As per Income-tax Act, 1961, an assessee can receive the income from 5 heads which are income from salary, house property, business or profession, capital gain or any other source. For each head, there is separate taxability is being defined under the act. Generally, the income earned by an assessee in the previous year is taxable in the assessment year however, there are some kinds of income in which the government received the tax from the payer by TDS. It’s another mode of recovery of Tax.

We receive income from different ways like Salary, Dividend income from mutual funds or stocks, commission, interest on your Bank Fixed Deposits / Securities rent, etc.,

The payer of these incomes (like your company/bank) may deduct a certain percentage of income (As defined under Income tax act) as TDS (Tax Deducted at source) based on certain threshold limits.

For Example, Mr. A is taking professional Service from Mr. B of Rs.3,00,000. In this case, Mr. A will be required to deduct the TDS @ 10% under section 194J and paid the net amount to Mr. B. Although, Mr. B will be eligible to take the credit of such TDS from his total tax liability.

Well as per the legal language, TDS or tax deducted at source is the process of collecting Income Tax by the government in the previous year in which the income has been earned by the assessee. It’s an indirect method of collecting the TDS which combines the concepts of “pay as you earn” and “collect as it is being earned.”

TDS is deducted at a specified rate, defined under income tax law, and different rates have been specified for different kinds of income

Now, let’s take one more example of TDS for more clarification;

Mr. A has made a Fixed Deposit in a PNB for Rs 10 Lakh for 1 year @ 9% pa interest rate. He will earn an interest income of Rs 90,000 after one year. The Bank may deduct TDS at the rate of 10% i.e., Rs 9,000 (10% of Rs 90,000) and deposits this Rs 90,000 with Income Tax Department (on behalf of you). Bank shall issues him a TDS certificate which reflects this deduction.

Now, we will discuss the latest TDS provisions which are inserted under the income tax act, 1961 and already applicable for Assessment year 2020-21

TDS under section 194A increased from Rs.10,000 to Rs.50,000

- To understand this, we have to understand 3 sections simultaneously i.e. section 194A, section 80TTA, and Section 80TTB.

