Introduction

In this article, we will discuss all filing of an appeal to Income tax appellate authority (ITAT). This article will be divided into the following parts:

- Cases in which an assessee can file an appeal to ITAT

- The time limit for filing of the appeal

- Memorandum of Cross objection

- Orders of the ITAT

- Procedure to be followed by Appellate Tribunal

- Admission to additional Evidence

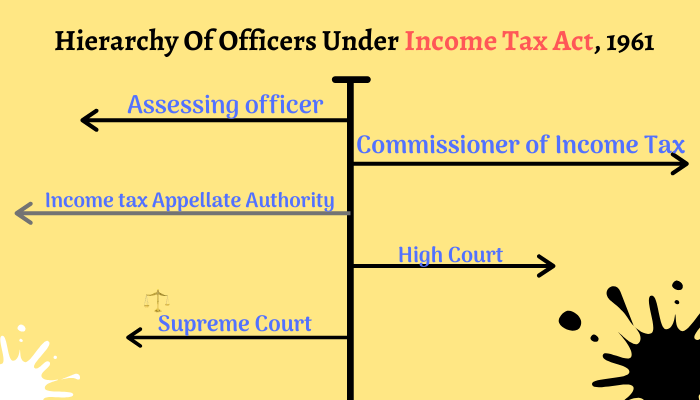

But first, let me explain to you about the hierarchy of officers under the income tax Act, 1961:

In simple words, an aggrieved party, on the order of its previous adjudicating authority, may file an appeal to its next superior authority. For Example: In case Commissioner of Income-tax (Appeals) passed the order against the assessee, then such person may file an appeal to income tax appellate authority (ITAT) subject to other provisions of the income tax act, 1961. If the order again passed against him by ITAT then assessee may go to the high court and then-Supreme Court.

Orders against which an appeal can be filed to ITAT by the assessee

An assessee may file an appeal to the appellate authority against the following orders:

- Order of CIT (Appeals) under section 250

- Where the assessee has filed the request to his assessing officer but AO did not rectify and person has filed appeal to CIT (A) for passing the order of rectification under section 154, then if CIT (A) has also passed the order against him, in such situation, the assessee can file against the order of CIT(A) passed under section 154 rectifying or refusing to rectify the order passed under section 250.

- Order of the penalty imposed under section 270(A) by CIT (Appeals).

- Order of CIT (A) passed under section 154 rectifying or refusing to rectify the order passed under section 270A.

In simple words, an assessee can file the appeal to ITAT where the CIT(A) has made a rectification or refused to rectify the order under section 154, relating to the order of penalty under section 270A passed against such assessee.

- Order of the CIT under section 263

Note: if the assessee has aggrieved with the order of his assessing officer, then such assessee shall have 2 option: whether to file an appeal to CIT (A) or making a request to CIT for revision under section 264.

Like this, the commissioner may itself or on the request of any person, may revise the order of assessing officer under section 263. In this case, the assessee can file an appeal to ITAT against the revision order of CIT under section 263.

- Similar to CIT (Appeals), the assessee can file an appeal against the order of CIT under section 154 rectifying or refusing the order passed under section 263.

- Order of the penalty imposed under section 270(A) by CIT.

- Order of CIT passed under section 154 rectifying or refusing to rectify the order passed under section 270A.

- Order of CIT passed under section 12AA, where it refuses to register the trust as charitable or religious trusts or canceling the registration of such trust.

- Order of CIT passed under section 80G, where it refuses to register the trust or cancel the registration of such trust under this section.

Note: Where any person gives a donation to the trust registered under section 80G then such person shall be eligible for the deduction under this section.

- Normally, a person cannot file an appeal against the order of assessing officer under section 143(3) or 147 or 153A except where such order has been passed in the pursuance of directions of DRP or order passed under section 154.

- As per Finance Act, 2018, one more case has been added in which the assessee can file the appeal to ITAT and this is the penalty order passed by CIT(A) under section 271J for giving incorrect report or certificate.

In all the above cases I have discussed on the behalf of the assessee. However, the commissioner may also direct the assessing officer to file an appeal to ITAT against the order of CIT (A) of the order under section 250 or 154.

Note: Department cannot file the appeal to ITAT against the order of assessing officer passed as per the directions of DRP.

The time limit for filing of Appeal

The aggrieved party may file an appeal within 60 days from the date on which the order against which appeal is to be filed, has been communicated to CIT and assessee, as the case may be.

Memorandum of cross objection

Where any party files an appeal to ITAT, then such an appellate tribunal shall send the notice to the other party and informed him that the appeal has been filed against him. In such a case, the other party may file a memorandum of cross objection to ITAT within 30 days in form 36A.

The ITAT shall treat such a memorandum of cross objection as if the fresh appeal has been filed. Also, the department can also accept such a memorandum even expiry of 30 days if it satisfied that there was a sufficient cause for not filing it within the prescribed time.

Section 154: Order of Appellate Tribunal

The income tax appellate tribunal may, after giving an opportunity of being of heard, pass such order as it may deem fit.

Where there is any mistake apparent from the record, then the ITAT may rectify such mistake under section 154 within 6 months from the end of the month in which the order has been passed by ITAT on the notice brought to by assessee or assessing officer.

Procedure to be followed by the tribunal for passing the order

The power and functions of ITAT are exercised and discharged by the benches constituted by the president of ITAT. The bench will be consist of at least 1 judicial member and 1 accountant member.

Order by Single member: In case, where the total income of the assessee, as computed by assessing officer does not exceed Rs.50 lakhs, then the president or the other member of the ITAT, on the authorization of the central government, my dispose the case by sitting singly.

The difference of Opinion: If a member of a Bench differs in opinion on any point, such point shall be decided as per the majority. However, if the members are equally divided, then such a case shall be referred by the president of ITAT and then heard by other members or members of ITAT and then the order shall be passed in accordance with the majority.

Orders of Appellate Tribunal: Order can be of 2 types of question i.e. the question of law and question of fact. If ITAT has passed the order related to the question of fact then such order shall be final and no appeal can be admitted to the high court against the order.

However, the assessee may file a writ petition to the high court challenging the fact-finding process adopted by ITAT. If the high court is satisfied with the writ petition then it may quash the order of ITAT. Also, if high court has dismissed the writ petition then assessee may file a special leave petition to Supreme Court. Here also, if the Supreme Court is satisfied that the fact-finding process of the ITAT is not correct then it shall quash the order of ITAT.

On the question of law, the aggrieved party may file the appeal to the high court.

As we already discussed above, ITAT has the power to rectify its orders. However, ITAT cannot review its order passed under section 254(1).

Admission to Additional Evidence

Income Tax Appellate authority may, after giving an opportunity of being heard, admit the additional evidence produced before them which has not been produced before Commissioner of income tax (Appeals). However, ITAT shall not accept the additional evidence on rectification proceedings.

Very helpful Inormation. Thank you for this guide on how to filing an appeal to ITAT.

Thank you