To curb the Tax evasion and to extend the scope of taxation, the government has introduced a new section 194M in the union budget, 2019 which is made applicable with effect from 1st September 2019. In this article, we shall discuss section 194M.

In this article, we will discuss about...

Contents of the article

- Section 194M

- Who is required to deduct TDS u/s 194M?

- What is the meaning of ‘Contract’, Commission or Brokerage’, ‘professional Services’, ‘Work’ as referred u/s 194M?

- What is the Rate of TDS?

- When to deduct TDS

- What is the Threshold Limit u/s 194M?

Section 194M

As per the provisions of section 194M with effect from 1st September 2019, Individual or a Hindu undivided family (other than those who are required to deduct income-tax as per the provisions of section 194C or section 194H or section 194J) who is responsible to pay any sum to a resident for carrying out any work (including supply of labour for carrying out any work) is required to deduct any income tax at the rate of five percent on such sum, or aggregate of sums paid, at the time of credit of such sum to the account of the payee or at the time of payment thereof whether in cash or by issue of a cheque or draft or by any other mode, whichever is earlier.

Who is required to deduct Tds u/s 194M?

As per the provisions of section 194M, An Individual or HUF is required to deduct Tds under this section if

- Such Individual or HUF is required to pay a sum to the resident

- For carrying out any contract work, or for providing any professional services or commission agent services (other than services referred to in section 194D)

- And such sum payable should exceed Rs.50 Lakhs.

- And such an individual or HUF is not required to get his books of accounts audited.

What is the meaning of ‘Contract’, Commission or Brokerage’, ‘professional Services’, ‘Work’ as referred u/s 194M?

Contract: The word contract shall include sub-contract

Work: The expression Work shall

Includes

- advertising;

- telecasting and broadcasting works including the production of programs for such broadcasting or telecasting;

- transportation of goods or passengers by any mode of transport other than by railways;

- catering;

- product manufacturing or supplying as per the requirement or specifications of a customer by using material purchased from such customer,

Does not include

- product manufacturing or supplying as per the requirement or specification of a customer by using material purchased from a person, other than such a customer.

Commission or Brokerage: The expression ‘Commission or Brokerage’

Includes

- any payment received or receivable, directly or indirectly, by a person acting on behalf of another person for services provided (other than professional services) or

- any services in relation to buying or selling of goods or in relation to any transaction relating to any asset, valuable article or thing, other than securities.

Professional Services: The expression ‘Professional Services’

includes

- legal services, medical services, engineering or architectural profession or the profession of accountancy or interior decoration or technical consultancy or advertising or such other professional services as is notified by the Board for the purposes of section 44AA or of the purpose of section 194J.

What is the Rate of TDS?

Under the provisions of section 194M, an Individual or HUF is required to deduct any income tax at the rate of five percent.

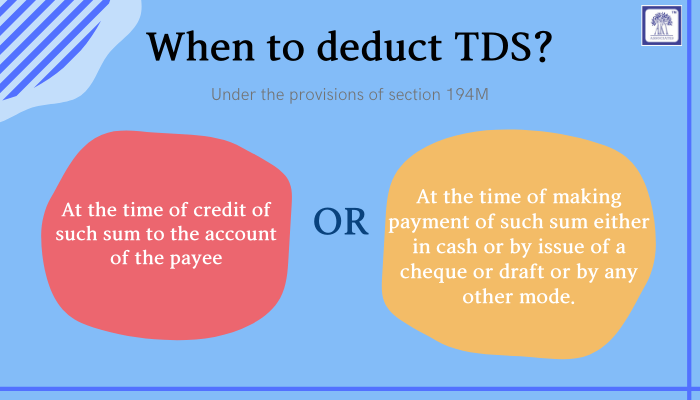

When to deduct TDS?

Under the provisions of section 194M, An Individual or HUF is required to deduct any income tax on such sum paid at the earlier of the below

- at the time of credit of such sum to the account of the payee; or

- at the time of making payment of such sum either in cash or by the issue of a cheque or draft or by any other mode.

What is the Threshold Limit u/s 194M?

No deduction shall be made under this section if such sum or aggregate of such sums paid or credited to a resident during a financial year does not exceed Rs.50 Lakhs.