In this article, we will discuss about...

Introduction:

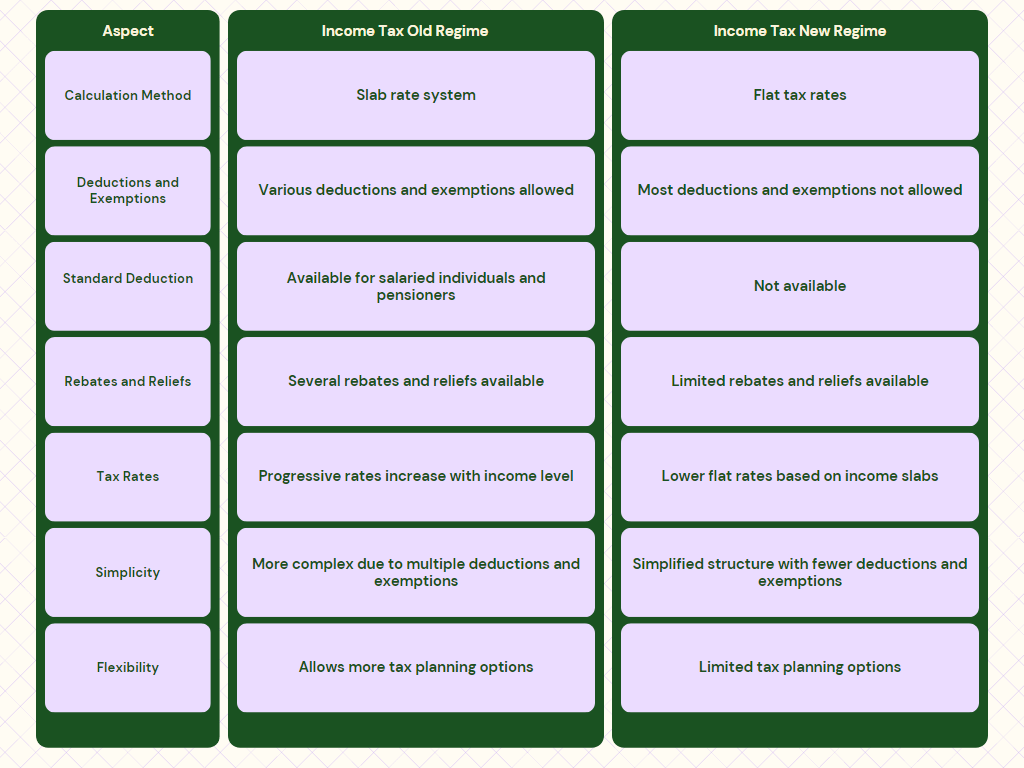

With the onset of the financial year 2023-24, taxpayers in India are faced with a crucial decision regarding the tax regime they wish to opt for: the old tax regime or the new tax regime. The government introduced the new tax regime in FY 2020-21, offering lower tax rates but eliminating several exemptions and deductions. This article aims to provide a comprehensive analysis of the old and new tax regimes in the context of FY 2023-24, helping taxpayers make an informed decisions based on their individual financial situations.

Understanding the Old Tax Regime:

The old tax regime, also known as the existing tax regime, follows a progressive tax structure with multiple income tax slabs and corresponding tax rates. It allows taxpayers to claim various exemptions, deductions, and rebates, such as HRA (House Rent Allowance), standard deduction, and deductions under Section 80C (investment in specified instruments). The old regime is considered beneficial for individuals with higher incomes or those who have significant deductions to claim.

Advantages of the Old Tax Regime:

- Deductions and Exemptions: One of the significant advantages of the old tax regime is the availability of various deductions and exemptions, which can help reduce the overall taxable income. This includes deductions for investments in specified instruments like life insurance policies, Employee Provident Funds (EPF), Public Provident Funds (PPF), and tax-saving fixed deposits.

- Flexibility: The old tax regime offers more flexibility in terms of tax planning, as taxpayers can strategically utilize deductions and exemptions to optimize their tax liability. It allows individuals to tailor their investments and expenses to maximize tax savings.

Consult CA Arun Tiwari for more info at 📞 8080088288 or cs@aktassociates.com

Understanding the New Tax Regime:

The new tax regime, introduced in FY 2020-21, aims to simplify the tax structure and lower the tax burden for individuals. It offers lower tax rates but eliminates most exemptions and deductions available in the old regime. Under the new regime, taxpayers can choose to forego deductions and exemptions and pay taxes at the prescribed slab rates.

Advantages of the New Tax Regime:

- Lower Tax Rates: The new tax regime provides lower tax rates compared to the old regime, resulting in reduced tax liability for individuals. The revised slab rates offer relief to taxpayers across different income brackets.

- Simplification: The new regime simplifies the tax-filing process by eliminating the need to track and claim various deductions and exemptions. Taxpayers can calculate their tax liability based on the applicable slab rates without the hassle of maintaining documentation for exemptions and deductions.

Factors to Consider for Choosing the Regime:

- Income Level: Individuals with higher incomes who rely on significant deductions and exemptions may find the old regime more beneficial due to the tax-saving opportunities it offers. On the other hand, individuals with lower incomes or those who don’t have many deductions to claim may find the new regime more advantageous due to its lower tax rates.

- Deductions and Exemptions: Evaluate your eligibility for deductions and exemptions available in the old regime. If you have substantial deductions and exemptions that can significantly reduce your tax liability, sticking with the old regime might be preferable.

- Simplicity vs. Savings: Consider your preference for a simplified tax-filing process versus potential tax savings. The new regime offers simplicity by eliminating the need for meticulous record-keeping and documentation for exemptions and deductions. However, if maximizing tax savings is a priority and you can optimize deductions and exemptions, the old regime may be a better choice.

Conclusion:

The decision between the old and new tax regimes in FY 2023-24 depends on several factors such as income level, eligibility for deductions and exemptions, and personal preference. While the new tax regime offers lower tax rates and simplification, the old regime allows taxpayers to leverage deductions and exemptions to reduce their taxable income effectively. It is advisable to evaluate your financial circumstances and consult with a tax professional to make an informed decision that aligns with your specific needs and goals.