In our previous articles, we have explained that the income of Non-resident which has been accruing or arise or deemed to accrue or arise in India, shall be taxable in India. NRI may have income from outside India from employment or business or in India from any other sources which he wants to be kept in India.

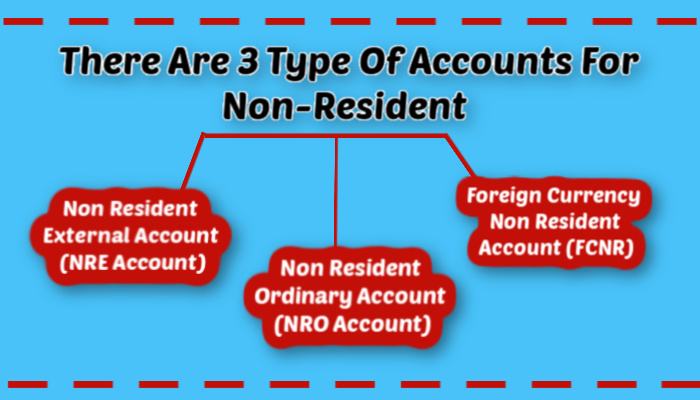

After analyzing above, A NRI have been given an option to open 3 types of accounts which are

- Non-Resident External Account (NRE Account)

- Non-Resident Ordinary Account(NRO Account)

- Foreign Currency Non-Resident Account (FCNR)

All the above 3 Accounts can be opened as savings accounts or current Account or Recurring deposits or fixed deposits accounts.

But before that, it is necessary to understand when a person shall be called a Non-resident. Although, for this also, we have a separate article, so here let’s take a glimpse of the definition in a simple manner

As per section 6 of the Income-tax Act, 1961, a person is called a resident who stays in India for

- 182 days or more in the current Previous Year

Or

- 60 days or more in the current Previous Year and 365 days or more in preceding 4 Previous Years.

Example 1: Mr. A went to Australia for the 1st time for employment on 12th August 2018. He returns to India on 24th April 2019.

Now, check the above conditions

- The period from 01.04.2019 To 11.08.2018= 134 Days i.e. Less then 182 days hence in FY 18-19, Mr. A shall be an NRI as per this condition.

Or

Since in the example we have specified that Mr. A went foreign for the ist time hence, these conditions won’t be satisfied.

Now we will discuss each account one by one:

Non-Resident External Account (NRE Account):

NRE is an account maintained in rupees in which a Non-resident invest its foreign income earned outside India. NRE Account is held in India and maintained in rupees.

With NRE Account, Foreign currency of NRI can be easily deposited from outside India. The amount which is deposited is in the foreign currency and NRE Account maintained in rupees. That means when the amount is deposited, such foreign currency is converted into Indian rupees at the prevailing exchange rate.

An NRI can also appoint a person by a power of attorney who can use the debit card and checkbook.

The amount deposited in the account and the interest earned on such deposits is totally tax-free.

Non-Resident Ordinary Account (NRO Account):

NRO Account is the account opened by the NRI in which he can maintain and manage its income earned in India like any rental income or dividend income etc.

Whenever the residential status of any person is changed, the normal bank account can also be redesignated into NRO Account.

This account can be opened by 2 NRI or jointly with an Indian resident. This account can also be used for basic payments like electricity or water bill payments.

In NRO accounts, the tax deduction is not available to NRI as compare with NRE Account.

For Example, Mr. Nikhil went to the US for employment last year. Since, he resides there for more than 182 days, hence he becomes a Non-Resident. His family lives in New Delhi. Mr. Nikhil has also owned 10000 shares of Reliance Industries. In August month, RIL issued a dividend of Rs. 1,00,000/- to Mr. Nikhil.

He has also received a salary income of 10000$ in August month.

Now, Mr. Nikhil has 2 incomes. One is in the foreign currency as salary and second is in Indian currency as dividend income.

He shall deposit the salary in NRE Account which shall be converted in the Indian currency at the prevailing exchange rate on that day and Dividend income shall be deposited in the NRO Account.

Foreign Currency Non-Resident Account (FCNR):

In India, the savings Bank interest rates are much higher then as compared to other countries. This is one of the reasons that most of the NRIs want to invest in India. In this case, although they earn higher returns they always have a foreign exchange risk. Let me explain it with an example:

Mr. Nikhil (NRI) lives in Australia. He invests $10000 for a year on 10.08.2019 in India. Other details are as follows:

| Particulars | India | Australia |

| Deposit Interest Rate | 10% | 2% |

| Date | 10.08.2019 | 10.08.2020 |

| Exchange Rate per Doller | 60 | 70 |

As on 10.08.2019: The amount in rupees that Mr. Nikhil Invest in India:

$10000 * 60 = 6,00,000/-

Interest amount earned in a year on 10.08.2020: 6,00,000 * 10% = 60,000

Total Amount that Mr. Nikhil have as on 10.08.2020: 6,00,000 + 60,000 = 6,60,000

Now, Mr. Nikhil Convert the amount in dollars: 6,60,000 / 70 = 9428.57

Net Gain (Loss) to Mr. Nikhil:

$10000 (Investment Amount) – $9428.57(Withdrawal Amount) = 571.43 (Loss)

That means, although he has earned a better interest in India as compared to Australia due to a decrease in rupee rate during the year, he has to incur a net loss of $571.43

Hence, to save from such exposure risk, the government has allowed the NRI to open an account in the foreign currency itself in India. The account in which the NRI deposit such foreign currency is called foreign currency Non-Resident Account (FCNR).

2 thoughts on “Types of Accounts for Non Residents”