre-requisites for making a voluntary payment

Form DRC 03 is used to intimate the payment made voluntarily either

- Before the issue of show cause notice or

- Within 30 days from the issuance of show cause notice (if SCN has already issued).

Procedure for Filing Form DRC 03

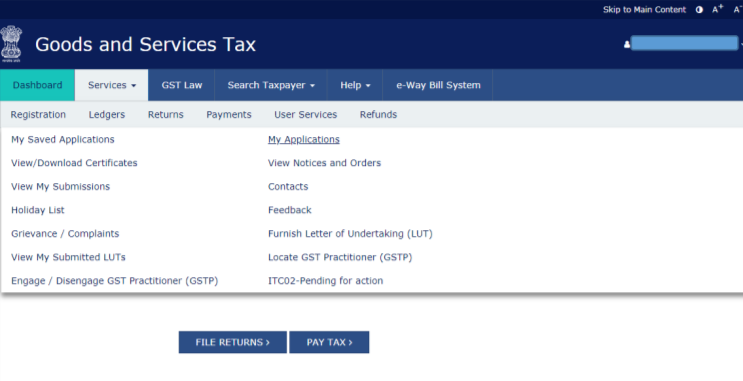

Step-1: Login to the GST portal (https://services.gst.gov.in/services/login) and go to the ‘Services’ option and select the ‘My Applications’ provided under the ‘User Services’ Tab.

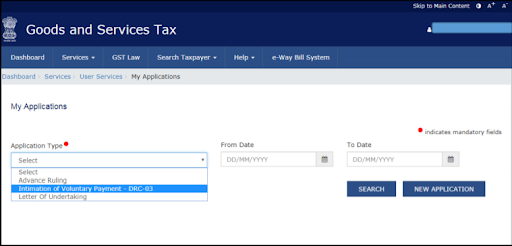

Step-2: After selecting ‘MY Applications’, choose ‘Intimation of voluntary payment DRC-03’ from the drop-down list provided under ‘Application Type’ Tab and then click on the ‘New Application’ tab.

Step-2: After selecting ‘MY Applications’, choose ‘Intimation of voluntary payment DRC-03’ from the drop-down list provided under ‘Application Type’ Tab and then click on the ‘New Application’ tab.

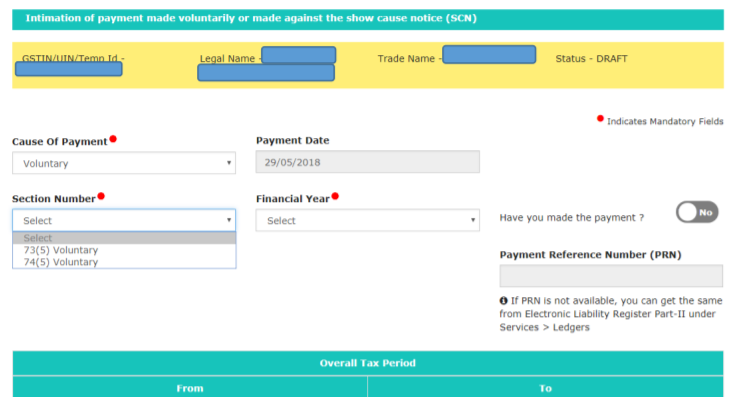

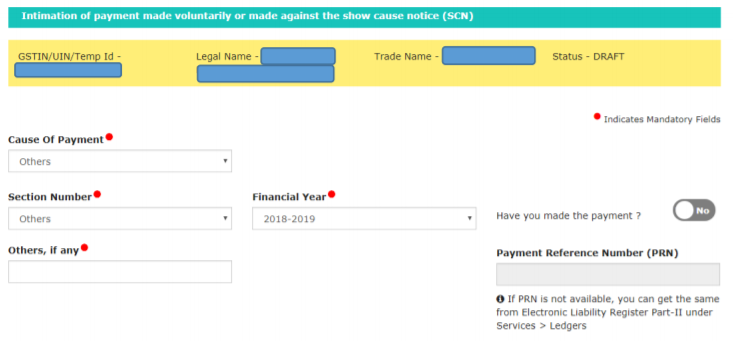

Step-3: After clicking the ‘New Application’ tab a page will be opened requiring the following details:

Case 1: In case a taxpayer didn’t make any tax payment before and doesn’t have any payment reference number (PRN).

Select the cause of payment as ‘voluntary’ or ‘SCN’ (as the case may be) and then select the appropriate section number.

In the case of selection of ‘SCN’ provide details of show cause notice such as reference number and issue date.

Case 2: In case the taxpayer has already created PRN and never used it before and attempts to make the payment of tax within 30minutes of PRN creation.

Select the cause of payment as ‘voluntary’ and select appropriate section number and select ‘YES’ for the option ‘Have you made the payment?’ and enter the payment reference number.

‘Get payment details’ link shall be displayed on clicking the same the details of payment shall be auto-populated.

Case 3: In case the taxpayer has already created PRN and never used it before and attempts to make the payment of tax after 30minutes of PRN creation.

Select the cause of payment as ‘voluntary’ and select appropriate section number and select ‘YES’ for the option ‘Have you made the payment?’ and enter the payment reference number.

‘Get payment details’ link shall be displayed, click the same to enter the details of payment made.

Step-4: After successfully providing the above details, select the ‘Tax Period’ and ‘Act Type’ and then click proceed to pay (if payment was not made).

Step-5: To view the Form DRC-03 draft, click the ‘Preview’ tab provided at the bottom of the page.

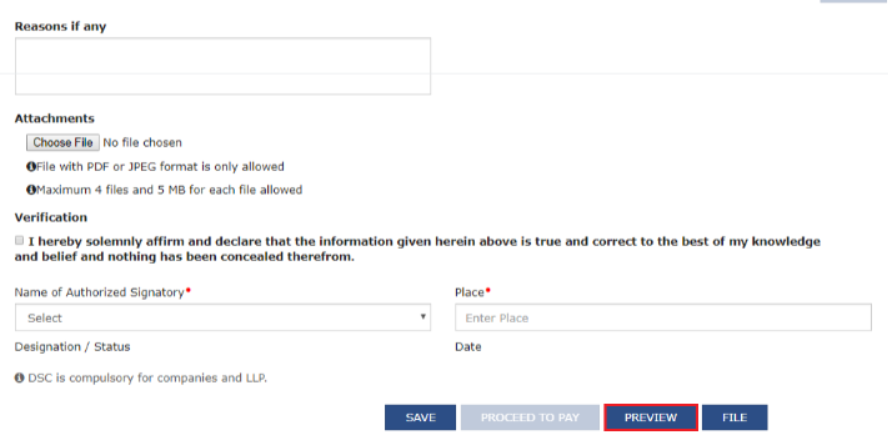

Step-6: Specify the Reasons if any in the box provided. Choose a file to attach, click on the verification checkbox and then select the authorized signatory and provide place name.

Step-7: Click on the tab ‘File’ to file Form DRC 03. The taxpayer has two options to file Form DRC 03, either by using DSC or by EVC method.

Is Partial payment allowed for Demand raised in SCN?

If a taxpayer is voluntarily making a payment on the basis of SCN then he will not be allowed to make a partial payment for the demand raised in SCN. He needs to pay the full amount raised in the Show Cause Notice.