In this article, we will discuss about...

Scenario With its Purpose

While making payments to NRI’s outside India, One such compliance is to submit Form 15CA and 15CB, when required along with the TDS LIABILITY The various scenarios where you need to submit these forms have been discussed in this article. The main objective behind is to collect taxes at the time of payment to NRI’s because it may not be possible at a later stage to collect payment. Thus to keeping monitor and trace the transactions in an efficient manner, it was proposed to introduce e-filling of information in the certificates.

Meaning of Form 15CA and 15CB

- As per Section 195 of Income-tax Act, 1961, every person liable for making a payment to non-residents shall deduct TDS from the payments made to non-residents if such sum is chargeable to Income-tax accordingly TDS is required to be deducted at the time of payment and then form 15CA and 15CB are the declaration for the same.

- Indian resident who is making the payment to a Non Resident or a Foreign Company has to submit the form 15CA. This form is submitted online. And a Form 15CB is required that is CA CERTIFICATE after uploading the form 15CA online.

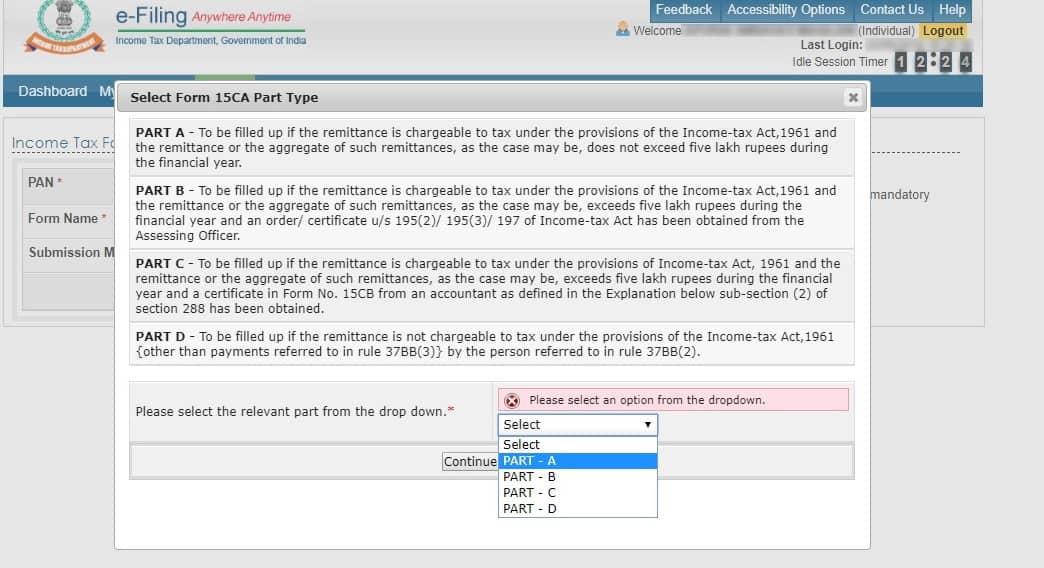

- Information designed in the form 15CA for payment to non- resident, not being a company, or to a foreign company in Form 15CA has been classified into 4 parts –

PART A: – If the payment to NRI does not exceed 5 lakh rupees during the F.Y. (whether taxable or not).

PART B: – Where an order /certificate u/s 195(2)/ 195(3)/197 of Income Tax Act has been obtained from the A.O. (Whether Nil rate or Lower rate Certificate).

