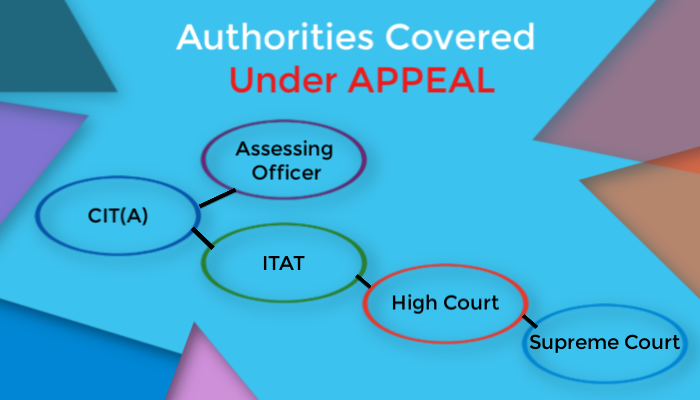

Where any person is not satisfied with the assessment order of assessing officer, he may file an appeal to its superior body. In this article, we will discuss the appeal and the procedure for filing the appeal. Before going on this, we will have to understand the authorities covered under appeal.

In this article, we will discuss about...

Assessing Officer CIT(A) ITAT High Court Supreme Court

In simple words, the appeal against the order of the assessing officer may be filed to Commissioner of Income-tax (Appeals). Likewise, the appeal against the order of CIT (A) may be filed to income tax appellate authority and then high court and at last to Supreme Court.

So let’s discuss the filing of the appeal and its procedure at each level:

Appeal to Commissioner of Income-tax (Appeal)

Where the assessee is not satisfied with the order of his assessing officer then he may file an appeal to CIT (A) within the period of 30 days from the date on which such order has been communicated to him.

Although, the period of 30 days can be extended further for a period as allowed by the commissioner if there is a sufficient cause for not filing it.

Generally, people think that appeal can be filed to CIT (A) against all the orders of the AO but it’s not true. Section 246A has been defined as the list of orders against which a person can file an appeal to CIT (A). For Example, The Person shall not be able to file the appeal to CIT(A) against the order of assessing officer under section 143(3) or 147 or 153 if such order has been passed on the direction of DRP. For this, the appeal can be filed directly to the income tax appellate tribunal. In our previous articles, we have discussed these orders in detail. You can refer them to understand it more clearly. So it is advisable that before the filing of the appeal, you should refer section 246A of the income tax Act, 1961.

As you know, our prime minister is making all its efforts for making digital India and one of the great examples of this, is the e-filing. Now, you can file the return or even respond to your assessing officer about any queries related to the assessment or intimation or filing of appeal through electronic mode.

The appellant has to fill the form 35 along with the following documents:

- Statement of facts

- Grounds of appeal

- Address of the appellant on which he is willing to receive any documents related to the appeal.

- Assessment year for which the appeal is related.

- Notice of demand in original

- Copy of challan of fees

- Certified copy of the order of assessing officer against which the appeal is being filed to CIT (A).

Note: If the assessee is not happy with the order of assessing officer, then he shall have the 3 options:

- Filing of rectification letter under section 154 or

- Filing of appeal to the commissioner of income tax (Appeals) under section 246

- Filing of revision petition to the commissioner of income tax under section 264

Yes, you heard correct. The assessee can even file the revision petition to the commissioner of income tax and its time period is 1 year from the date of communication of the order of assessing officer which is substantially more than the period specified for the filing of an appeal to the commissioner of income tax (Appeals). But, do you know, even revision petition looks more attractive as compared to the filing of the appeal, still, many of the people refer appeal and not revision. The reason for this, if the order has been passed against the assessee, then he can further file an appeal to the superior authority in case of appeal but it’s not possible in case of revision.

In simple words, the order of the commissioner under revision is a final order and no appeal can be filed against such order. Normally, people go for the revision in those cases, in which the time period of 30 days has been expired.

