Concept of GST

GST is a tax levied only on the value-added at each stage of supply chain comprising of manufacture, sale, and consumption of taxable goods or services. The GST provides for a comprehensive and continuous chain of tax credits beginning from the manufacture or production of goods or provision of service up to the retailer or consumer to ensure that

(a) there is no cascading effect by levying a tax on tax at each stage; and

(b) the tax is levied only on the value-added at each stage of the supply

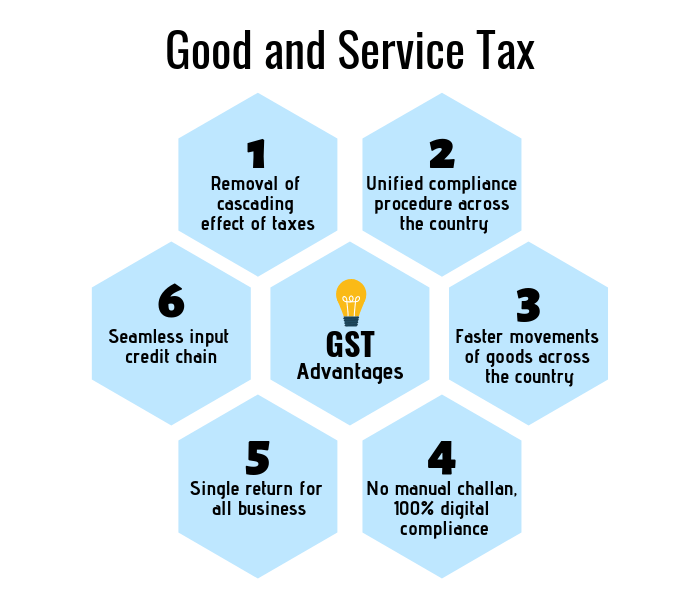

GST will be beneficial for the economic growth of the country and all the stakeholders in the following ways:

- Common National Market:

GST has removed economic barriers and created an integrated economy with a unified common national market with harmonized laws, common tax rates and procedures.

- Single Tax:

GST subsumes most of the central and state taxes into a single tax and provides for a seamless credit scheme in the supply chain. Elimination of multiple taxes and double taxation will remove the effect of cascading.

- Competitive prices:

As a result of mitigation of ill effects of cascading, the average tax burden is likely to come down, which is expected to bring down the prices of goods and services and make them market-friendly and competitive.

- Make in India:

a) GST will give a major boost to the ‘Make in India’ initiative of the Government of India by making goods and services produced in India competitive in the national as well as international market giving rise to the exports and also demand goods and services in domestic markets.

b) More consumption and higher exports will result in higher production and manufacturing activities leading the growth of the industries to turn India into a “Manufacturing hub”.

c) Increased manufacturing will create additional job opportunities in industry and service sectors.

- Foreign Investment:

Unified common national market will attract Foreign Direct investment necessary for the “Make in India” campaign.

- Ease of Doing Business

a) Mitigation of double taxation will make doing business easier and also reduce litigation and disputes relating to double taxation of a transaction as both goods and services.

b) GST is a simple tax regime with fewer exemptions.

c) It will reduce multiple taxes leading to simplification and uniformity and the need for multiple record-keeping for a variety of taxes saving the cost of compliance.

d) GST envisages simplified and automated procedures for various processes such as registration, returns, refunds, tax payments, etc.

e) GST prescribes common procedures for registration, refund, filing of returns, classification of goods, etc. will make the taxation system more certain.

f) The public interface between the taxpayer and the tax administration will be considerably reduced as interaction will be through the common GSTN portal.

g) GST regime will improve the environment of compliance with online filing of returns, verification of input credits and encourage more paper trail of transactions.

h) Electronic matching of input tax credits all-across India thus making the process more transparent and accountable.

i) Timelines are prescribed for obtaining registration, refunds, etc.

j) GST will help in improving the liquidity of the business.

- Economic growth and Tax compliance:

a) GST will widen the tax base, improve compliance by the taxpayers, and increase the tax revenues of the government.

b) A cumulative effect of high production, export, etc. Will improve the overall investment climate in the country and be helpful in growth in economic activities, increase the GDP, boost economic growth and remove poverty.

c) Uniform GST rates across the country will reduce tax avoidance or evasion by eliminating rate arbitrage between different stage or intra-state and inter-State sales

- Consumers

a) The final price of goods is expected to be lower due to the seamless flow of input tax credit between the manufacturer, retailer and service supplier.

b) A large number of small retailers with turnover up to Rs 20 lakhs are exempted from tax and those having a turnover up to Rs 1.5 Crore will be covered under a composition scheme with low to moderate tax rates. This will mean purchases from such retailers at relatively lower prices giving a quantum increase to the consumption of goods.

- Uniformity in tax rates, nomenclature, and interpretation

GST will ensure uniformity in rates of tax and interpretation.

Conclusion:

By way of GST, Govt tries to build a unified tax system and easy input credits system.GST is a new concept by replacing Services & Goods. Under GST two new concepts HSN & SAC introduced for identification of Goods ( HSN) & services (SAC).