Various Government authorities are using Digital Signature Certificate (DSC) for authentication and signing purposes. In this article, we will discuss the procedure to register and update DSC on the GST Portal.

In this article, we will discuss about...

Digital Signature Certificate (DSC)

Digital Signature Certificate (DSC) is a method of signing the electronic document in an asymmetric cryptography way. The main feature of DSC is to authenticate the user by sending the Information.

Uses of DSC on GST Portal

DSC enables the authorized Signatory to act on behalf of the business in respect of GST for the following purposes

- For Signing the forms, documents. and Returns

- For the purpose of Return Filings.

- For making online payments.

Persons mandated to use DSC

Following are the taxpayers who are required to use DSC mandatorily

- Public Limited Company

- Private Limited Company

- Unlimited Company

- Foreign Company

- Limited Liability Partnership (LLP)

- Foreign Limited Liability Partnership

- Public Sector Undertaking

Prerequisites to Register DSC

The following are the Prerequisites needed to register DSC.

- The designer utility should be installed on the computer.

- DSC Dongle (DSC USB Token).

- Software supporting the DSC is should be on the computer.

Registration of DSC on GST Portal

Following is the procedure to register DSC on GST Portal

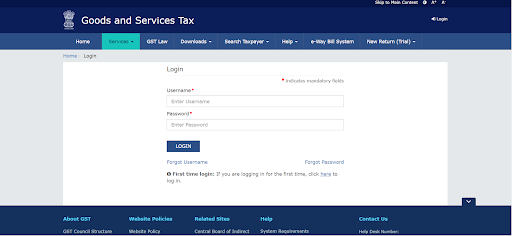

- Step-1: Visit the Official website of GST at https://services.gst.gov.in/services/login and Login to the GST Portal Using valid login credentials.

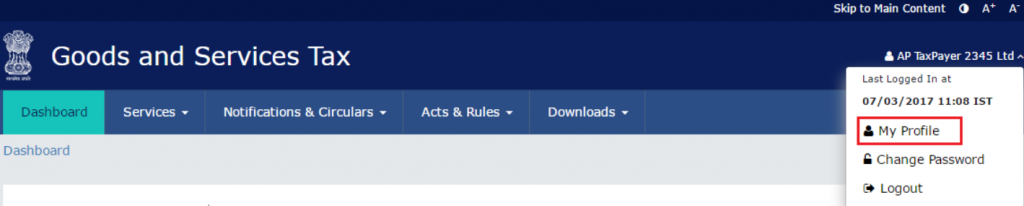

- Step-2: After successfully logging into the portal, click the ‘My Profile’ tab provided under the dropdown list against the profile name.

