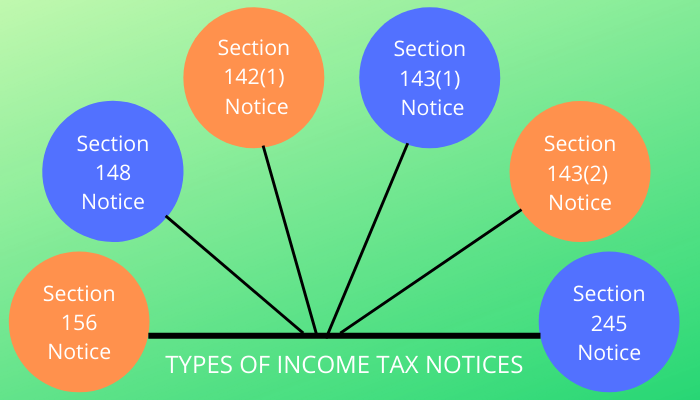

Every taxpayer is required to furnish return of income to the income tax department. After filing such return of income by the assesses the income tax department processes the same and examines the correctness of return of income. For the purpose of such examination, the Income tax department may raise the Different Types of How To Respond To Income Tax Notice as required and relevant to the case as may be.

In this article we will discuss about Different Types of Income Tax Notice issued by Income Tax Department.

- Section 142(1) Notice- Inquiry before Assessment

- Section 143(1) Notice- Intimation Notice

- Section 143(2) Notice- Scrutiny Notice

- Section 148 Notice- For cases where income has escaped assessment.

- Section 156 Notice- Demand Notice

- Section 245 Notice- Refund adjusted against demanded tax

Section 142(1) Notice- Inquiry before Assessment

The Notice under this section shall be served to the assesses as a preliminary investigation to acquire required details before starting the assessment.

Assessing officer on serving a notice under this section may call on the assesses the following information.

- To furnish a return of income of the assesses or return of income of any other person in respect of which he is assess-able under the income tax act, where such assesses has not filed his return of income with in the time specified under section 139(1) or before the end of relevant assessment year.

- For the purpose of making an assessment, assessing officer may require to produce accounts or documents.

- To furnish in writing including a statement of affairs of all assets and liabilities of the assesses, whether included in the accounts or not as the Assessing Officer may require.

Under Section 143(2) Scrutiny Notice

The notice under this section shall be served by assessing officer or the prescribed income tax authority after furnishing return under section 139 or in response to the notice issued under section 142(1) to ensure that

- Assesses has not understand the income or

- Assesses has not computed excessive loss or

- Assesses has not underpaid taxes in any manner

The Notice served under this section requires assesses either to

- Attend the assessing officer office or

- To produce documents in support of deductions, exemption, relief’s, losses claimed and proof of all sources of income based on which assesses has filed his return of income.

Under Section 143(1) Intimation Notice

The notice under this section shall be served to the assesses as an intimation specifying the sum determined to be payable by, or the amount of refund due to, the assesses which is computed on the total income or loss after making the following adjustments, namely:

- any arithmetical errors in the return.

- an incorrect claim if such claim is apparent from any information in the return.

- disallowing the loss claimed, if return of the previous year was furnished after the due date specified under section 139(1) for which set off of loss is claimed.

- Disallowing the expenditure indicated in the audit report if such expenditure was not taken into account in computing the total income in the return.

- Disallowing the deductions claimed under sections 10AA, 80-IA, 80-IAB, 80-IB, 80-IC, 80-ID or section 80-IE, if the return is furnished after the due date as specified under section 139(1).

- Adding the income appeared in Form 26AS or Form 16A or Form 16 if the same has not been included in computation of the total income in the return.

The Assessment under this section can be made within a period of 1 year from the end of the financial year in which the return of income is filed.

Section 148 Notice– For cases where income has escaped assessment

The notice under this section shall be issued by the assessing officer for making the assessment or reassessment or re-computation under section 147, if he has the reasons to believe that any income which is chargeable to Income Tax has escaped assessment.

Time limit for issuance of notice under section 148

- In case of the Income escaped assessment is Rs.1 Lakh or less than that, notice has to be served within four years from the end of relevant assessment year and notice cannot be issued by the officers who are in below the rank of Assistant Commissioner or Deputy Commissioner.

- In case of the Income escaped assessment is Rs.1 Lakh or more than that, notice has to be served beyond four years but up to 6 years from the end of relevant assessment year and notice can be issued only by the Chief Commissioner or Commissioner.

- In case of the Income in relation to any asset located outside India is chargeable to tax in India but has escaped assessment, Notice has to be served beyond four years but up to 16 years from the end of relevant assessment year.

Section 156 Notice- Demand Notice

The notice under this section shall be served to the assesses specifying the sum do payable, where any tax, interest, penalty, fine or any other sum is payable in consequence of any order passed.

The tax demanded under this section has to be paid within the period of 30 days from the date of service of demand notice.

Section 245 Notice- Refund adjusted against demanded tax

The notice under this section shall be served by the assessing officer to the assesses as an intimation to set off the amount to be refunded or any part of that amount, against the sum which is due to be payable under this Act by the person to whom the refund is due.

The assesses has to respond with in the period of 30 days from the date of receipt of notice. In case of not responding with in such stipulated period, the assessing officer may consider it as a consent and proceed with the assessment.

2 thoughts on “6 Types of Income Tax Notice Act, 1961 – AKT Associates”