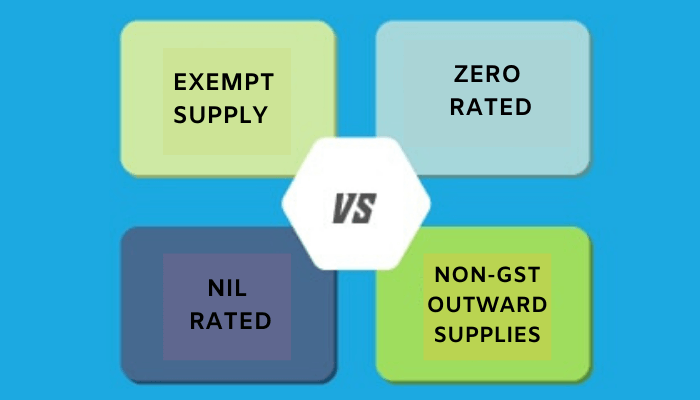

In this article we will discuss the terms specified in the GST act such as Exempt supply, Nil rated supply, Zero Rated supply, and Non-GST Outward supply.

Exempt Supply

As per the provisions of Section 2(47) of the GST act, Exempt supply is defined as the supply of any goods and services or both which attracts nil rate of tax or which may be wholly exempt from GST under section 11, or under section 6 of the Integrated Goods and Services Tax Act, and Exempt supply includes non-taxable supply.

Non-taxable supply is defined under section 2(78) of the GST act as the supply of goods or services or both which shall not be charged to tax under the Goods and Services Tax Act.

Following are the Non-taxable supplies covered under GST act

- Alcoholic liquor for human consumption

- Petroleum crude

- High-speed diesel

- Motor spirit (commonly known as petrol)

- Natural gas

- Aviation turbine fuel

NIL Rated Supply

Nil rated supplies are the supplies that attract zero rate tax, i.e., Goods and Services or both which attracts zero percent GST is called Nil Rated Supply.

Note: No Input Tax Credit shall be available in respect of Goods or services or both which are used for supply of Nil rated supplies.

Following are the supplies which attract Nil rate tax

- Unpacked Food Grains, Fresh Vegetables & Fruits, meat, etc…,

- Milk, Curd, Salt, Unpacked Paneer and natural honey

- Newspapers etc.,

Zero Rated Supply

With respect to the provisions of section 16(1) of the IGST Act, Zero Rated Supplies shall be any of the following supplies of goods or services or both

- Export of Goods or Services or Both

- Supplies made to a Special Economic Zone Developer

- Supplies of Goods or Services or both to a unit in Special Economic Zone.

Points to be noted:

- Taxes paid on zero-rated supplies of goods or services or both or on inputs or input services which are used in making supplies of such zero-rated Goods or Services or Both are refundable.

Non-GST Supplies

Non-GST Supplies are the supplies that don’t fall under the definition of section 7(supply) of the GST act. i.e., Supply of Goods or services or both on which tax shall not be leviable is called Non-GST Supplies. For example ‘Transaction in Money and Securities’ are considered to be a Non-GST Supply.

The following Supplies are not covered under GST, and no tax shall be levied.

- Services in the course or in relation to his employment by an employee to an employer.

- Any Court or Tribunal Services established under any law for the time being in force.

- Functions performed by:

- The Members of Parliament, State Legislature, Panchayats, Municipalities, and other local authorities

- Any person who holds any post under the provisions of the Constitution

- Chairperson or Member or Director in a body established by the government or a local body and who is not an employee of the same

- Burial, Funeral, crematorium, or mortuary services including transportation of the deceased

- Sale of Land and Building

- Actionable claims are other than lottery, Gambling, and Betting.

- Supply of Goods from Non-Taxable territory place to another non-taxable territory place without such goods entering into India.

- Supply of goods to any person before Home consumption clearance.

thank you very much in advance