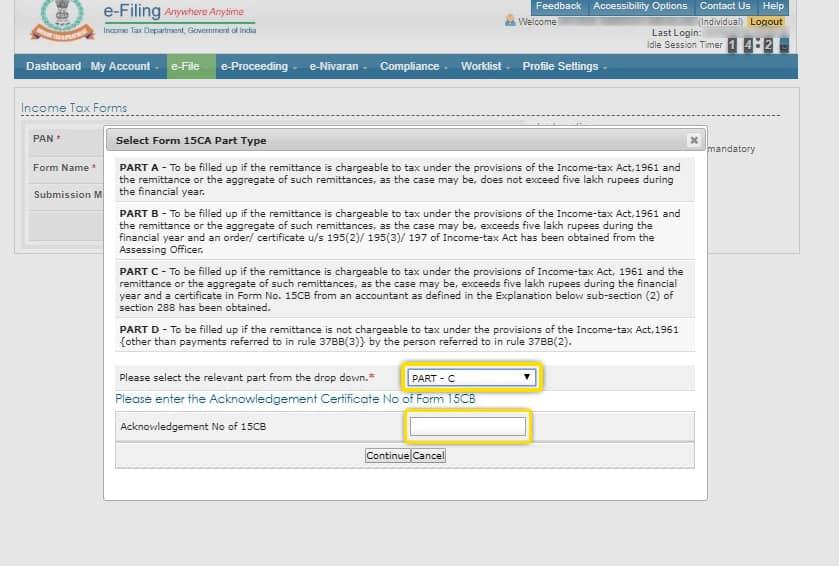

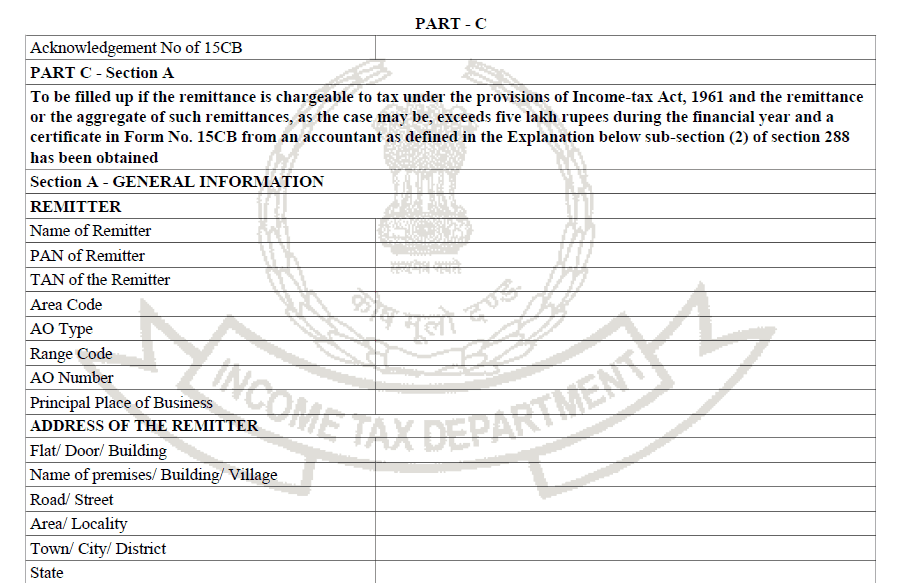

PART C: – If the payment to NRI exceeds 5 lakh in aggregate during the FY.

PART D: – Where the Payment made to NRI is not chargeable to tax under domestic law.

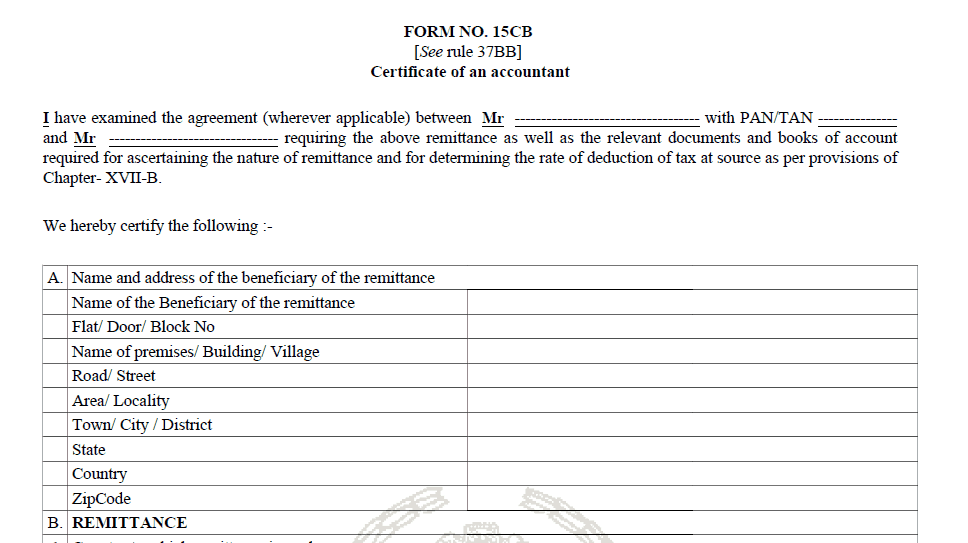

- In form 15CB, A CA certifies details of the payment, TDS rate, and TDS deduction as per Section 195 of the Income Tax Act, if any DTAA is applicable, and other details of nature and purpose of the remittance.

- Form 15CB is firstly filed before filling Part C of Form 15CA. The Acknowledgement Number of e- verified form 15CB should be verified, to prefill the details in Part C of Form 15CA.

Exceptional Cases that don’t Need Form 15CA/CB

- Where RBI Approval is not required for payment to NRI then Individual is not required to furnish the information in Form 15CA and 15CB

- Few of payments (28 items) mentioned in Rule 37BB that does not require reporting through the submission of 15CA and 15CB.