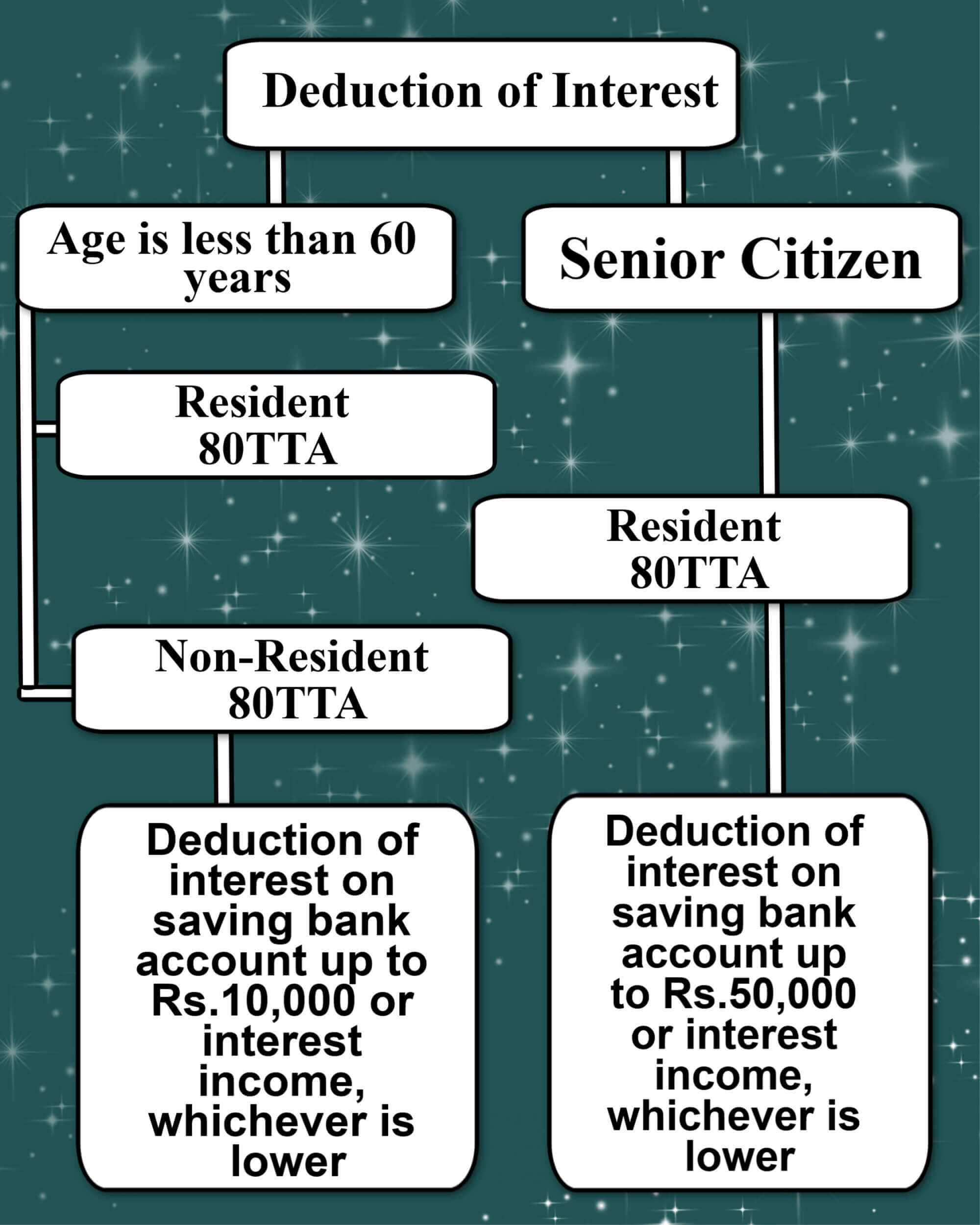

As per section 80TTA: Where an assessee being individual/ HUF is having an income of interest from saving bank accounts from Bank or post office then there is no income tax shall be applicable up to the limit of Rs.10,000 or amount of interest income, whichever is lower. However, the said section shall be applicable where the resident is not a senior citizen.

As per section 80TTB: In case the income of interest is being earned by the senior resident person, then the said limit shall be increased to Rs.50,000 or interest income, whichever is lower.

Note: In case, the assessee is being senior nonresident person, then section 80TTA remains applicable and deduction up to Rs.10,000 shall be applicable.

Now let’s read section 80TTA and 80TTB in tabular form:

First let me tell you about the TDS on interest income to Non-resident, well as per the aforesaid provision we know that the interest income up to Rs.10,000 is exempt under section 80TTA and if the interest is more than such amount then the TDS shall be deducted under section 195.

Now let’s see the provision of TDS relating to residents. 80TTA provides the deduction on the interest income from savings bank account but section 194A does not deal with interest from saving bank account. In simple words,

If a resident assessee, aged less than 60 years or non-resident, is having an interest income of more then 10,000 from saving bank accounts then also TDS shall not be deducted under section 194A.

Section 194A is applicable to the interest income earned from the fixed deposit or recurring deposit.

However, section 80TTB covers both interest i.e. interest from saving bank account as well as interest from the fixed deposit or recurring deposits. In simple words,

If a resident assessee, aged more than 60 years, is having an interest income of Rs.50,000 from the fixed deposit or recurring deposit accounts then no TDS shall be deducted under section 194A.

As per the old provision of section 194A, where the individual or HUF is having an interest income from the fixed deposit or recurring deposit then no TDS shall be deducted where is the interest income is up to Rs.10,000.

As per the amendment, Where the assessee aged less than 60 years, the limit shall be increased from Rs.10,000 to Rs.40,000. and Where the assessee is a senior citizen then the limit shall be increased from Rs.10,000 to Rs.50,000. The change was made due to section 80TTB.

Crux of amendment: Where the income of the assessee being resident individuals aged less than 60 years than the limit of TDS is Rs.40,000 and where the age is more than 60 years, having interest income is up to Rs.50,000, then such amount shall be allowed as deduction under section 80TTB and no TDS shall be deducted on interest income up to Rs.50,000. However, where the interest income is more than 50,000 then TDS shall be deducted @10% under section 194A.

194I: TDS on rent

Similar to section 194A, the applicability of section 194I is also being increased. As per this section, the threshold limit for the deduction of tax on rent has been increased from ₹1.8 lakh to ₹2.4 lakh. Note: this section shall be applicable where the deductor is non-individual entities.

194M: TDS on contractual work or professional fees

This section provides that

- Every Individual or HUF (Other than those people who are liable for the deduction of TDS under section 194C and 194J)

- Will deduct TDS @ 5% on the sum, or the aggregate of sums, paid or credited in a year

- On account of contractual work or professional fees

- If such sum, or aggregate of such sums, exceeds 50 lakh rupees in a year.

Note: As per this section, assessee being Individual or HUF, who are liable to get their accounts audited, is required to deduct TDS under section 194C or 194J. If individual and HUF are not covered in this case, then they were required to deduct the TDS under section 194M if the payment was related to contractual work or Professional Fees.

In Simple words, this section shall not be applicable to the individual or HUF if they were required to deduct the TDS under section 194C or 194J.

Note: The definition of contractual work and professional service under section 194C and 194J is the same as defined under section 194M.

