GST is a Dual Tax. Dual GST is assumed to be a simple tax with one or two Central Goods and Service Tax (CGST) and State Goods and Services Tax (SGST) rates. That means, In India, both Centre and State have been assigned the powers to levy and collect taxes through appropriate legislation.

A registered person has to file the RETURN* regarding Supply in prescribed form like outward supply in GSTR-1 or Summary return in GSRTR-3b. However, these forms would be changed from October 2019.

Return means the statement of information furnished by the registered person to the department. The return serves the following purpose:

- Mode for transfer of information to the tax department

- Compliance verification

- Finalization of tax liabilities

- Specify the details in a specific format

Who is Liable to get Registered under GST?

GST registration is mandatory for-

- Any business whose turnover in a financial year meet the following criteria then the person will be mandatorily required to b registered

| Aggregate Turnover | Registration Required | Applicability |

| Previous Limits – For the Supply of Goods/Providing Services | ||

| Exceeds Rs.20 lakh | Yes – For Normal Category States | Up to 31st March 2019 |

| Exceeds Rs.10 lakh | Yes – For Special Category States | Up to 31st March 2019 |

| New Limits – For Sale of Goods | ||

| Exceeds Rs.40 lakh | Yes – For Normal Category States | From 1st April 2019 |

| Exceeds Rs.20 lakh | Yes – For Special Category States | From 1st April 2019 |

| New Limits – For Providing Services | ||

| However, there is no amendment in the threshold limit for a service provider, it is same as before | ||

Let’s understand the concept of Each Return

1. Detail of Outward Supplies (Section 37) GSTR-1

Every person is required to file the details of outward supply details in form GSTR-1 except the following persons:

- Input service distributor (ISD) (Section 20)

- Non-Resident Taxable Person (Section 26)

- A person registered under composition scheme (Section 10)

- Person deducting TDS under GST (Section 51)

- Person Collecting TCS under GST (Section 52)

- Supplier of OIDAR

The due date to file GSTR-1 is 10th of next succeeding month. However, if the registered person annual turnover is up to 1.5 crore then he has to file the return within 10th of next quarter.

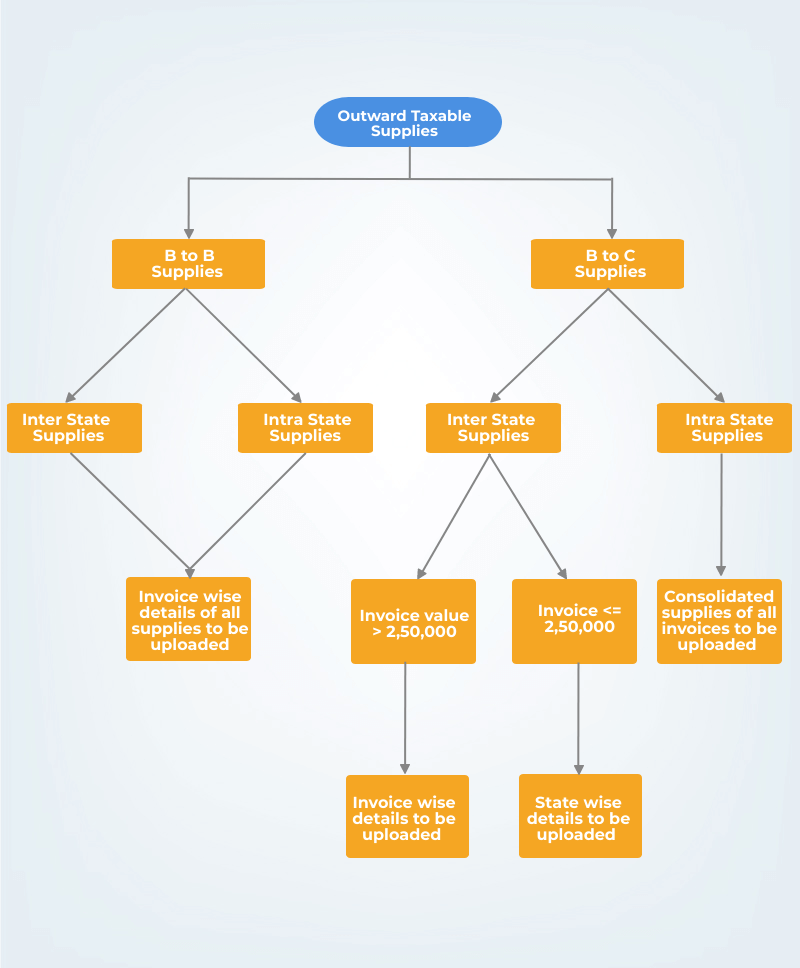

If the registered person is making supplies to the other registered person then he has to file the return by uploading the details of supplies in invoice wise. However, if he is making supplies to an unregistered person then in case of interstate supplies if the invoice amount exceeds Rs. 2,50,000/- then he is required to file invoice wise details otherwise he shall file state-wise consolidated details and in case of intrastate supplies, he may upload the consolidated details of invoices.

