GST department has taken various initiations and steps to curb the GST malpractices and defaults. Suo moto cancellation of GST registration is one of such initiations which shall be discussed in this article.

Contents of the Article

- What is Suo Moto Cancellation of Registration?

- What are the Circumstances that initiate Suo Moto Cancellation of GST registration?

- What are the preconditions for Suo moto cancellation of Registration

- Is the Issue of Show Cause Notice (SCN) before the Suo moto cancellation of registration is mandatory?

- What is the Time limit to respond to SCN?

What is Suo Moto Cancellation of Registration?

Suo moto cancellation of registration is an action taken against the taxpayer to cancel his registration under Goods and Services act by the tax officials under various circumstances as specified under section 29 of the CGST Act and Rule 22 of the CGST Rules.

What are the Circumstances that initiate Suo Moto Cancellation of GST registration?

Following are the Circumstances specified u/s 29 of CGST act that initiates the Suo Moto Cancellation of GST registration

- Failure to submit the Enrollment application within 3 months from the appointed day or such extended period specified

- Failed to file the returns for a continuous period of six months by any Taxpayer other than composition taxpayer.

- Supplying goods or services or both without issuing any invoice, in violation of the provisions of the Act or rules made thereunder, with an intention to evade tax.

- Issues any invoice or bill without supplying goods or services or both in violation of the provisions of this Act, or the rules made thereunder leading to wrongful availment or utilization of input tax credit or refund of tax

- Failure to pay the amount (which was collected as representing the tax) to the account of the Central or State Government beyond a period of 3 months from the date on which such payment becomes due

- Failure to deposit any amount of tax, interest or penalty to the account of the Central or State Government beyond a period of 3 months from the date on which such payment becomes due

- Where the person is no longer liable to deduct tax at source as per the provisions of GST Law

- Where the person is no longer liable to collect tax at source as per the provisions of GST Law

- Where the person is no longer required to be registered under provisions of GST Law

- Where the GST Practitioner has been found guilty of misconduct in connection with any of the proceedings under the GST Law.

- Business closure or discontinuation

- Change in Constitution which leads to change PAN

- Ceased to be liable to pay tax

- Transfer of business on account of amalgamation, merger or demerger, sale, lease or otherwise disposed of, etc.

- Sole Proprietor death

- Not furnishing returns for 3 consecutive tax periods by Composition person.

- Cases where registration has been obtained by means of willful misstatement, fraud, or suppression of facts, Etc.

What are the preconditions for the Suo moto cancellation of Registration?

To Initiate the Proceedings for Suo moto cancellation of GST Registration as specified u/s 29 of the CGST Act, the Tax authorities must possess a valid reason for such initiation.

Is the Issue of Show Cause Notice (SCN) before the Suo moto cancellation of registration is mandatory?

Yes, it is mandatory to issue a show-cause notice before suo moto cancellation of registration. In the case of Suo moto cancellation of registration, the tax officers or officials cannot cancel GST registration unless they have provided a show-cause notice (SCN) and an opportunity of being heard to such taxpayer.