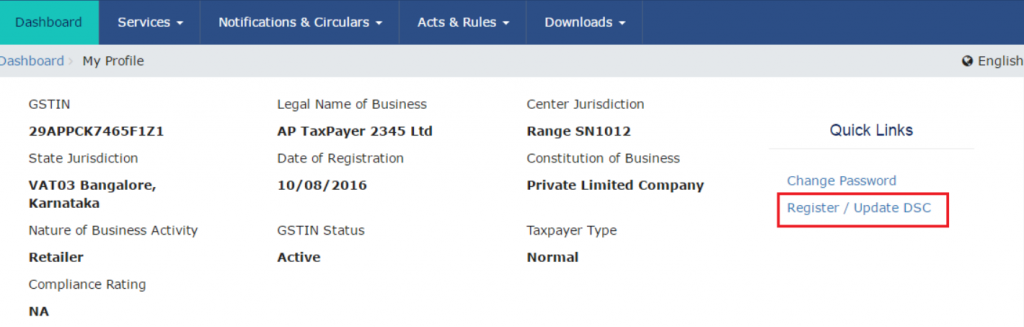

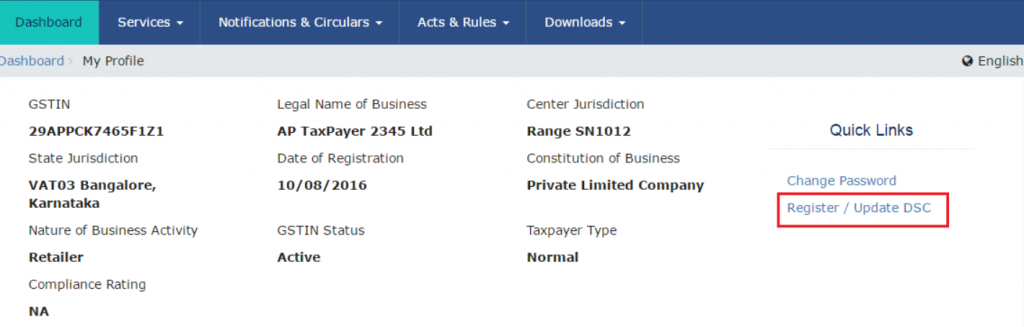

- Step-3: On clicking ‘My Profile’ Tab a profile page of the taxpayer shall be displayed. Click ‘Register/Update DSC’ link provided on the page.

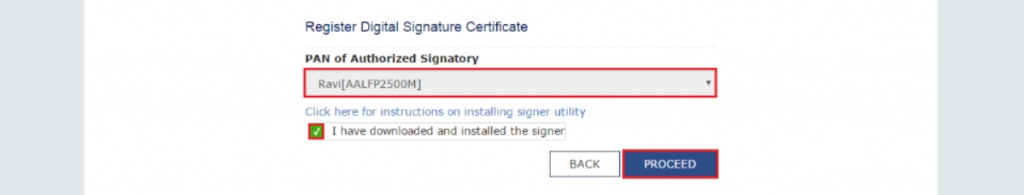

- Step-4: On clicking the Register/Update DSC link ‘Register Digital Signature Certificate’ shall be displayed requiring the PAN of the Authorized signatory. Select the PAN of the authorized signatory for whom the DSC is to be registered from the dropdown list. Select provided checkbox ‘I have downloaded and Installed the signer’ and submit by clicking the ‘Proceed’ option.

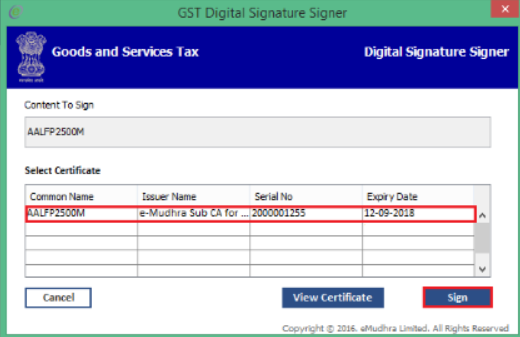

- Step-5: Select the Certificate and sign by clicking the ‘Sign’ option.

A success message shall be displayed stating “Your DSC has been successfully registered”.

Updating DSC on GST Portal

- Step-1: Click the ‘Register/Update DSC’ link provided in the profile page under the option of the ‘My Profile’ tab.

- Step-2: On clicking the Register/Update DSC link ‘Register Digital Signature Certificate’ shall be displayed requiring the PAN of the Authorized signatory. Select the PAN of the authorized signatory for whom the DSC is to be updated from the dropdown list. And Submit the details by clicking the update button.

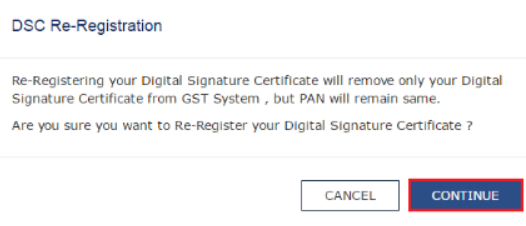

- Step-3: Proceed with the Continue option.

- Step-4: Select the certificate and sign by clicking the sign option.

After Successfully signing, a success message shall be displayed stating “Your DSC has been successfully registered”.

Thank you for sharing this valuable post. This informative Write-up has helped me to understand the digital signature very closely with no hassle.