Let’ have a quick GSTR-1 functioning:

Special Feature Brought in GST

IN GST DUAL mechanism major change brought in GST return of these returns cannot be revised. So if any error or mistake has been identified in any filed return then it can be amended in the succeeding returns

Provided, Rectification can be done up to a specific period of time thereafter no changes can be made.

For instance, GSTR-1 can be rectified up to the earlier of following:

Due Date of monthly return u/s 39 of September month following the end of the financial year in which the mistake appeared

Or

Date of filing of Annual Return

For Example, Mr. A has found a mistake in his GSTR-1 for the month of July 19 return. He has filed his annual return (GSTR-9) in 10th August 2020. Now the due date for the rectification of return is earlier of the following:

The due date for the month of September of next year i.e. 20th October 2020

Or

Date of filing of his Annual Return i.e., 10th August 2020

Hence the due date for the rectification of return is 10th August 2020.

2. Detail of Inward Supplies (Section 38) (GSTR-2)

The registered person is required to file the details of inward supplies in form GSTR-2 up to 15th of succeeding month.

However, This Form is not notified by the government.

3. Summary Return (Section 39) ( GSTR-3B)

Section 39 prescribes the monthly return in form GSTR-3 for every registered person which is to be file up to 20th of succeeding month. However, this form is not notified by the government.

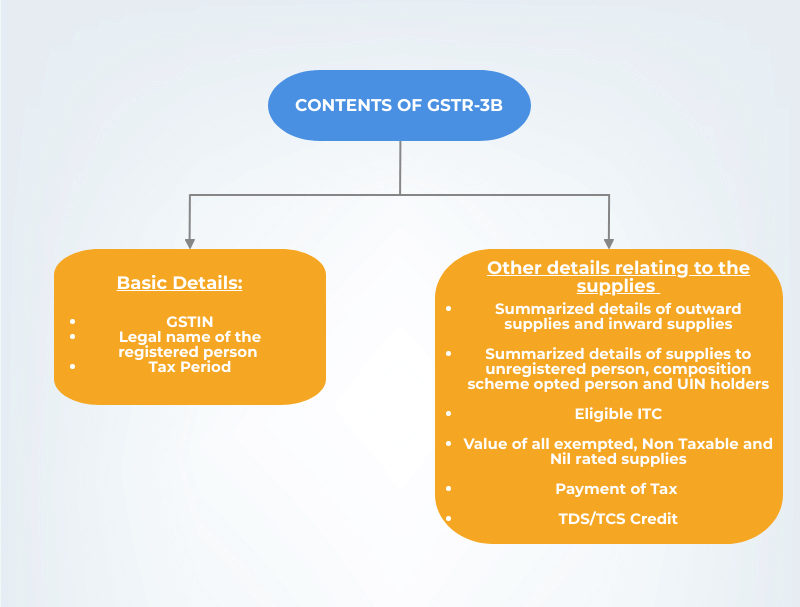

GSTR-3B

Since, instead of GSTR-3, the government has notified GSTR-3B for a time being. It shall be filed within 20th of Succeeding month.

It contains the details of the summary of all outward supplies, Inward supplies including the inward supplies liable to RCM, ITC, etc. Thus, GSTR-3B does not require invoice wise details.

4. Return of Composite Supplier (section 39(2))

The person who has opted to pay tax under the composition scheme, as defined under section 10 of CGST Act, will have to file a quarterly return in form GSTR-4 within 18th of the month succeeding the relevant quarter.

A composition dealer is not eligible to avail the ITC on the invoices or debit notes issued by the supplier.

A composition dealer is required to issue BILL OF SUPPLY rather than Tax invoice

A composition dealer has to mandatorily file the return even if no supplies were during the relevant quarter.