Note: For the applicability of this section, the payee must be the individual.

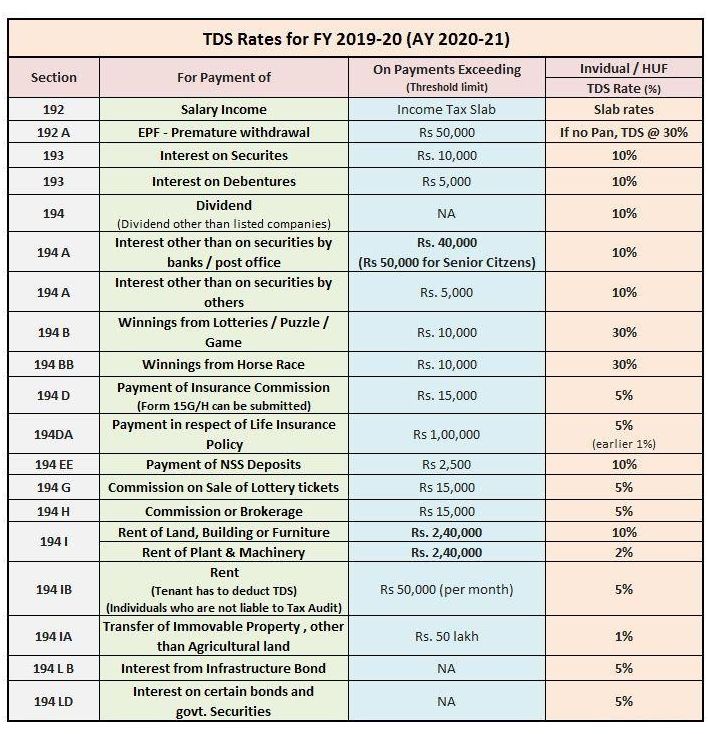

Amended TDS Rate Chart for FY 2019-20 / AY 2020-21

Sometimes, deductee is not liable for the filing of return however he has to file the return only due to claim the refund of tax which has been deducted by the deductor as TDS. For this, the income tax department has provided an option to the tax-payer in which he can obtain a certificate from his Assessing officer in which the AO allowed to deduct the lower rate of TDS as compared to the normal rate of tax as defined under the act, or even direct for no deduction of TDS. It all depends upon the request of the assessee and other facts and conditions which have been presented by the assessee before his AO.

The time limit within which the application to be made by Assesse

There is no time limit that has been defined under the income tax act, within which assesse should give an application under section 197 of the act. Although if the assessee is having a regular receipt, under which TDS would be deducted in any of the above-specified sections then it is advisable for the assessee to file an application at the beginning of the financial year.

Procedure to be followed to obtain such certificate

The assessee shall file the application in form 13 to obtain the certificate of a lower rate of deduction or nil rate of deduction of TDS. Form 13 can be filed manually or online. If the assessee wants to apply the certificate online then he can file the application through the TRACES site.

This form is very important because of it a prescribed form as described in law against which the request can be made, hence it is suggested for the assessee, who wants to apply for it, to fill all and correct details in the particulars as specified in the form.

The next part rests with AO that means if the AO is satisfied with the conditions of the assessee and form is complete and correct then the AO shall process for the issue of the certificate.

Once the certificate has been issued, then it is the responsibility of the assessee to give the copy of the certificate to all the deductors so that the deductee can deduct the TDS at a lower rate or even not deduct the TDS, as the case may be, from the invoice amount.

The validity of the certificate

Once the certificate has been issued by the AO, then it shall be valid for the rest of the financial year. In simple words, the certificate can be issued only for a particular financial year and for next year the same process has to be followed by the assessee.

Documents need to be submitted to AO along with form13

- As we already discussed above, one Signed copy of the application in Form 13.

- Copy of last 3 financial year Income tax return copy.

- Assessment order copy which has been received in the last 3 financial years, if any.

- If the assessee is having a business or professional income then the annual report of the last 3 financial year which includes audit reports.

- Projected financial statements for the current financial year.

- Income computation of the last 3 financial years and estimated income computation of the current financial year.

- PAN Card Copy.

- TAN number of all those parties from whom payment may be received to him.

- TDS Acknowledgement copy of TDS return for the last 2 years.

- Any other documents related to such a source of income.

Once the application has been received to AO, then it’s the responsibility of the AO to review and disposed of the application within 30 days from the end of the month in which the application has been received.

So, the process is very simple, you just have to attach the above-specified forms in the application to your AO and the AO has to give the certificate within 30 days. After that, you will have to provide a copy of this certificate to all the buyers so that he can make the payment with a lower deduction or no deduction of income tax.

Also, the same process shall also be followed in the case of TCS under section 206C(9) of the income tax Act, 1961.

Very good sir