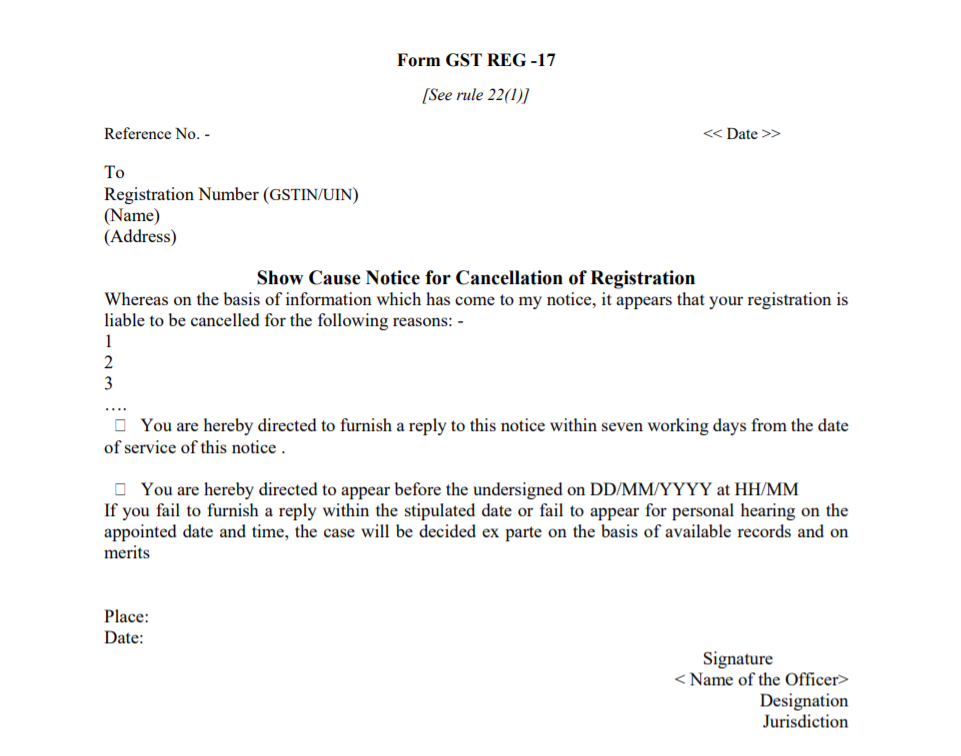

Format of Show Cause Notice has been annexed below

What is the Time limit to respond to SCN?

The Taxpayer is required to respond by filing a reply to the show-cause notice within the provided stipulated period generally 7 working days using the Services > Registration > Application for Filing Clarifications link.

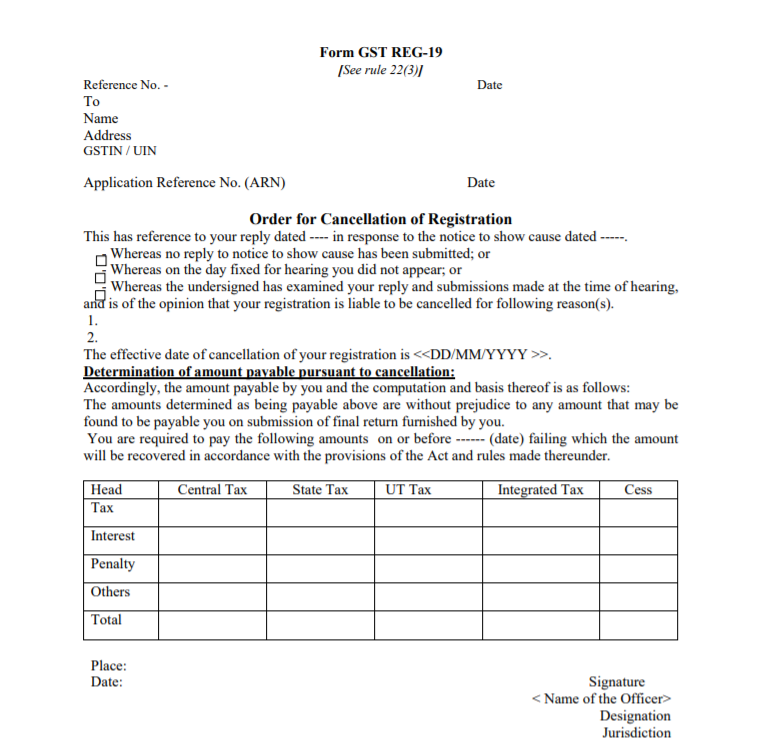

In case the taxpayer has not responded within the prescribed period, the tax officers may proceed further to cancel the GST registration by issuing the GST cancellation order in Form GST REG-19.

Format of Form GST Reg-19 has been annexed below

Dear Sir,

I have received an SCN on 03rd march-2020 SUO Moto for Non Filing of monthly returns and due date for revert was 13thMarch. 2020.

I was unable to visit the authority but have subsequently filed mine returns till Dec-2020 by 13th. March-2020.

But on 17th March-2020 , i was served order for cancellation of registration, after filing of voluntary returns i should have been given an grace time to explain mine concern coz due to corona COVID is was unable to reach office but made sure to update mine return till 3rd Quarter ending.

Please advice your input on how to restore mine registration.

Hi as this needs more clarification please contact us on 8080809061 or mail us at cs@aktassociates.com

I have applied for cancellations one year back on 2019 June, till today no steps taken against my application, as from the date I business I am filling nil return, asked tax officer about the issue, they say my ARN not showing to them, even after 1 year they can’t find resolution, can I stop gst filing so that they cancel my registration, and is there will be any chance for penalty, as even for there I won’t made any outward inward,

Please help, no one helping me..

hi, i am civil work contractor and my GSTIN is cancelled (suomoto),i want to file earlier months and don want to evoke my cancellataion . In uture if i want can i apply for new GSTIN

Sir I am not able to make gstn return from registration iam a short business my turnover only under 5 lac yearly