Income Tax Provisions

Section 5 of the Income-tax Act, itself clearly defines the scope of taxable Income but the conflict arises when it comes to Section 9, so following is the summary of Sec 9 just is depicting the following matrix:-

- Summary of Section 9 –

| Sr. No. | Nature of Income | Taxability |

| 1. | Business Income | Taxable, if there is any direct or indirect business connection in India or property or asset or source in India or transfer of a capital asset situated in India. |

| Capital Gain | Taxable if Shares/Property is situated in India or derives its value substantially from assets in India. | |

| 3. | Salary Income | If earned in India. |

| 4. | Interest Income | If sourced in India (if the payer is Resident). |

| 5. | Royalties | Taxable, If exclusively incurred for business in India irrespective of the residential status of the payer. |

| 6. | FTS(fees for technical services) | If incurred for business in India irrespective of the residential status of the payer. |

TDS Liability

When payment is made to NRI outside India then if it is taxable under Income Tax act then TDS required to be deducted at the time of payment outside India to NRI under section 195 of Income Tax ACT and thereafter prescribed form 15CA/CB is required to be file by following the appropriate procedure thereof.

5. Documents required for Form 15CA and 15 CB:-

-Details of Remitter:-

- Name of the Remitter who is making payment

- Address of the Remitter who is making payment

- PAN of the Remitter who is making payment

- Principal Place of Business who is making payment

- E-mail Address and Phone No. of Remitter who is making payment

- Status of the Remitter (Firm/ Company/ Other)

-Details of Remittee:-

- Name and Status of the Remittee(the recipient who received the payment )

- Address of the Remittee

- Principal Place of Business

- Country of the Remittee

♥ Details of Remittance(payment):-

- Country to which the Remittance is made

- Currency

- Amount of Remittance in Indian Currency

- Proposed Date of Remittance

- Nature of Remittance as per Agreement (Invoice Copy)

♥ Bank Details of Remitter(who is making a payment):-

- Name and Bank of Remitter

- Name of Branch of the Bank

- BSR Code of the Bank

♥ Documents required for DTAA Benefit (IN INCOME TAX ACT):-

- Tax Residency Certificate (TRC) from the payee (Tax Registration of the Country in which recipient (payee) is registered).

- Form 10F duly is required to b filled by an Authorized person of the Payee (Self Declaration).

- No PE (Permanent Establishment) declaration. If income is of business nature then it is mandatory.

Few Crucial Papers Required for Form 15CA/15CB:

- Agreement & Invoices with respect to the payment made to NRIs.

- Payment Details in regard to remittance made outside India.

- Correspondence (Whatever communication made with outside India

- Rate of conversion of Foreign Currency in respect of country to which payment made to the relevant person

- Details of Bank that assisting the payment made to outside country

- In case the transaction is between the Group company then Pricing Emails is required.

- The requirement of Proof of Service, if there are a transaction in-between group companies.

Where to upload Form 15CA/CB

The Prescribed procedure for E- filing of Form 15CA is as follows:

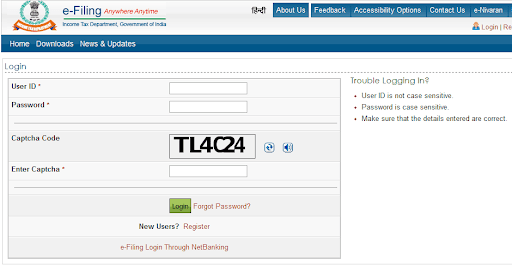

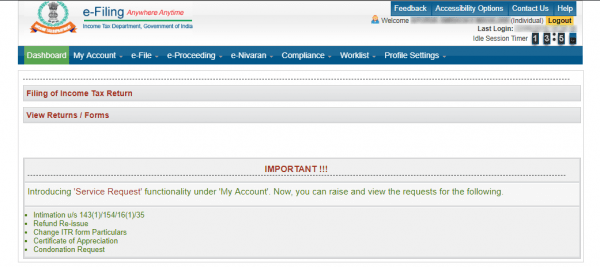

Step 1. Go to Income Tax Filing Website (1) and login to your account.

