In this article, we will discuss about...

GSTR-2A

Form GSTR-2A is a purchase-related tax return which is auto-generated for each business by the GST Portal based on the information submitted or uploaded by the supplier or seller in following returns

- In the case of Regular Registered Taxpayer– GSTR-1

- In the case of Non-resident- GSTR-5

- In the case of Input Service Distributor- GSTR-6

- In case of Person liable to deduct TDS- GSTR-7

- In case of e-Commerce operator(TCS Details) – GSTR-8

Purpose of GSTR-2A

Form GSTR-2A is a read-only return which is not used for the purpose of filing. GSTR-2A return possesses the list of details of all the invoices uploaded by the counterparty and such details can be viewed and downloaded for reconciliation and for future purposes.

Details of GSTR-2A

Form GSTR-2A contains 7 particulars which shall be discussed below

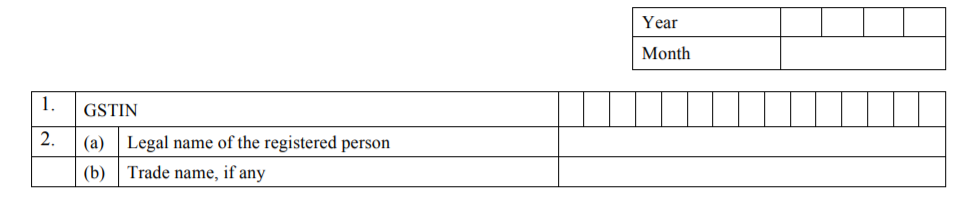

1. GSTIN: GSTR-2A form contains the 15-digit unique GSTIN number of the taxpayer.

2. Name of the Taxpayer including Trade name (if any) shall be declared in the second particular of Form GSTR-2A.

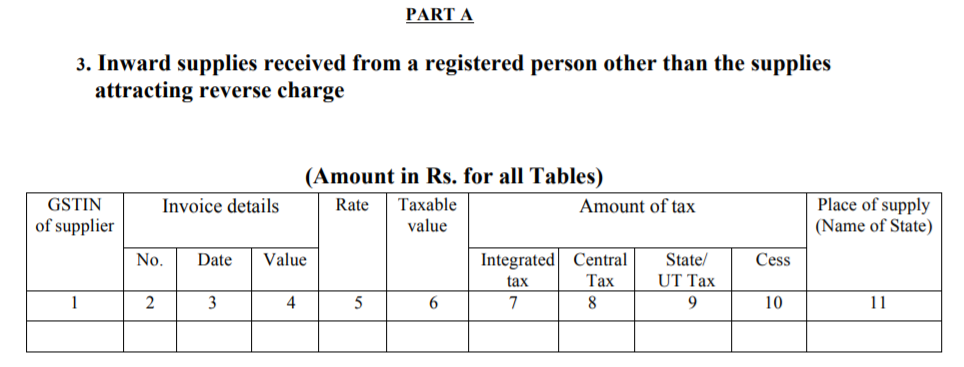

3. Inward supplies other than the supplies attracting reverse charge received from a registered person:

This contains the Invoice details such as invoice number, date, and rate of tax, place of supply and taxable value of the supplies received from a registered taxpayer under forwarding charge and declared by the seller in his GSTR-1.

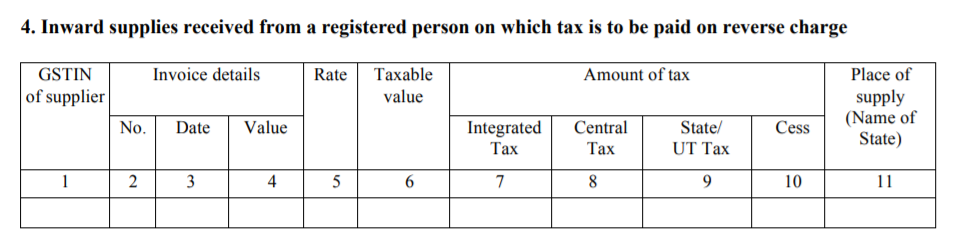

4. Inward supplies received from Registered person on which tax is to be paid under reverse charge:

This contains the Invoice details such as invoice number, date, and rate of tax, place of supply and value of the supplies including taxable and non-taxable received from a registered taxpayer on which tax is paid under reverse charge.

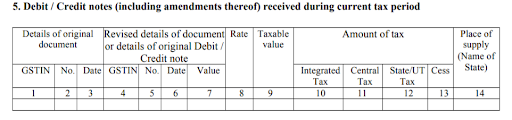

5. Debit or Credit notes including amendments thereof received during the current tax period:

This contains the details of debit and credit notes issued by the seller. This also contains the details of amendments made during the period.

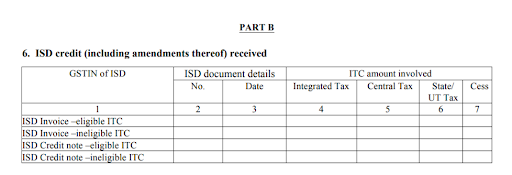

6. ISD Credit including amendments thereof received:

In the case of Branch, whenever the head office files Form GSTR-6 return for the month, the information under this section will be auto-generated for the same month.

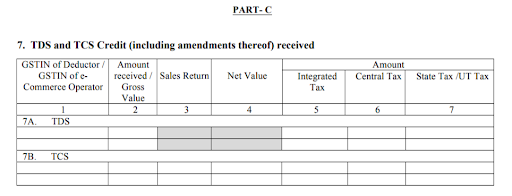

7. TDS and TCS Credit including amendments thereof received:

- TDS Credit Received- This section shall be applicable in case the taxpayer is engaged in specified contracts with specified persons such as government bodies. Such specified persons (government bodies) will deduct a tax at a specified percentage on transaction value.

- All information under this section shall be auto-populated from form GSTR-7 return which is filed by the deductor.

- TCS Credit Received- This section shall be applicable to the taxpayers engaged in online business registered with e-commerce operators.

- Such e-commerce operators shall collect tax at source at a specified percentage at the time of making payment to such sellers, and the information regarding the same shall be auto-generated from the GSTR-8 return filed by the e-commerce operator.

Corrections in GSTR-2A

GSTR-2A is a read-only form, and no corrections or amendments shall be done in this return. The corrections that are required to be made in this document shall be done in GSTR-2.