Pre deposit to be made before the filing of the appeal

The following amount of fees is required for filing of an appeal to the commissioner of income tax (Appeal):

| Total Income as computed by the assessing officer | Amount of pre-deposit |

| Up to Rs.1 Lakhs | 250 |

| More than 1 Lakhs but up to Rs.2 Lakhs | 500 |

| More than 2 Lakhs | 1000 |

So, in any case, the pre-deposit amount does not exceed Rs.1000.

This is the pre-deposit but what about the tax amount. Whether it is required to be deposited before the filing of the appeal. So its answer is:

If you have filed the return of income then the tax payable in the return of income should be required to be deposited before the filing of an appeal to CIT (A) and

In case the assessee has not filed the return and the assessing officer has computed the total income as per best of his judgment under section 144 then the tax payable as computed by such an assessing officer is required to be deposited by the assessee. However, in this case, the CIT (A) may allow the assessee for filing of appeal without paying such tax payable amount.

Procedure for filing of the appeal

- First, log in to your account at income tax website https://www.incometaxindiaefiling.gov.in/home

- Then go to the “E file” and click on the “prepare and submit online form” where you have to select from 35.

- After click on the continue button, a form shall be displayed on your screen.

- Read all the instructions carefully especially while filing the details about the grounds of appeal because CIT(A) shall not admit any additional ground which was not mentioned on the grounds of appeal except some specified cases.

Order of CIT (A)

Commissioner of Income-tax (Appeals) has the power to confirm or modifying or annulling the order of assessing officer. However, it cannot pass the order to refer back to the assessing officer and ask for the passing of order again.

Filing of Appeal to Income-tax Appellate Tribunal (ITAT)

Likewise section 246A, there are some orders list has been defined which provides the list of orders against which the appeal can be filed to ITAT. You can refer to our previous articles to gain an understanding of these orders in detail.

The time limit for filing of Appeal

The aggrieved party may file an appeal within 60 days from the date on which the order against which appeal is to be filed, has been communicated to CIT and assessee, as the case may be.

Memorandum of cross objection

Where any party files an appeal to ITAT, then such an appellate tribunal shall send the notice to the other party and informed him that the appeal has been filed against him. In such a case, the other party may file a memorandum of cross objection to ITAT within 30 days in form 36A.

The ITAT shall treat such a memorandum of cross objection as if the fresh appeal has been filed. Also, the department can also accept such a memorandum even expiry of 30 days if it satisfied that there was a sufficient cause for not filing it within the prescribed time.

Mistake apparent from the record

Where there is any mistake apparent from the record, then the ITAT may rectify such mistake under section 154 within 6 months from the end of the month in which the order has been passed by ITAT on the notice brought to by assessee or assessing officer.

Admission to Additional Evidence

Income Tax Appellate authority may, after giving an opportunity of being heard, admit the additional evidence produced before them which has not been produced before Commissioner of income tax (Appeals). However, ITAT shall not accept the additional evidence on rectification proceedings.

Procedure for filing of an appeal to ITAT

Following documents were required for filing of an appeal to ITAT:

- Form 36 (3 copies)

- Copy of order against which an appeal is filed

- Order of the assessing officer

- Statement of facts

- Copy of challan

Pre Deposit for the filing of an appeal to ITAT

The amount of pre-deposit for filing of an appeal to ITAT shall be as follows:

| Total Income as computed by the assessing officer | Amount of pre-deposit |

| Up to Rs.1 Lakhs | 500 |

| More than 1 Lakhs but up to Rs.2 Lakhs | 1500 |

| More than 2 Lakhs | 1% of the total income but maximum up to Rs.10000 |

Appeal to High Court

If the appellant is not satisfied with the order of income tax appellate authority then it can further file an appeal to the high court within the period of 120 days from the date of communication of the order of ITAT. Although, the high court shall accept the case if the question in dispute is a question of law.

Appeal to Supreme Court

All the orders of the high court under the income tax act can be applied for the appeal to the Supreme Court. Here, the time period has not been defined within which the assessee shall have to file the appeal. The order of the Supreme Court is the final order and the appellant cannot file any further appeal against the order of the Supreme Court.