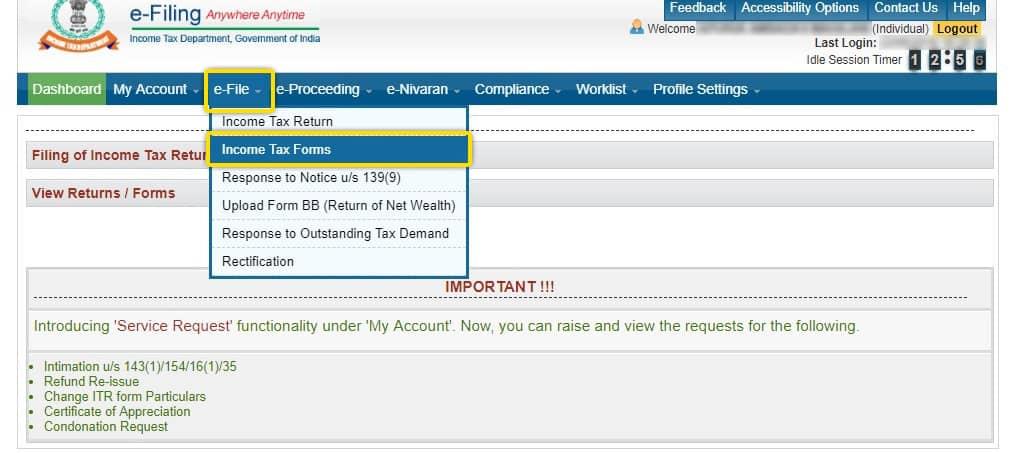

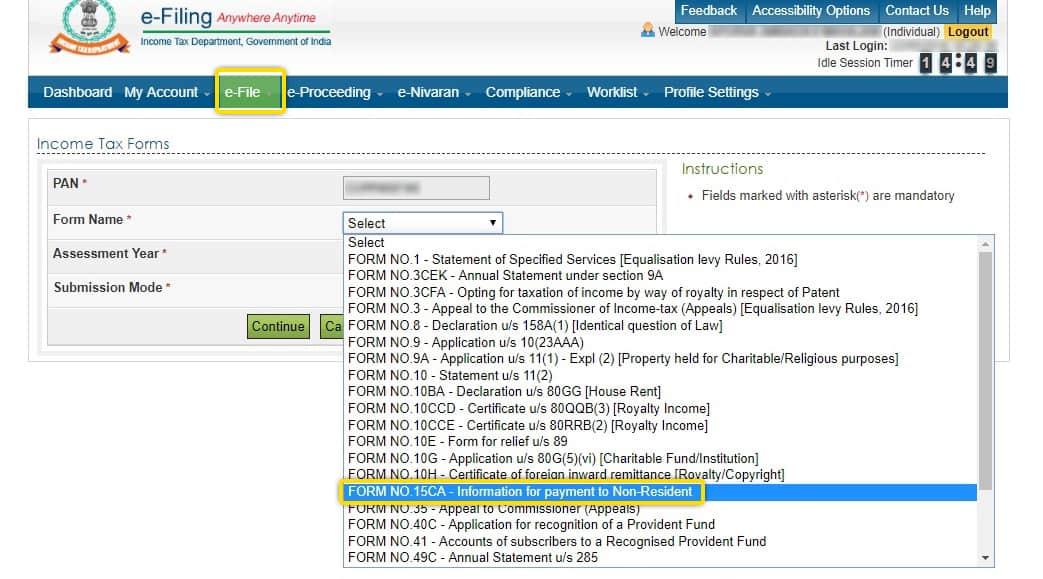

Step 2. Click on ‘e-File’ tab and select ‘Income Tax Forms’ from DROP DOWN MENU

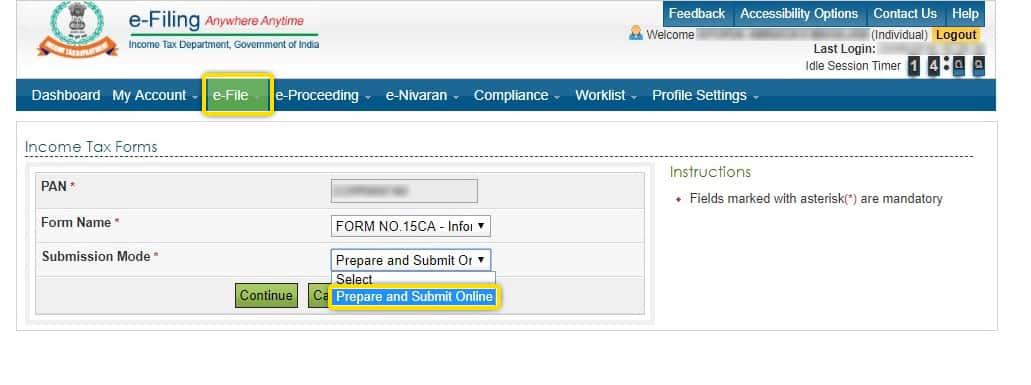

Step 3.Click on “Form 15CA” from the menu and & then “Continue”.click on it

Step 4. Click on the appropriate ‘Form 15CA’ that is applicable from the drop-down menu.

Step 5. The last step to fill the Form 15CA and then click on “Submit” to complete the process.

Very comprehensive one

thanks