What is the Reverse Charge Mechanism (RCM) in GST?

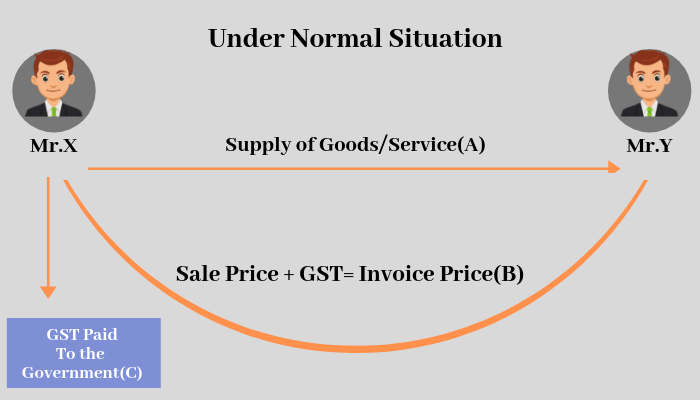

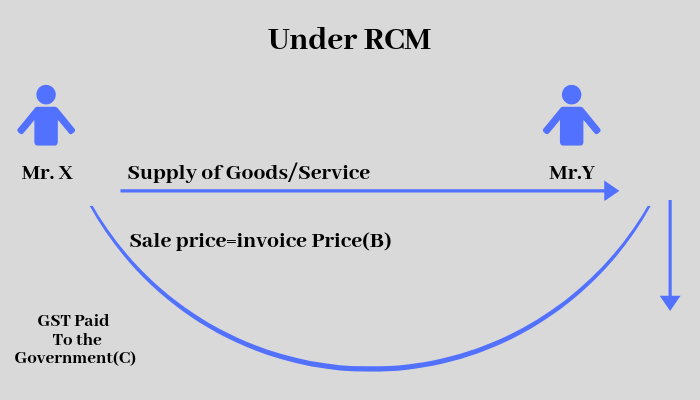

GST is an Indirect Tax i.e. Normally Seller collects GST from the buyer and pays it to the government. However, in some cases, the buyer pays GST directly to the government. This is called the Reverse Charge Mechanism.

Under Normal Situation

Under RCM

First We understand the concepts What is Reverse Charge Mechanism in GST because once we understand this then we just have to go through the cases where it applies.

Why RCM is required in GST Regime?

There are some unregulated sectors or unorganized Sectors on which Government has less control on a supplier like Transporters, Small Lawyer firms, Unregistered businesses GTA. Hence, the government transfers the burden to deduct & pay GST on recipient instead of the supplier.

Procedure to be followed in GST reverse charge

Section 9(3) and 9(4) of CGST Act, 2017 deals with GST Reverse Charge (RCM), where 9(3) depends upon the nature of supply or supplier and 9(4) applies where taxable supply provided by the unregistered dealer to Registered person.

- Goods or Services: Currently there are 7 goods and 14 services on which RCM applies. ( List of such goods and services are separately provided below)

- Inter/ Intra: As per section 7 of IGST Act, 2017, if the location of supplier and place of supply is under the same state, then it would be considered as Intrastate supply and CGST and SGST would be applicable however if the location of supplier and place of supply are in different state then it would be an interstate supply and consequently IGST shall be applicable

For Example:

Inter-State Supply

Mr.X (Registered Supplier of Delhi) Transfer goods to Delhi to Haryana to the Mr.Y (Registered Supplier of Haryana). Here, the Location of Supplier is Delhi and the place of supply is Haryana, hence it is an Interstate Supply and IGST shall be applicable.

Intra State Supply

However if Goods were supplied to Delhi then it means the place of supply is also Delhi, Hence it is an intrastate supply and CGST and SGST shall applicable.

- Taxable Person: As per section 24 of the CGST Act, if a person receiving a supply which falls under RCM under the GST category then he shall compulsory required to register himself irrespective of his turnover in the preceding financial year.

For Example

GTA is giving services by supplying goods by road to XYZ a partnership firm. GTA has not charged GST @12% on its invoice. Now XYZ shall be liable to pay GST under RCM@ 5%, and XYZ shall be required to get compulsory registered.

In this example, if the recipient is an unregistered individual instead of a partnership firm, then such supply is exempted because as per serial number 21A of Notification number 12/2017, Services provided by a goods transport agency to an unregistered person, including an unregistered casual taxable person is exempted from GST.