5. Non-Resident Taxable Person (NRTP) (Section 39(5)) (GSTR-5)

Non-Resident Taxable Person is those people who came to India for a shorter period and does not have any fixed business establishment in India.

A Registered NRTP does not require to file the returns which are applicable to the normal taxpayer.

They have to file monthly return in Form GSTR-5 in which he has to mention all the outward and inward supplies details.

He also has to deposit the GST in advance on estimation basis.

Their registration time period is normally 90 days which can be further extended for 90 days. However, if he making supplies for a further period then he shall have to make the registration as the application to the normal registered person.

The last date to file the form GSTR-5 is earlier of following:

20 days after the end of the calendar month

Or

Within 7 days after the end of validity of the period of registration.

A Non-Resident Taxable person is not required to file the Annual Return (GSTR-9).

6. Return for Input service distributor(ISD)

In a layman language, An ISD is the head office which distributes the eligible and ineligible credit to its other offices as per rules 39 of CGST Rules, 2017.

An ISD is not required to file details of outward supplies in the return. It needs to file a monthly return in form GSTR-6 in which it mentioned the details of input credit received for distribution, Total ITC, eligible ITC, ineligible ITC, etc.

An ISD shall have to file the return on or before 13th of the succeeding month. Since the information of ITC shall be available to the recipient registered person only when the supplier registered person shall disclose his outward supplies details whose due date is 10th of succeeding month. Hence, an ISD can only file the return after 10th of the month and before the 13th of succeeding month.

7. Return for the person who is required to deduct TDS under GST

When the registered person is making supplies to the Central government or state government or local authority or government agencies then the recipient is required to deduct TDS as per section 51.

The deductor i.e. recipient shall have to file the return in form GSTR-7 within 10th of the Succeeding month.

The deductor shall issue a TDS certificate in form GSTR-7A to the deductee within 5 days of crediting the amount to the government.

8. Return for E-commerce operator (ECO) for supplies affected through E-commerce (Section 52)

E-commerce operator shall furnish his return in GSTR-8 in which it specifies the details of supply of goods or service or both effected through e-commerce including the amount of TCS.

While charging the amount of GST, E-commerce operator shall also charge additional amount as tax collected at source. This amount is charged on the invoice value and not on GST value.

ECO shall have to file the return within 10th of the succeeding month in tax been collected at source. Also, the due date for depositing the TCS amount is 10th of succeeding month.

9. Annual Return (GSTR-9/9A)

Every person is required to file the annual return in form GSTR-9 except the following:

- Casual taxable person

- Non Resident taxable person

- Input service distributor (ISD)

- The person authorized to deduct or collect the tax under section 51/52

For Composition, the dealer shall have to file the annual return in GSTR-9A.

The due date of filing the annual return is 31st December of the next financial year. If any error or mistake or any difference remains unchanged in GSTR-1 or GSTR-3B or in books then it can be rectified in his annual return.

10. GST AUDIT REQUIREMENT

Every registered person whose aggregate turnover in the FY exceeds 2 crores then he has to get his accounts audited by a chartered accountant or cost accountant.

Such registered person shall have to file the form GSTR-9C along with the

- Annual Financial statements

- A reconciliation statement of Annual financial statements with the Annual Return (GSTR-9)

11. Final Return (Section 45)

Any registered person whose registration has been canceled or he has surrendered his registration, shall have to file final return in form GSTR-10.

He has to file the return within 3 months of later of the following:

Date of cancellation

Or

Date of order of cancellation

12. Return for the persons Having UIN

Any specialized agency of the united nation organization or

Any multilateral Financials institutions or

Embassy of foreign countries

Are eligible for the refund on the taxes paid in the specific goods or services or both as specified by the government. Hence to claim the refund, such persons have to form GSTR-11 in which they furnish the details of inward supplies of taxable goods/ services.

The due date for filing the return is 28th of succeeding month.

These persons are not called a registered person.

13. Default in Furnishing of Return

As per section 46 If the registered person fails to file the GSTR-1 or 2 or 3B or 10 return then a notice would be sent to them, which required them to file the return within 15 days.

Late Fees: For GSTR-1/2/3/10

Lower of the following

100 per day till the failure continues

Or

Rs. 5,000

Late Fees: for non-furnishing the Annual Return under section 44

100 per day till the failure continues

Or

0.25% of the turnover of the registered person in the state/UT.

8 thoughts on “GST Returns and GST Return Due Dates”