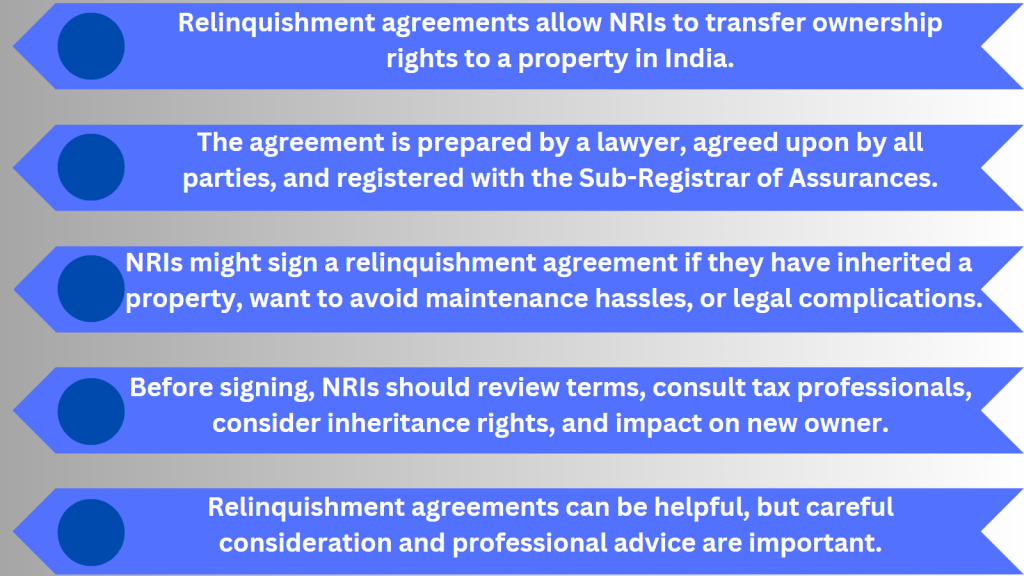

A relinquishment agreement is a legal document that allows a Non-Resident Indian (NRI) to relinquish their rights to a property in India. This agreement is typically used when an NRI inherits property in India but does not wish to keep it or sell it but instead wants to transfer its ownership to another person. In this article, we will explain the basics of a relinquishment agreement for NRI.

The Basics of a Relinquishment Agreement

The Basics of a Relinquishment Agreement

A relinquishment agreement is a legal document that transfers the ownership rights of a property from one person to another. In the case of an NRI, it allows them to relinquish their rights to property in India. A lawyer typically prepares this document, and all parties involved sign it. It is important to note that a relinquishment agreement is a voluntary agreement, and the NRI must consent to the transfer of ownership.

Read our FAQs on Relinquishment Agreement

Consult CA Arun Tiwari for more info at 📞 8080088288 or cs@aktassociates.com

The Process of Creating a Relinquishment Agreement

Creating a relinquishment agreement requires the involvement of several parties. First, the NRI who wishes to relinquish their ownership rights must hire a lawyer to draft the agreement. The lawyer will then work with the other parties involved, such as the new owner or owners of the property, to negotiate the terms of the agreement.

Once the terms of the agreement are agreed upon, the document must be signed by all parties involved. This includes the NRI who is relinquishing their ownership rights, as well as the new owner or owners of the property. The document must also be witnessed by two witnesses who are not related to any of the parties involved.

After the document is signed and witnessed, it must be registered with the Sub-Registrar of Assurances in the jurisdiction where the property is located. The registration process involves paying a fee and submitting the original document along with any required supporting documents.

Why an NRI Might Choose to Sign a Relinquishment Agreement

There are several reasons why an NRI might choose to sign a relinquishment agreement. One common reason is that they have inherited a property in India but do not wish to keep it. In this case, signing a relinquishment agreement allows them to transfer their ownership rights to someone else.

Another reason an NRI might choose to sign a relinquishment agreement is that they want to avoid the hassle of maintaining the property from a remote location. This can be especially difficult if the property requires frequent maintenance or repairs.

Finally, an NRI might choose to sign a relinquishment agreement if they do not want to deal with the legal complications that can arise when owning property in India as a non-resident.

Key Considerations When Signing a Relinquishment Agreement

Before signing a relinquishment agreement, there are several key considerations that an NRI should keep in mind. These include:

-

The terms of the agreement:

One should carefully review and negotiate the terms of the relinquishment agreement to ensure that they are fair and reasonable.

-

The tax implications:

Transferring ownership of a property can have tax implications, and an NRI should consult with a tax professional to understand the tax implications of signing a relinquishment agreement.

-

The impact on inheritance rights:

Signing a relinquishment agreement can impact inheritance rights, and an NRI should consult with a lawyer to understand the impact of signing such an agreement.

-

The impact on the new owner:

If the NRI is transferring ownership to someone else, they should carefully consider the impact of this transfer on the new owner. This includes understanding any legal or financial obligations that the new owner will inherit as a result of the transfer.

Conclusion

In summary, a relinquishment agreement is a legal document that allows an NRI to relinquish their ownership rights to a property in India. A lawyer typically prepares this document, and all parties involved sign it. It is important for NRIs to carefully consider their options and consult with legal and tax professionals before signing an agreement.