Form MGT 7 is an automated e-form required to be filed by every company on an annual basis. This article discusses such form in detail, its procedure of filing within due date, etc.

In this article, we will discuss about...

Form MGT-7

Form MGT-7 is an electronic form used to file the details of annual return with the Ministry of Corporate Affairs (MCA) pursuant to Section 92(1) of the Companies Act, 2013 and rule 11(1) of the Companies (Management and Administration) Rules, 2014.

Who is Required to file Form MGT-7

All Companies registered in India irrespective of whether the company is private or public are required to file the Form MGT-7 every year.

Consequences of not filing Form MGT-7

In case of failure to file Form MGT-7 within the due date, a penalty of Rs.100/- per day of default shall be levied/ charged.

Details required to file Form MGT-7

Every Company is required to file Annual Return details in form MGT-7 pertaining to the financial year for which such form is filed by providing the following:

- Details of registered office.

- Details of principal business activities, particulars of its holding, subsidiary and associate companies.

- Details of shares, debentures and other securities and shareholding pattern.

- Details of Indebtedness

- Details of members and debenture-holders along with changes therein since the end of the past financial year.

- Details of promoters, directors, key managerial personnel along with changes therein since the end of the previous financial year.

- Details of the shareholding patterns of the company.

- Details of meetings of members or a class thereof, Board and its various committees along with the details of attendance.

- Details of Directors and Key Managerial person remuneration.

- Details Penalty or punishment charged on the company, its directors or officers and

- Details of compounding of offenses and appeals imposed against such penalty or punishment.

- Details of matters relating to compliance certifications and disclosures as may be prescribed.

- Details of such other matter as may be required

Required Attachments to Form MGT-7

Following are the list of documents required to be attached for filing e-Form MGT- 7

- In the case of a Company having Share Capital, a list of Shareholders and Debenture holders are mandatory.

- In case the AGM has been extended, the approval letter for such an extension is mandatory.

- MGT-8 copy

- And any other optional attachments

The due date for Filing Form MGT-7

Form MGT-7 has to be filed within a period of 60 days from the date of the conclusion of the company’s Annual General Meeting (AGM).

Since the due date for conducting the company’s Annual General Meeting (AGM) is on or before the 30th September of the subsequent financial year, Form MGT-7 Due Date shall be 29th November of Subsequent financial year.

Extension of Due date for Filing Form MGT-7

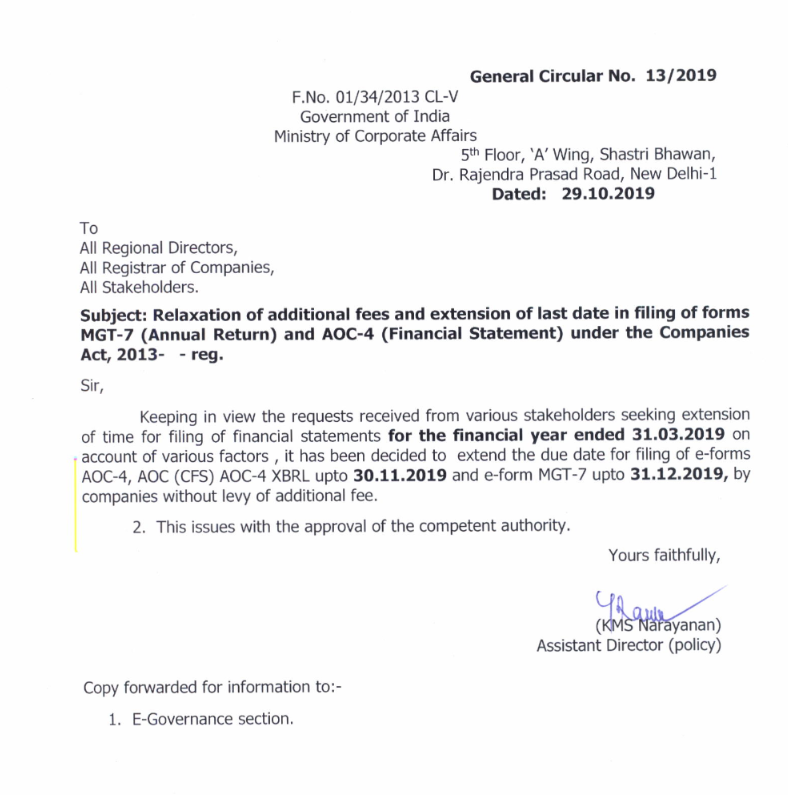

As per the Circular No.13/2019 dated 29.10.2019 issued by Ministry of Corporate Affairs (MCA), the due date for filing Form MGT-7 (Annual Return) for the financial year ended 31.03.2019 has been extended up to 31.12.2019 without levy of any additional fees.

The Notification of such extension shall be accessed below:

1 thought on “Know All about Form MGT 7- Annual Return”