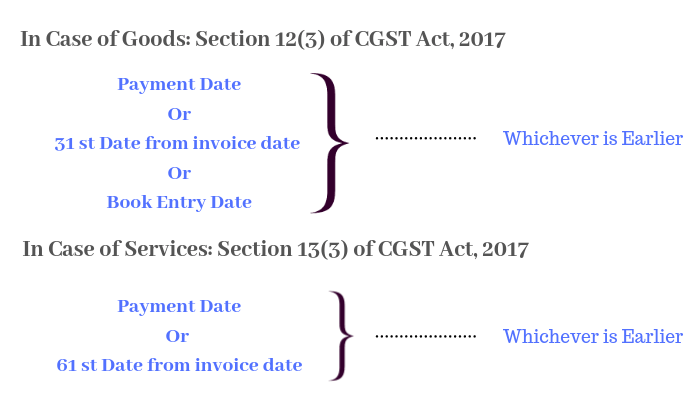

- Time of Supply:

- Invoice: As per section 31(3)(f), In an RCM Supply, if the supplier is not registered, the recipient shall issue self-invoice.

- Records: As per section 35 of the CGST Act, 2017, the person who is liable to pay tax shall maintain all the records of supply attracting the GST.

- Payment: As per Section 49(4) of CGST Act, 017, When GST is payable under RCM, it should be paid by cash i.e., Electronic Cash Ledger. The GST under RCM can’t be paid by utilizing ITC because GST Liability under RCM is not an Output tax and ITC under GST can be utilized only against output Tax.

Also, Recipient can avail the ITC on GST payable under RCM only after making the payment of that tax in the electronic cash ledger.

For Example, Mr. X avails the service of GTA on Jan 19 and liable to pay GST under RCM.

Now, Mr.X shall pay the GST under RCM through only Electronic Cash Ledger on Jan 19.

Mr.X may claim the ITC of such payment on Feb 19.

- Others:

- Composite Supply

If any person registered under Composition Scheme and receives any supply which covered under RCM, then he shall be liable to pay GST at the rate applicable under RCM i.e., @ 5%. Also, after making the payment, he shall not be eligible to take the credit of such tax payment under RCM.

2. Journal Entries in RCM

It can be easily understood through an example.

XYZ Pvt Ltd is taking arbitral services from ABC Pvt Ltd. for Rs.1,00,000/-. Now XYZ Pvt Ltd. Shall enter the following entries:

| S.No. | Particulars | Folio | Head | Amount | Calculation |

| 1 | Legal Expenses | Dr | Expenses | 1,00,000 | 1,00,000 |

| ITC on RCM | Dr | Assets | 5,000 | 100000*5% | |

| To ABC Pvt Ltd. | Cr | Liability | 90,000 | 1,00,000 – 1,00,000 * 10% (TDS) | |

| To TDS Payable U/s 194J | Cr | Liability | 10,000 | 1,00,000 * 10% | |

| To GST Payable | Cr. | Liability | 5,000 | 100000*5% | |

| (Being legal expense has been booked and TDS and GST liability has been charged) | |||||

| 2 | Payment of TDS and GST Liability | ||||

| TDS Payable U/s 194J | Dr. | Liability | 10,000 | ||

| GST Payable | Dr. | Liability | 5,000 | ||

| To Bank | Cr. | Assets | 15,000 | ||

| (Being TDS liability has been paid in the 7th of next month and GST has been paid 20th of Next month) | |||||

- Cases on which RCM Applies: Following are the cases on which Recipient is liable to pay tax under RCM:

In the case of Goods

| Sl No. | Description of supply of goods | Supplier of goods | Recipient of goods |

| 1 | Cashew nuts, not shelled or peeled | Agriculturist | Any registered person |

| 2 | Bidi Wrapper leaves (tendu) | Agriculturist | Any registered person |

| 3 | Bidi Wrapper leaves (tendu) | Agriculturist | Any registered person |

| 4 | Silk yarn | Any person who manufactures silk yarn from raw silk or silkworm cocoons for the supply of silk yarn | Any registered person |

| 4A | Raw Cotton | Agriculturist | Any registered person |

| 5 | Supply of Lottery | State Government, Union Territory or any local authority | Lottery distributor or selling agent |

| 6 | Used vehicles, seized and confiscated goods, old and used goods, waste and scrap | Central / State Government, Union territory or a local authority | Any registered person |

| 7 | Priority Sector Lending Certificate | Any registered person | Any registered person |

In the case of Services (Notification Number:13/2017)

| Sl. No. | Category of Supply of Services | Supplier of service | Recipient of Service |

| 1 | Supply of Services by a goods transport agency (GTA) who has not paid central tax at the rate of 6%, in respect of transportation of goods by road to- | Goods Transport Agency (GTA) | (a) Any factory registered under or governed by the Factories Act, 1948(63 of 1948); or |

| (b) any society registered under the Societies Registration Act, 1860 (21 of 1860) or under any other law for the time being in force in any part of India; or | |||

| (c) any co-operative society established by or under any law; or | |||

| (d) any person registered under the Central Goods and Services Tax Act or the Integrated Goods and Services Tax Act or the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act; or | |||

| (e) any body corporate established, by or under any law; or | |||

| (f) any partnership firm whether registered or not under any law including association of persons; or | |||

| (g) any casual taxable person; located in the taxable territory. | |||

| 2 | Services supplied by an individual advocate including a senior advocate by way of representational services before any court, tribunal or authority, directly or indirectly, to any business entity | An individual advocate including a senior advocate or firm of advocates. | Any business entity located in the taxable territory. |

| 3 | Services supplied by an arbitral tribunal to a business entity | An arbitral tribunal | Any business entity located in the taxable territory |

| 4 | Services provided by way of sponsorship to any body corporate or partnership firm | Any person | Any body corporate or partnership firm located in the taxable territory |

| 5 | Services supplied by the Central Government, State Government, Union territory or local authority to | Central Government, State Government, Union territory or local authority | Any business entity located in the taxable territory |

| a business entity excluding, – | |||

| (1) renting of immovable property, and(2) services specified below-(i) services by the Department of Posts by way of speed post, express parcel post, life insurance, and agency services provided to a person other than Central Government, State Government or Union territory or local authority;(ii) services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport;(iii) transport of goods or passengers. | |||

| 5A | Services supplied by the Central Government, State Government, Union territory or a local authority by way of renting of immovable property to a person registered under the Central Goods and Services Tax Act, 2017 (12 of 2017). | Central Government, State Government, Union territory or local authority | Any person registered under the Central Goods and Services Tax Act, 2017.” |

| 5B | Services supplied by any person by way of transfer of development rights or Floor Space Index (FSI) (including additional FSI) for construction of a project by a promoter | Any person | Promoter |

| 5C | Long term lease of land (30 years or more) by any person against consideration in the form of an upfront amount (called as premium, salami, cost, price, development charges or by any other name) and/or periodic rent for construction of a project by a promoter | Any person | Promoter |

| 6 | Services supplied by a director of a company or a body corporate to the said company or the body corporate | A director of a company or a body corporate | The company or a body corporate located in the taxable territory |

| 7 | Services supplied by an insurance agent to any person carrying on insurance business. | An insurance agent | Any person carrying on insurance business, located in the taxable territory |

| 8 | Services supplied by a recovery agent to a banking company or a financial institution or a non-banking financial company | A recovery agent | A banking company or a financial situation or a non-banking financial company, located in the taxable territory |

| 9 | Supply of services by an author, music composer, photographer, artist or the like by way of transfer or permitting the use or enjoyment of a copyright covered under clause (a) of sub-section (1) of section 13 of the Copyright Act, 1957 relating to original literary, dramatic, musical or artistic works to a publisher, music company, producer or the like. | Author or music composer, photographer, artist, or the like | Publisher, music company, producer or the like, located in the taxable territory |

| 10 | Supply of services by the members of Overseeing Committee to Reserve Bank of India | Members of Overseeing Committee constituted by the Reserve Bank of India | Reserve Bank of India. |

| 11 | Services supplied by individual Direct Selling Agents (DSAs) other than a body corporate, partnership or limited liability partnership firm to bank or non-banking financial company (NBFCs). | Individual Direct Selling Agents (DSAs) other than a body corporate, partnership or limited liability partnership firm. | A banking company or a non-banking financial company, located in the taxable territory |

| 12 | Services provided by the business facilitator (BF) to a banking company | Business facilitator (BF) | A banking company, located in the taxable territory |

| 13 | Services provided by an agent of business correspondent (BC) to a business correspondent (BC). | An agent of business correspondent (BC) | A business correspondent, located in the taxable territory |

| 14 | Security services (services provided by way of supply of security personnel) provided to a registered person: | Any person other than a body corporate | A registered person, located in the taxable territory |

| Provided that nothing contained in this entry shall apply to, – | |||

| (i) (a) a Department or Establishment of the Central Govt. or State Government or Union territory; or | |||

| (b) local authority; or | |||

| (c) Governmental agencies; | |||

| which has taken registration under the Central Goods and Services Tax Act, 2017 only for the purpose of deducting tax under section 51 of the Act and not for making a taxable supply of goods or services; or | |||

| (ii) a registered person paying tax under section 10 of the said Act. |

8 thoughts on “Reverse Charge Mechanism in GST”